Monero value this week has surged more than 20 percent after a report published by the Satis Group predicted robust bullish forecasts for the privacy-centric cryptocurrency.

The XMR/USD pair on August 30 was trading at around 97.36-fiat after strong bearish sentiment rejected the previous upside near 110-fiat. The same day, Satis Group, a major ICO advisory firm, published a report predicting Monero among the significant price gainers within the next decade. Soon after the story hit the public domain, and got covered Bloomberg, the XMR/USD started to show strong upside swings and broke key resistance levels. Just today, at the start of the Asian session, the pair established 142.70-fiat as its new intraday high, the highest since July 28.

Satis: Monero Value Could Reach Over $41,000

The Satis report predicts Monero value to surge by a whopping 38,391 percent over the course of next ten years. The study believes there will be a strong use case for anonymous cryptocurrency projects like Monero in the future that could lead to a surge in global demand.

“Considering the nature of the use cases,” Satis wrote, “the Privacy market user base will most likely rely on networks that have more active codebase development, more resistance to centralized control (possibly through mining), a growing ecosystem, and growing user base.”

Satis also favored Monero over its competition for its active codebase, its resistance to centralized mining efforts, and its anti-regulation framework.

“While ZEC has an easier time being traded in regulated markets (since it has privacy features by request, not by default), we believe this will be a setback to adoption by darker markets, which prefer networks that are fungible,” wrote Satis while referring to Monero.

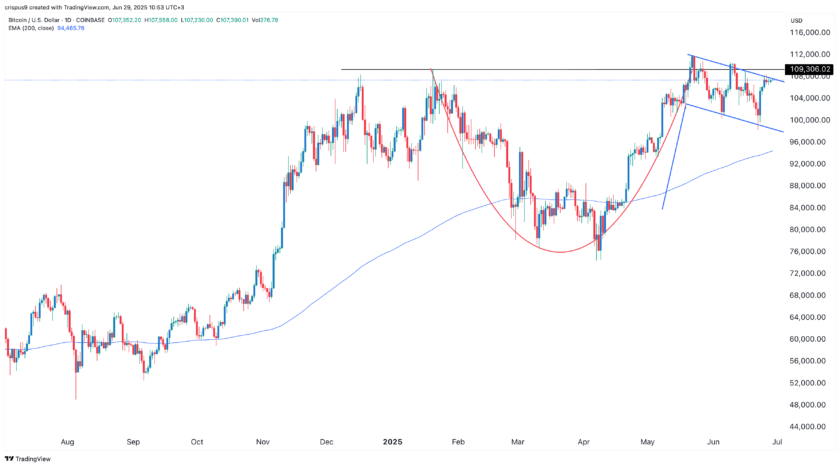

XMR/USD Technical Analysis

The latest rally in XMR/USD markets has brought the pair above its 100H and 200 moving averages. The 100H MA, in particular, is now crossing above the 200H MA, indicating a medium-term buying sentiment in the market. The RSI and the Stochastic indicators, meanwhile, have entered their respective overbought areas, now awaiting correction. Also, the pair has broken above its Rising Wedge resistance, meaning more bulls.

XMR/USD is currently targeting 142.70-fiat as its interim resistance level. While there is a considerable possibility of day traders executing their long positions towards the said level on decent profits, the bearish correction that could follow later should be weaker than the upside sentiment. That being said, we’ll be looking for a pullback only to test new support in 126-128 area from Jully. It will also be the formation of a bull pennant.

In the event of a breakout above 142.70-fiat, Monero could attempt a run towards the late July resistance area between 148- and 151-fiat. Day traders should not forget to place their stop losses a few dollars above/below their entry points, based on the direction towards which they are entering their positions.

Featured image from Shutterstock. Charts from TradingView.

Follow us on Telegram or subscribe to our newsletter here.

• Join CCN’s crypto community for $9.99 per month, click here.

• Want exclusive analysis and crypto insights from Hacked.com? Click here.

• Open Positions at CCN: Full Time and Part Time Journalists Wanted.