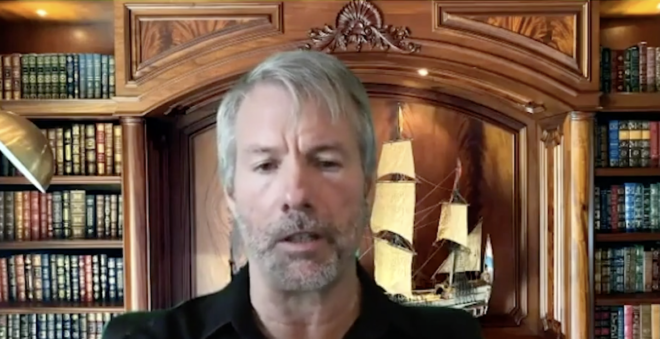

MicroStrategy CEO Michael Saylor pledged to keep pouring the business intelligence company’s excess cash into bitcoin Thursday, telling investors his team will also “explore various approaches” for additional buys.

“Going forward, we continue to plan to hold our bitcoin and invest additional excess cash flows in bitcoin. Additionally, we will explore various approaches to acquire additional bitcoin as part of our overall corporate strategy,” Saylor said in the company’s quarterly filing.

The company is currently sitting on a trove of 70,784 bitcoins. While most of that was purchased with excess cash, Saylor raised $650 million late last year in a debt offering to buy yet more bitcoin.

“Regarding our bitcoin strategy, our pioneering decision to make bitcoin our primary treasury reserve asset has made MicroStrategy a thought leader in the cryptocurrency market and generated great interest in MicroStrategy as a corporation,” Saylor said.