In the last year, stablecoins have gone from representing just a tiny fraction of global cryptocurrency trading volume to more than half of it. This, because more users than ever before now use stablecoins to exit volatility, invest, and make payments.

But in order for stablecoins to truly achieve mass adoption, they need to appeal to a wider audience, including those that have never used cryptocurrencies before and those simply looking for a safe haven asset during times of crypto market volatility.

To help push this ambition, a number of platforms and projects have appeared in the last year — each of which has a different approach to making stablecoins more useful and appealing. Here, we take a look at the three platforms doing the most to grow the stablecoin industry.

BXTB

The dramatic uptick in interest surrounding stablecoins in recent months has also had a significant knock-on effect on the Ethereum network, which has struggled to cope with the increased transaction volume.

This has led to a simultaneous increase in transaction fees, which now stand at more than 10 times higher than they were a year ago — and recently touched as high as $15 per transaction on average. This has made it difficult for stablecoin users to access the rapidly expanding decentralized finance (DeFi) industry or transact with stablecoins on a regular basis — since the fees could at times be simply too high.

BXTB looks to overcome this issue with its highly-scalable sidechain solution, which hosts a new type of stablecoin known as CHIP. These CHIP stablecoins are collateralized by other stable assets, like Tether (USDT) or DAI tokens, which are used in combination with a second token, known as BXTB to create CHIP stablecoins in addition to an activated form of BXTB called yBXTB. For example: BXTB + DAI = yBXTB + CHIP.

Image: BXTB

Since the CHIP stablecoin exists on an Ethereum sidechain, it can be transferred for dramatically lower fees and near-instant confirmation times — thereby eliminating two of the major roadblocks to stablecoin adoption today: cost and delays.

But BXTB also goes one step further to actively promote the use of stablecoins both by retail users and projects, because it is the only stablecoin solution to generate a yield for users. By allowing users to access DeFi applications and transact in stablecoins at low cost, while also providing a consistent return to users that choose to opt-out of crypto volatility by holding yBXTB and CHIP tokens.

The Corion Foundation

The Corion Foundation is among those doing the most to push stablecoin adoption, since it is behind the rapidly growing #MoneyInTheRightDirection movement — which sees ambassadors including influencers, content creators, lobbyists and industry leaders, in addition to a range of partners and merchants help push the benefits of stablecoin usage, and move the industry one step closer to mainstream adoption.

The goal of this movement is to achieve 20 million daily stablecoin users by 2021, by onboarding new users, merchants, and payment gateways, hosting events and providing consultancy and legal advice, among a huge range of other efforts.

Check out our latest community update about our recent product integrations, partnerships and listings. Our aim is to build a strong background for #CorionX token, to every user to enjoy features and benefits. #MoneyInTheRightDirection $CORX @StablecoinPAYhttps://t.co/R2BmKK2XC7

— CorionX – #MoneyInTheRightDirection (@CorionPlatform) October 24, 2020

To help with this vision, the Corion Foundation launched CorionX (CORX) — a utility token designed to incentivize the use of stablecoins, open finance, and DeFi among both individuals and businesses. This token can be used by retailers as a reward system for encouraging stablecoins payments with their customers and can be used as partial collateral for stablecoins.

Cryptocurrency projects, instutions and more can use the CorionX utility token to pay for services offered by the Corion Foundation and its partners, such as whitelabel services, scoring, and access to stablecoin infrastructure. Beyond this, users can also stake their CORX tokens to earn a 2.5% quarterly yield through the Loyalty Staking Program.

Like the other platforms on this list, CorionX benefits stablecoin adoption as a direct result of the utility provided by CORX token. But more than this, the Corion Foundation is actively working to both grow the stablecoin industry and promote the use of stable crypto assets through a strong multi-pronged approach.

Curve

Trading is one of the most popular uses of stablecoins and cryptocurrencies in general. In general, cryptocurrency exchanges tend to charge between 0.1% and 0.2% of the transacted amount for each trade — which though reasonable for volatile assets like Bitcoin (BTC) and Ethereum (ETH) is simply too high to make stablecoin to stablecoin trading attractive — particularly when dealing with large sums.

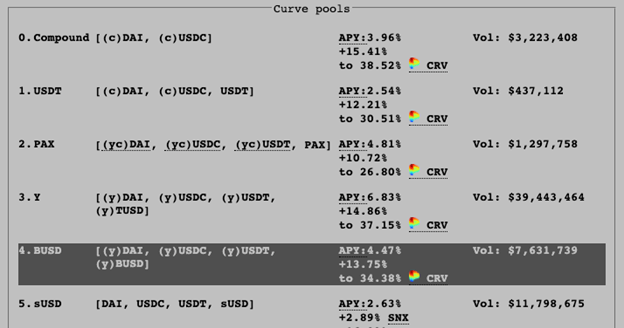

To overcome this issue and make stablecoin trading more accessible, a DeFi protocol known as Curve Finance was born, allowing users to exchange one stablecoin for another for a fee of just 0.04% — less than half that charged by even the cheapest centralized cryptocurrency exchanges. Because of the unique way it operates, it also allows traders to exchange stablecoins with extremely low slippage — ensuring even large orders can be fulfilled without suffering a loss due to slippage.

Image: Curve Finance

Since it launched in January 2020, Curve has become one of the most popular DeFi exchange platforms, and now allows users to exchange assets in more than a dozen pools, and earn a yield by providing liquidity in a variety of stablecoins, making it easier for users to extract value from their otherwise dormant assets.

Image by Mona Tootoonchinia from Pixabay