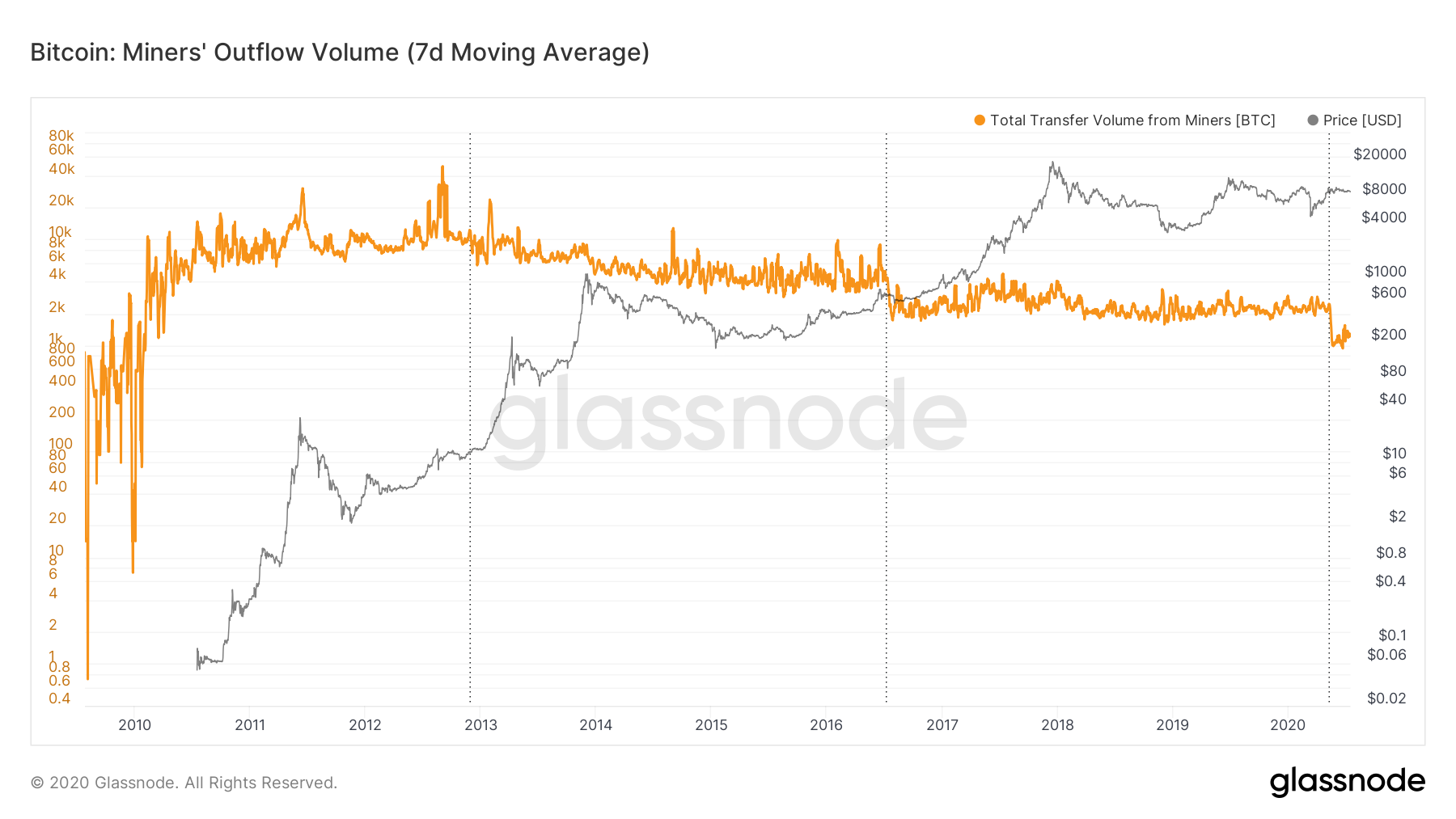

Onchain data shows that bitcoin miners are hoarding despite the 50% loss in revenue that started on May 11, during the third reward halving. The seven-day average of bitcoin miners’ outflow volume and mining funds sent to exchanges remains significantly low.

