Businessman and reality TV star Kevin “Mr. Wonderful” O’Leary has slammed bitcoin bull Anthony Pompliano for concentrating too much of his wealth in one asset. This occurred after the co-founder and partner at cryptocurrency investment firm Morgan Creek Digital revealed that 50 percent of his net worth is in bitcoin.

Speaking on CNBC, the “Shark Tank” star chided Pompliano for the putting half of his wealth in the cryptocurrency, calling the strategy “insane.”

“I forbid that. That’s insane. That breaches everything about diversification in investing. That’s crazy.”

O’Leary added that “you never go beyond concentrations of that nature. 50 percent? Shame on you! That’s nuts!”

So what’s the right way to diversify?

Asked about his own asset allocation strategy, O’Leary said,

“In any one stock, never more than 5%. In any one sector, never more than 20 [percent].”

“I teach this stuff you never go beyond concentrations of that nature. 50% shame on you! That’s nuts!” @kevinolearytv tells @apompliano #btc pic.twitter.com/e4pTEt5sgC

— Squawk Box (@SquawkCNBC) August 6, 2019

Pompliano’s highly aggressive bitcoin investment strategy could stem from his bullishness with regards to the cryptocurrency. Earlier this month, Pompliano predicted that bitcoin will likely reach $100,000 in the next two-and-a-half years.

According to the crypto bull, this will be driven by the lowering of interest rates by the Federal Reserve coupled with bitcoin halving in mid-2020.

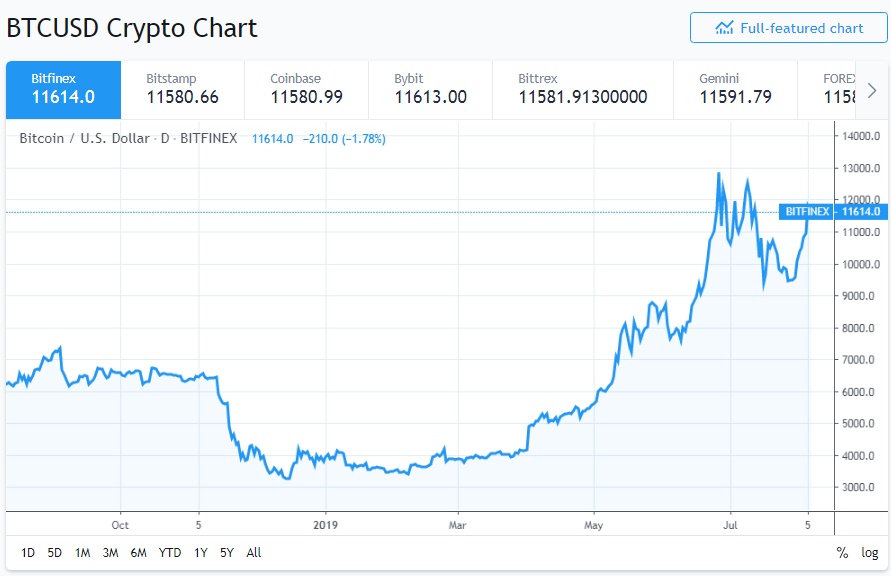

In his CNBC appearance, Pompliano also cited “global instability” as another reason to be bullish about bitcoin. Per Pompliano, the trade war tensions between the U.S. and China have resulted in bitcoin appreciating by double digits since May.

This, according to the bitcoin bull, was because “there are people around the world that are electing to put their wealth into something that is controlled by software and cannot be manipulated by a single country or politician.”

“There’s people around the world that are electing to put their wealth into something that is controlled by software and cannot be manipulated by a single country or politician,” says @apompliano on #btc pic.twitter.com/3ZpE53xl91

— Squawk Box (@SquawkCNBC) August 6, 2019

How has Bitcoin fared in the face of U.S.-Sino trade tensions?

Pompliano, who is famous for his “long bitcoin, short the bankers” war cry, is not alone in celebrating bitcoin’s emerging safe-haven status. The CEO of cryptocurrency firm Circle, Jeremy Allaire, and the co-founder of investment research firm Fundstrat Global Advisors have all recently touted bitcoin’s credentials as a hedge in times of global turmoil.

The markets put this to the test on Monday. The main U.S. stock indices fell drastically as fears of a prolonged trade war rose after a series of actions suggested that neither party was willing to compromise.

Bitcoin, meanwhile, has appreciated by over 20 percent in the last five days, culminating in the cryptocurrency briefly breaching the $12,200 level earlier today as its dominance level relative to other coins approached 70 percent.

The flagship cryptocurrency has slumped to below $11,700 amid signs of the stock market paring the losses from Monday.