Just minutes ago, Bitcoin made its latest attempt at rallying to $10,000, reaching $9,950 after the close of Sunday’s candle. The cryptocurrency fell short of the key $10,000 price point, since retracing to $9,900.

Bitcoin chart from TradingView.com

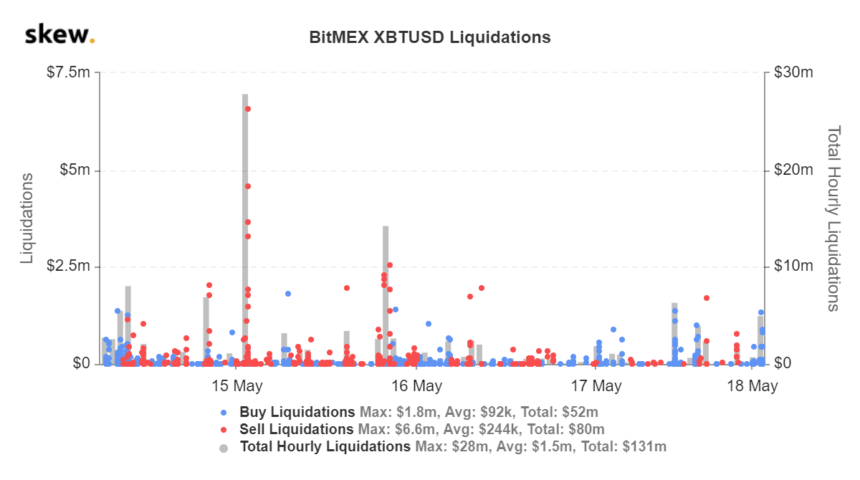

This move has not sparked much a reaction from the derivatives market, potentially because short traders were expecting the ongoing rally, and thus deleveraged their positions. Skew.com data indicates that a mere $5 million was liquidated during this upswing — far less than other liquidation events over the past two weeks.

BitMEX liquidation data from Skew.com

Bitcoin Could Run Into Resistance Near $10,000

While the recent move has been bullish, the cryptocurrency is currently running up against a sell wall of asks that may crush the short-term uptrend.

Per previous reports from NewsBTC, order book data of Bitfinex’s BTC/USD market shared by a popular crypto trader indicates that there is a massive block of orders looking to sell Bitcoin around $10,000 that may be hard to break past.

Bitfinex’s order book suggests that from $9,900 to $10,600, there is ~4,200 Bitcoin worth of sell orders, most of which are clustered around $10,000-10,400. That means on one exchange alone, there is over $40 million worth of sell-side pressure if the cryptocurrency attempts to rally past $10,000.

Order book (BTC/USD) screenshot from Majin (@Majinsayan on Twitter), a crypto trader. The data indicates that there is a cluster of resistance from $10,000-10,400 that may be hard for bulls to break past in the coming days and weeks.

The last time the cryptocurrency ran into such a sell wall was two weeks ago, when the cryptocurrency reached a multi-week high of $10,100. What followed was a strong drop from that level to $8,100 over the span of a few days.

All Eyes On $10,500

If Bitcoin manages to clear the resistance, all eyes will be on the $10,500 level.

As reported by NewsBTC, the level has been given much attention by prominent crypto traders and analysts over the past few months.

Depicted in the chart below is Bitcoin’s macro chart along with a line marking $10,500. The chart indicates that the level has been crucial on a number of occasions, as it marked the top of rallies two times in 2019 and once earlier this year.

Chart from TradingView.com illustrating the importance of the $10,500 level for Bitcoin over the past few years.

With Bitcoin rallying near this level once again, analysts have begun to tout its importance. The lead technical analyst at crypto research firm BlockFyre wrote:

“If Bitcoin gets over this. There isn’t much standing in the way of new all-time highs. They’d be on the horizon. Way less resistance than anything BTC overcame going from 3.7k to here. Would be a macro higher high confirmed. Don’t underestimate the implications!”

What he’s saying is if BTC can close multiple daily or a weekly candle above $10,500, the cryptocurrency will be cleared to rally higher as that would confirm a macro uptrend.

Photo by Michael Fousert on Unsplash