It was nighttime on Twitter and Michael Saylor was getting angry.

Saylor’s words were being twisted by the press. That sort of thing happens when you’ve run a public company as long as Saylor has: Tell a reporter one thing and he or she writes something else. The gray-haired, black polo-shirted business intelligence chief is used to what he calls “creative journalism.”

This article is part of CoinDesk’s Most Influential 2020 – a list of impactful people in crypto chosen by readers and staff. The NFT of the artwork, by Alotta Money, is available for auction at The Nifty Gateway, with 50% of the sale proceeds going to charity.

On this late-September Tuesday, the creative journalists were making Saylor sound like a hypocrite. Their tweeted headlines suggested the company he co-founded and leads, MicroStrategy, just days after bulking its treasury with a $425 million bitcoin reserve, was prepared to “liquidate” nearly half of it on any given Saturday.

Saylor hadn’t even spoken to these journalists. They had found the original quote in a Bloomberg article and conflated it into the headline he saw on Twitter now.

Their headline misrepresented Saylor’s commitment to bitcoin.

It is never a good idea to question Saylor’s dedication. The 55-year-old CEO has steered MicroStrategy through an accounting scandal, a Securities and Exchange Commission investigation, countless executive resignations and an-ever changing Big Data landscape. He watched as MicroStrategy’s competitors were gobbled up or wilted away. Now he’s a chairman with 72% voting power and his boardroom power is unquestioned. His word is MicroStrategy law.

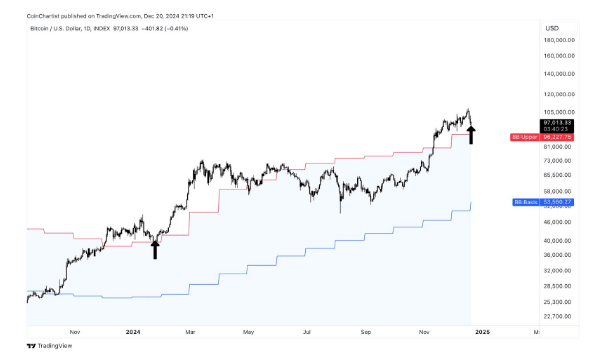

Since August, MicroStrategy’s new strategy has been bitcoin. Saylor began staking his company’s excess cash in BTC after concluding inflation would melt his dollars down. To Saylor, whose fiery rhetoric for technology spans his career, bitcoin is the most rational store-of-value investment, not just for MicroStrategy’s cash but for the entire world.

“Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy,” Saylor tweeted a few days prior to the Bloomberg story.

Back to Saylor. Reaction to the Bloomberg piece metastasized overnight. More reporters were writing he would dump bitcoin for prime bond yields. Another predicted Saylor would move his money into altcoins.

Michael Saylor has no use for altcoins.

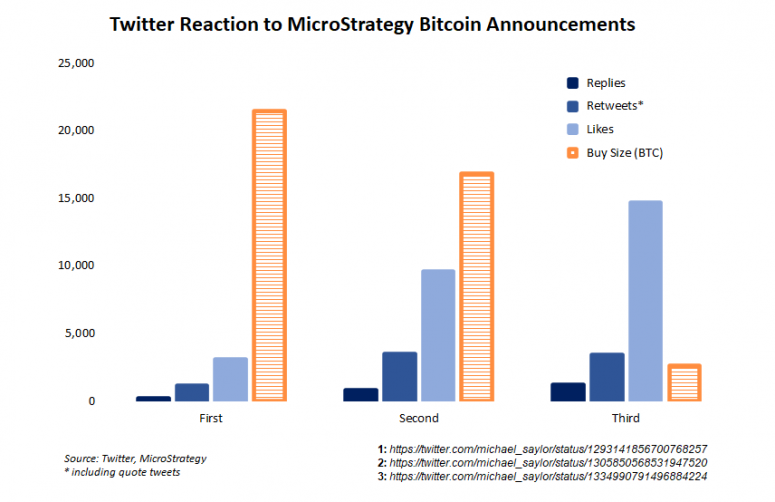

“There were four stories that came out in rapid succession, like a game of telephone,” Saylor told me. “Twenty years ago, I would have sat and simmered and just been irate. This year, I get on Twitter and say: ‘There’s no truth to any of these things.’ *Click.* And, you know, and all the Bitcoin Twitter cyber hornets go off on the journalists.”