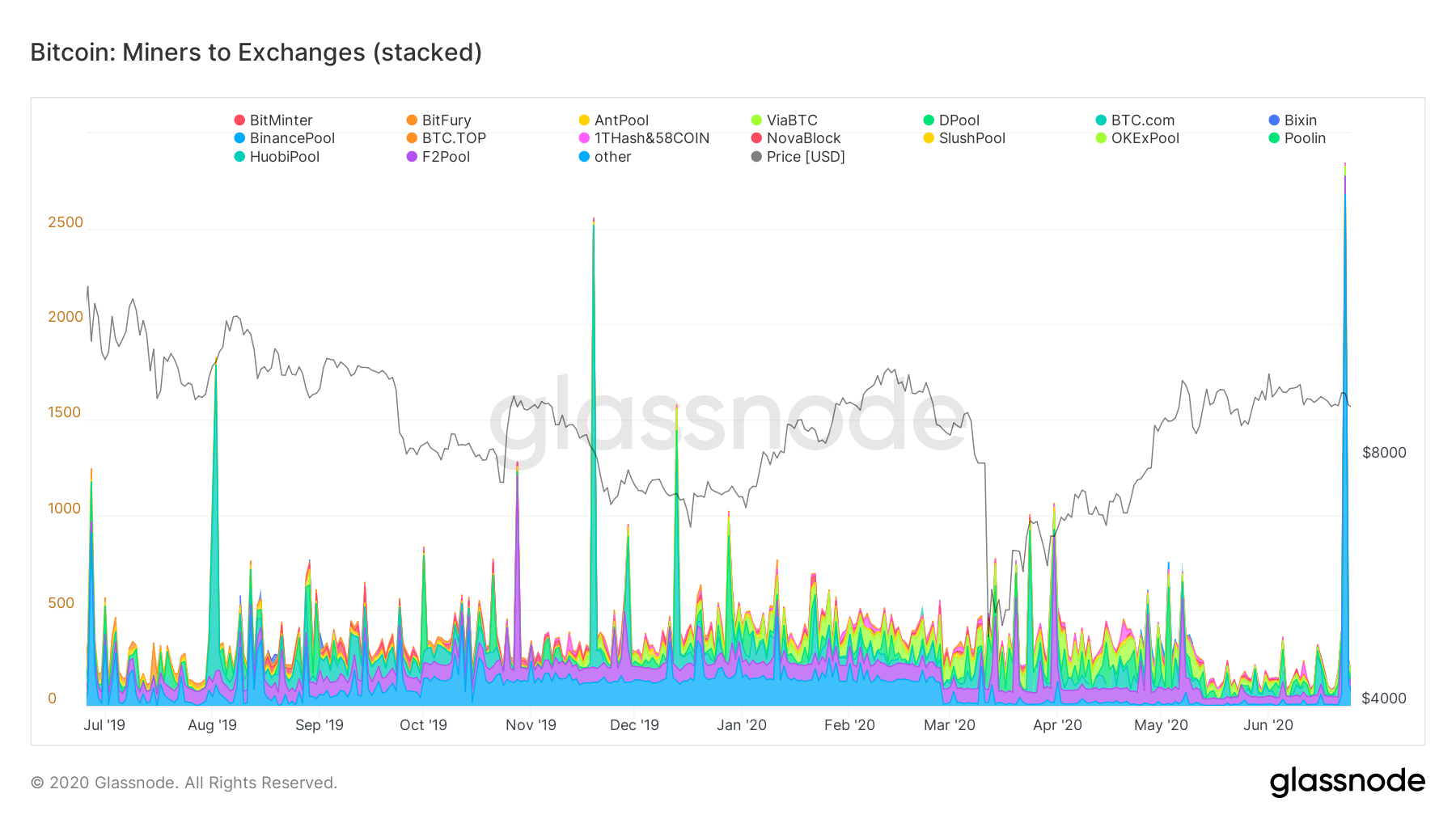

Roughly four weeks ago on June 19, the total amount of BTC transferred out of miners’ addresses saw a significant low not seen in over a decade. At the time, miners transferred 987 BTC that day, but six days later on June 25, miners sent nearly 3,000 bitcoin (2,650 BTC sent to Bitfinex) to exchanges that day.

Despite that specific movement on June 25, onchain data suggests ever since then miners have been seemingly hoarding coins.

Miner selling continues to remain at historical lows even though the reward halving took away half the revenue from operations. At the same time, the BTC hashrate is seeing all-time highs as well as the network is hovering around 125 exahash per second (EH/s).

Data from Glassnode statistics show the seven-day average of the total amount of BTC transferred from mining operations on July 14, is roughly 1,240 BTC ($11.3M). Mining funds sent to exchanges also remain low and data shows that miners sent less than 500 BTC ($4.5M) on Tuesday.

Speculators believe miners strategically hoard because mining operations wholeheartedly believe the price will rise in the near future. However, black swan events like the March 12 (Black Thursday) market sell-off can lead to more miner outflow to exchanges.

After March 12, the week that followed saw more BTC sent to exchanges than throughout the month of February.

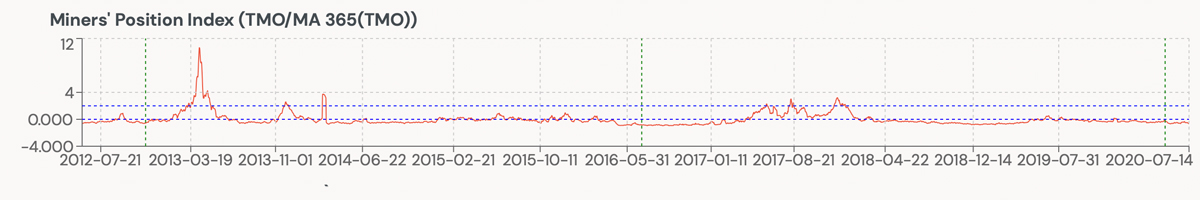

Onchain data from Cryptoquant had shown the same findings during the week after Black Thursday, as the “Miners’ Position Index” had risen higher. When the Miners’ Position Index values are zero or above, it indicates that most miners are selling BTC. Today’s data from Cryptoquant’s Miners’ Position Index and Glassnode’s outflow charts show that bitcoin miners are not selling all their new coins after finding a block, unless they have to sell under stress.

In fact, the bitcoin obtained by miners being sent to exchanges has dropped to a 12-month low this quarter. Glassnode and Cryptoquant stats show that the daily outflow has been declining rapidly despite the rare June 25th outflow.

Additionally, data stemming from bytetree.com also shows that miners tend to hoard coins in contrast to selling them as soon as the operation acquires virgin bitcoins.

The one-week cumulative, rolling data on bytetree.com shows a miner’s generation of coins and the difference in time between the first spend. Overall despite the end of last month (June 25) outflow from miners to exchanges, miners are strategically holding onto fresh coins in hopes of higher prices.

What do you think about the possibility of miners hoarding coins? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Cryptoquant, Glassnode,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.