The spot bitcoin market was fairly dull Thursday. That doesn’t mean it’s not moving: Holders of the cryptocurrency are increasingly plowing it into decentralized finance.

- Bitcoin (BTC) trading around $11,543 as of 20:00 UTC (4 p.m. ET). Slipping 0.50% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,274-$11,661

- BTC slightly above its 10-day and 50-day moving averages, a bullish to sideways signal for market technicians.

Little changed in the past day for bitcoin’s price. The top asset in the crypto market is back in $11,500 territory, where it was Wednesday, after briefly bottoming to $11,274 on spot exchanges such as Coinbase.

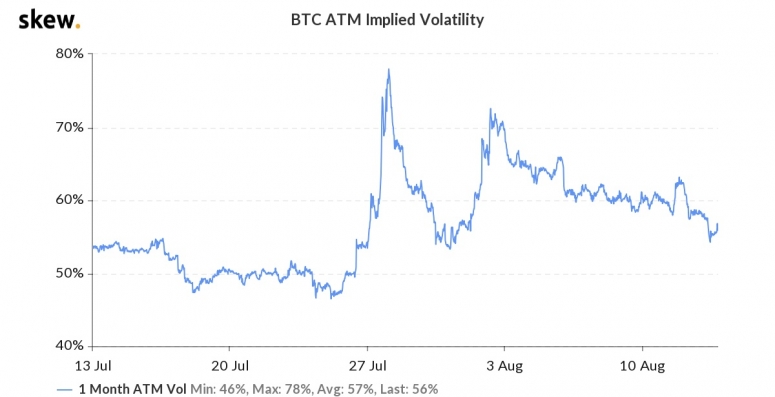

However, the state of the options market continues to suggest that traders anticipate a bumpier bitcoin ride over the longer term, according to Chris Thomas, head of digital assets for Swissquote Bank. “Implied volatility has edged higher, but only slightly. This shows that traders are still anticipating another big move, hence preferring long volatility strategies.”

John Willock, CEO of digital asset liquidity provider Tritum, expects bitcoin to move much higher before the year is done, but it will not be a steady upward trend. “There are quite a few psychological barriers to break along the way, especially once we get to $15,000, Willock said. “If our current pace keeps up I could definitely see $16,000 this year,” he added.

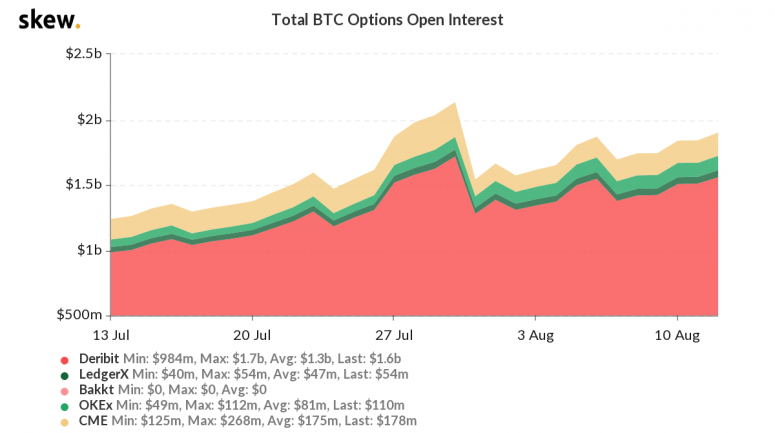

Swissquote’s Thomas also said the options market is currently seeing less institutional interest and more individual traders. He noted retail-friendly platform Deribit’s increase in bitcoin options open interest (outstanding contracts) versus more institutional-focused CME’s relative stagnation.

Deribit is an upstart crypto-only derivatives platform, while CME is a trading stalwart used by the biggest financial players for all types of commodities bets. “This shows that institutional players are standing aside, likely preferring to take a summer break,” Thomas said.

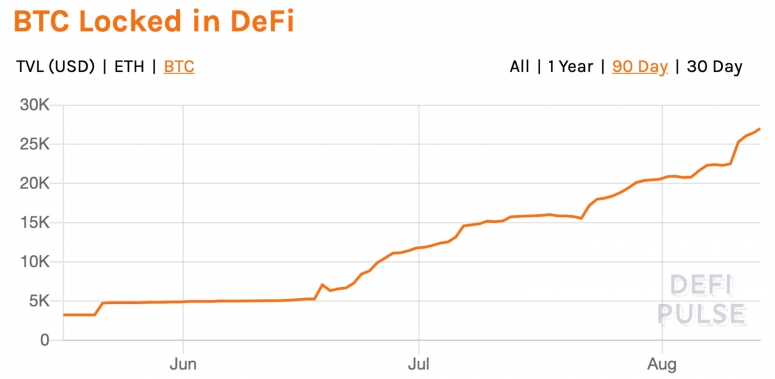

Bitcoiners plow BTC into DeFI

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Thursday trading around $394 and climbing 1.3% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

The amount of bitcoin locked in decentralized finance, or DeFi, surpassed 25,000 BTC Monday, and is currently at 27,027, according to data aggregator DeFi Pulse.

The top place for parking BTC in DeFI: Wrapped bitcoin, or wBTC, which allows investors to use the world’s oldest cryptocurrency on the Ethereum network. Over 21,000 BTC is locked in wBTC, by far its largest DeFi use.

Mark Hornsby, chief technical officer for crypto custodian Trustology, told CoinDesk that bitcoin’s role in DeFi could be bullish as investors feel comfortable about its role as the dominant cryptocurrency – and lock more of it inside Ethereum’s network.

“Due to its dominance, the bitcoin blockchain is an attractive proposition for DeFi,” Hornsby said. “Arguably, the lending and borrowing originating from these ‘wrapped’ instruments could bolster the underlying asset and, thus, bitcoin’s price point,” he added.

Other markets

Digital assets on the CoinDesk 20 are mixed Thursday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Read More: Token Sales Are Back in 2020

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil is down 0.54%. Price per barrel of West Texas Intermediate crude: $43.21.

- Gold was in the green 1.8% and at $1,951 as of press time.

- U.S. Treasury bonds were mixed Thursday. Yields, which move in the opposite direction as price, were down most on the two-year, in the red 5.6%.