The hornets obliged. They listen to Saylor’s bitcoin rhetoric; the entire media landscape now does. They want to hear the musings of the Bitcoin CEO.

In a year marked by institutions realizing the value of “digital gold” and getting in, Saylor has stood out as the CEO wielding bitcoin as the One Asset to Rule Them All. His stringent rejection of dollarized reserves led him this Spring to a crypto epiphany: Only in bitcoin, he declared to his company, can we save our excess capital from melting away.

He has leveraged that belief, his position, $475 million in cash, and 215,000 Twitter followers into becoming one of the Most Influential crypto voices of 2020.

The Bitcoin CEO

Since July, Saylor has shepherded MicroStrategy into one of the most bullish-on-bitcoin positions any publicly traded company has ever taken. First with an earnings call and then with multiple BTC purchases Saylor has normalized bitcoin on the corporate balance sheet. As of this writing, MicroStrategy’s trove stands at 40,824 BTC. A growing number of companies have followed Saylor’s lead in tapping the crypto markets as a treasury reserve, notably Square.

Winning corporate wallets is only half of a messaging strategy that plays as much to the everyman. Michael Saylor feeds an endless stream of pro-bitcoin declarations to his twitter followers (aka hornets). Their numbers have grown 69% since May.

In Saylor, they have found a voice unique among the “bulls” said to be powering this run – or any run, for that matter. No non-crypto CEO has ever talked up bitcoin as readily or explained his or her bitcoin philosophy as fully as Michael Saylor.

It is a philosophy dominated by the singular belief that bitcoin is the most viable vehicle for value storage that humanity has created. To Saylor, Bitcoin is so much “harder, smarter, stronger, faster” than gold that comparing the two is almost ridiculous – though he does, if only to play up the hilarity.

Bitcoin bulls like macro king Paul Tudor Jones and hedge fund legend Stanley Druckenmiller don’t talk this way. Neither does Ray Dalio, who, until recently, was among the most outspoken skeptics of bitcoin. It’s not because they disagree with Saylor’s philosophy. One cannot disagree with a viewpoint one has never even considered.

“They’ve got so many other things on their plate that they haven’t really focused upon this as an extraordinary engineering breakthrough and it’s going to change the course of humanity,” Saylor told CoinDesk.

Saylor says his bitcoin position is the “is the sum total of everything I’ve learned in my life.”

Which makes sense – sort of. His words are tinged with the sciences and a hefty dose of engineering. Especially aeronautical engineering.

“Aluminum is to the aeronautical industry, as Bitcoin is to the future of finance,” Saylor told me. “It’s an elemental thing that changes the world. You learn to recognize these things when you study engineering.”

Saylor studied aeronautical engineering at the Massachusetts Institute of Technology as part of the class of 1987. It was the first step on his ROTC-funded journey to becoming an Air Force fighter pilot. But Saylor, who spent his childhood surrounded by aviators at Wright-Patterson Air Force Base in Ohio, would never fly with them. Military docs misdiagnosed him with a heart murmur just as the Cold War was winding down. The Air Force suddenly didn’t need as many men, leaving Saylor with an all-expenses-paid education with no strings attached.

That left the young aeronaut with an opportunity to capitalize on his other focus area at MIT: science, technology and society. As Saylor studied the history of scientific revolutions, the evolution of technology, the impact human progress has on all areas of life, he began to see how the bigger picture comes about through one billion little bits.

“Multidisciplinary” continues to bleed through Saylor’s analysis. Speaking to me in September, Saylor tied bitcoin to thermodynamics, cybernetics, Austrian economics, marketing and finance in a 10-second span.

Soon after graduating in 1987, Saylor parlayed his STS skills into a consulting gig writing computer simulations for the chemicals giant DuPont. Think of it as a precursor to the big-data algorithms now powering economies behind-the-scenes. Even then, simulations were helping DuPont forecast its multi-billion-dollar titanium dioxide business over the decades.

“You couldn’t do these things with a spreadsheet. You needed nonlinear dynamics and servo mechanisms, you needed the feedback – that difficulty adjustment thing,” Saylor said, referencing the Bitcoin Network’s hard-coded mining regulator.

DuPont executives were enamored by Saylor’s modeling. But he was not quite as smitten with DuPont. Unwilling to spend years slowly climbing a corporate ladder, he planned to leave the company and return to academia. “I tried to quit,” Saylor said. DuPont responded by essentially seed-funding the team that would become MicroStrategy, which is now based in Virginia.

