Has all the fun gone out of trading bitcoin?

Maybe, but that could be a good thing, with one analyst predicting a $50,000 price for bitcoin as institutional investors begin to allocate.

In recent days bitcoin, by some measures, has become less volatile than stocks, although you would be foolish to expect that to continue.

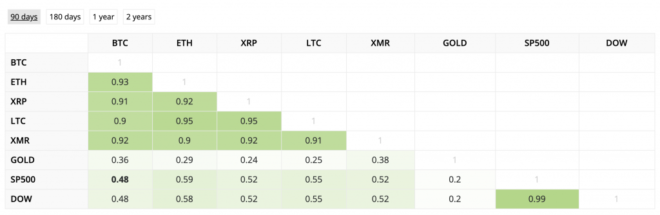

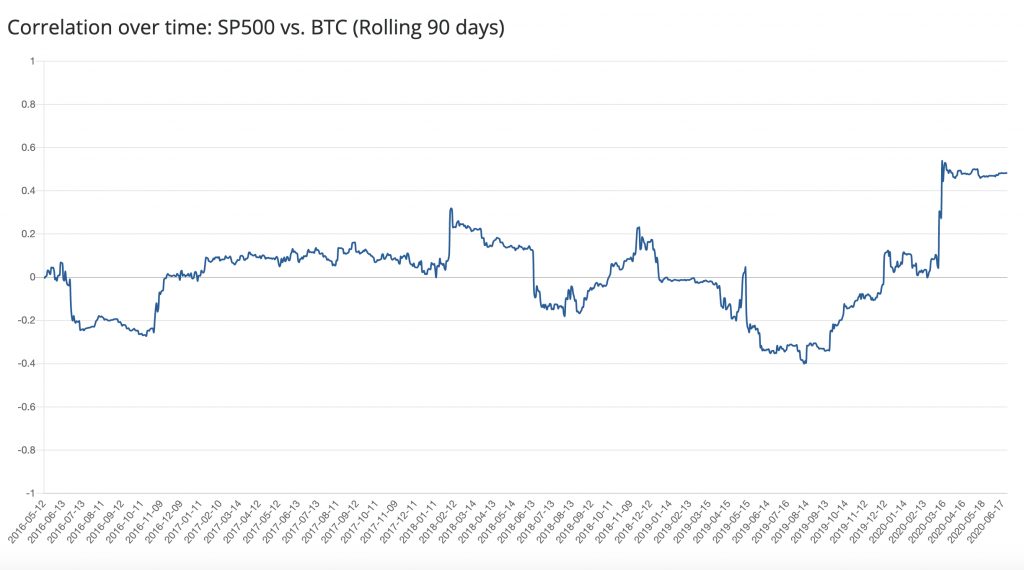

And on a wider view the correlation with equities has been tightening – currently at around 0.48 with 1 being a measure of absolute correlation (see data below from blockchaincenter.net).

BTC v S&P 500 correlation

No more weekend blast-offs for bitcoin price?

Nevertheless, the days when you could go into the weekend with the happy expectation of seeing the bitcoin price pump 10-20% in a heart beat may be a thing of the past.

That being so, what does it tell us about the state of the market?

Well, it is probably a sign of maturity. It means the bitcoin market is becoming like other established markets, such as gold and shares, that don’t trade over the weekends.

Back in the days when most of the volume was being initiated by retail investors, the weekends could get interesting as that was the time when ordinary folks weren’t at work and the market of interest never closed.

Sure, some of those retail investors are still playing – in fact the majority of traders are still small investors/speculators. But the volumes are being shifted by bigger players, even if the number of institutional entities in the market may have been overstated.

“We’ll tame bitcoin” said the institutions, and they have…

This brings to mind the thoughts of CME’s Leo Melamed, the derivatives trading venue’s chairman emeritus in a 2017 interview with Reuters before the launch of its bitcoin futures product.

Expanding on his belief that the CME’s bitcoin futures product would be more attractive to institutional investors than to mere speculators, he commented: “We will regulate, make bitcoin not wild, nor wilder. We’ll tame it into a regular type instrument of trade with rules.”

Those words ring true today. However, we could add some other markers of a maturing asset class beyond the no-longer-wild weekend trading observation.

Back in 2017 it was pretty hard to short bitcoin. That’s no longer the situation. The bitcoin derivatives market is booming, and by some estimates has doubled in size in the past 12 months alone.

Far from that adding to volatility, derivatives trading can actually make it harder for the price to fix on a parabolic trajectory because those who want to take a short position can readily do so.

The argument over whether such trades can impact the price if they are cash-settled misses the point. If you have a position wiped out on a synthetic trade it is still real money that you are losing and that can lead to long or short squeezes that have knock on effects elsewhere, including in actual bitcoin trading, as traders look to raise funds to cover margin calls.

Professional traders dominate bitcoin market

Research by Chainalysis last week found that retail investors – defined as those with bitcoin holdings valued at $10,000 or less, accounted for 96% of transfers to exchanges. But when the value of those transfers was taken into account, professional traders accounted for “85% of the value of bitcoin sent to exchanges”.

The Chainalysis research concludes: “Because of this, professional traders are the most significant contributors to large market movements, such as those seen during Bitcoin’s dramatic price decline in March as the Covid-19 crisis intensified in North America. However, professional traders are few in number, moving all that value in just 39,000 transfers per week on average in 2020.”

With such a relatively small number of market participants responsible for the bulk of liquidity, concentrated on four main trading venues (Binance, Coinbase, Huobi and Bitfinex), it is easy to see how the “smart money” is starting to have a determining influence on where prices are headed.

$1 trillion market cap = BTC $50,000

This brings us to some thoughts from Messari researcher Ryan Watkins who has been working through the numbers on how increased institutional interest might impact on the price of bitcoin.

He imagines a 1% allocation by family offices, hedge funds and other collective vehicles such as mutual funds:

Chris Burniske, a partner at Placeholder VC, helpfully filled in the blanks for Watkins in a tweet in which derives a $50k price for bitcoin from the institutional inflows:

“Depending on your assumptions, an aggregate 1% institutional allocation to Bitcoin can easily bring $BTC’s marketcap above $1 trillion, or over $50,000 per BTC”

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of EWN or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.