Following a $425 million bitcoin purchase by his billion-dollar company, Microstrategy CEO Michael Saylor reveals that he personally owns about $240 million in bitcoin. Meanwhile, his company’s bitcoin gains have outperformed the company’s other earnings.

Microstrategy and Its CEO Are Both Bitcoin Hodlers

The CEO of the billion-dollar company Microstrategy, Michael Saylor, has revealed his own bitcoin holdings. His company, Microstrategy, recently bought $425 million in bitcoin as its primary Treasury reserve asset.

Saylor, who has been outspoken about bitcoin ever since his company decided to make the cryptocurrency its primary Treasury reserve asset, tweeted Wednesday:

Some have asked how much BTC I own. I personally hodl 17,732 BTC which I bought at $9,882 each on average. I informed Microstrategy of these holdings before the company decided to buy bitcoin for itself.

Microstrategy purchased a total of approximately 38,250 bitcoins for an average purchase price of about $11,111 per BTC, at an aggregate purchase price of $425 million, its 3Q 2020 earnings announcement details.

At the current BTC price of $13,447.85, the company’s bitcoin holding is worth over $514 million. Saylor’s personal BTC stash is worth $238.46 million. In addition, his company’s share price rose almost 38% from $117.81, when it announced the bitcoin capital allocation strategy during the release of its second-quarter financial results on July 28, to $162.15 at the time of this writing.

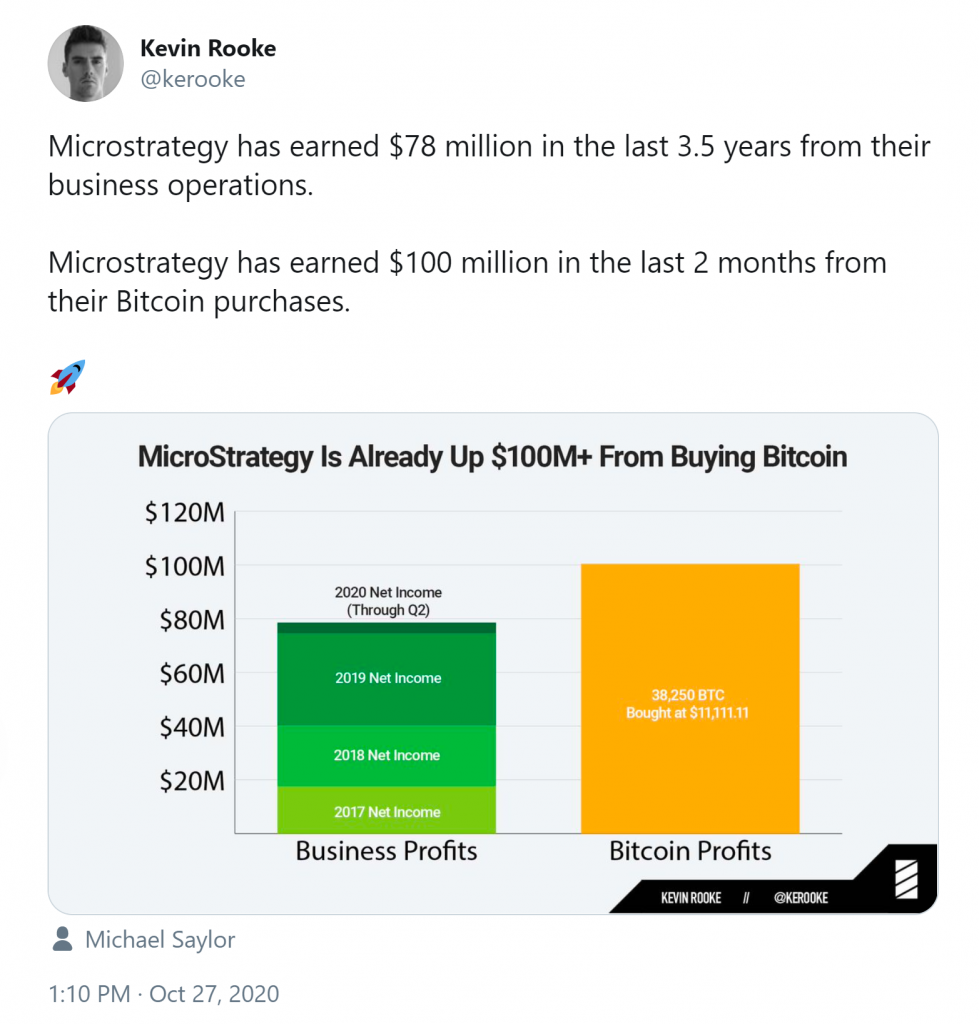

Independent analyst Kevin Rooke pointed out in a tweet on Tuesday that “Microstrategy has earned $78 million in the last 3.5 years from their business operations,” while it earned “$100 million in the last 2 months from their bitcoin purchases.” The gains are unrealized, however, and Saylor has indicated that Microstrategy plans to keep its BTC for 100 years.

Saylor has not always been a bitcoin bull. A former bitcoin skeptic, he tweeted on Dec. 18, 2013: “Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling.”

However, since his big bitcoin purchase, the CEO has been a strong proponent of bitcoin, calling the cryptocurrency the best store of value, much better than gold or tech stocks. He recently made a strong long-term bull case for bitcoin.

What do you think about Saylor and Microstrategy’s bitcoin holdings? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.