At 24 years old Saylor found himself in an enviable position for any tech founder: running a firm with big-corporate appeal. His data mining insights could help parse ever-grander business intelligence problems for some of America’s best-known companies, like McDonald’s, another early MicroStrategy client. It was a hit.

He’s still helming MicroStrategy 31 years later.

Keeping up with the times

Saylor told me MicroStrategy has survived for three decades by evaluating the marketplace and evolving about every three years. Tech trends move pretty fast. If you don’t stop and look around once in a while, you could miss it.

Saylor admits he’s missed it a few times. Some product launches went nowhere. Others kept MicroStrategy in the mix.

But the single-largest debacle came 20 years ago, when MicroStrategy’s soaring stock tanked on an earnings restatement that revealed two quarters of profit had actually been losses. The massacre was immediate: MSTR’s share price plunged 62%. “LOST $6B IN A DAY,” screamed a merciless New York Daily News headline decrying the “hotshot tech CEO” who flew too close to the sun. SEC investigators swooped in, sued Saylor and settled for $11 million in fines.

Saylor told me he’s more humble and careful now than he was 20 years ago, but no less passionate about the technologies he believes will change the world.

“I say to people, ‘it’s not the bad ideas that are the problem. It’s the overly enthusiastic pursuit of the good ideas, right?’ Because if you actually have a good idea, and you have billions of dollars of assets, and you want to put a billion dollars behind it, 150% of your time and energy and heart and soul, and maybe it might work.”

Saylor says he spends around 20% of his time “communicating something regarding bitcoin” these days. He tweets about bitcoin every day, records interviews about bitcoin every week. He referred to himself as an “enthusiastic evangelist” during our interview, using the word “enthusiastic” somewhat unnecessarily.

“I wanted to be clear to people: It’s not a summer romance with Bitcoin nor is it a shallow financial speculation, nor am I trying to brute force anyone into doing what I want them to do,” he said.

The MSM has noticed. Reporters from the New York Times, Barrons, the Wall Street Journal and Bloomberg now flock to Saylor for color on the Great Bitcoin Bull Run of 2020. One publication even deemed him the “most important proselytizer” of the institutional bitcoin age, not unreasonably.

Gone are the days where reporters bug Saylor about his record-setting stock tumble and hard-partying lifestyle, another mostly forgotten piece of Saylor’s reported backstory. Now he is the public face of bitcoin for all of Corporate America, plain and simple.

Some interviewers have asked Michael Saylor if his transformation into a bitcoin booster is an elaborate gambit of talking his book. Could the CEO who owns 23% equity in a company that controls nearly 0.2% of all the BTC in existence (and who personally owns over 17,000 bitcoins) benefit from appreciating asset valuations? Are his proclamations sincere?

Sincerity or no, the investment, which Saylor said was the “best thing” he could do for MSTR shareholders, employees, vendors and customers, is working – even better than he thought it would. “The stock is up $100 a share, and bitcoin is up, and everybody’s happy,” he said.

MSTR shares are up over 183% since Saylor first uttered “bitcoin” on the company’s July 28 earnings call, pushing share prices not seen in more than 20 years.

If MicroStrategy is reinventing itself as a bitcoin company, then Saylor would not say. But last Friday, Saylor plunked another $50 million into MicroStrategy’s bitcoin reserves. Better to stuff the crypto hornets’ energy hive with $475 million than in the dollarized iceberg that Saylor tells anyone who will listen is slowly melting away.

Other signs point to a corporate fortune heavily dependent on bitcoin’s success. On Monday, MicroStrategy announced it would seek to raise $400 million from institutional investors in a convertible senior note sale that would allow the company to bet on more bitcoin. MicroStrategy had previously been playing with house money. With this planned debt raise its asking institutions to finance Saylor’s dream.

To the public, Saylor has certainly reinvented himself as the bitcoin CEO.

Michael Saylor told me he “avoids opining on things that aren’t my business.” He doesn’t want to tell anyone how to raise their children, doesn’t want to bully you into buying more bitcoin. But he does want the big fish out there to believe in the philosophy that led him to become the “enthusiastic evangelist” with $475 million on the line.

“If I have a billion dollars in bitcoin, and if I think people like me should also own a billion dollars in bitcoin, then it’s reasonable for me to express my opinion about why,” he said.