By CCN: In the past six months, the bitcoin price has increased from around $4,000 to $8,000, recording a staggering 115 percent year-to-date gain against the U.S. dollar.

The bitcoin price is up 115 percent year-to-date against the U.S. dollar (source: coinmarketcap.com)

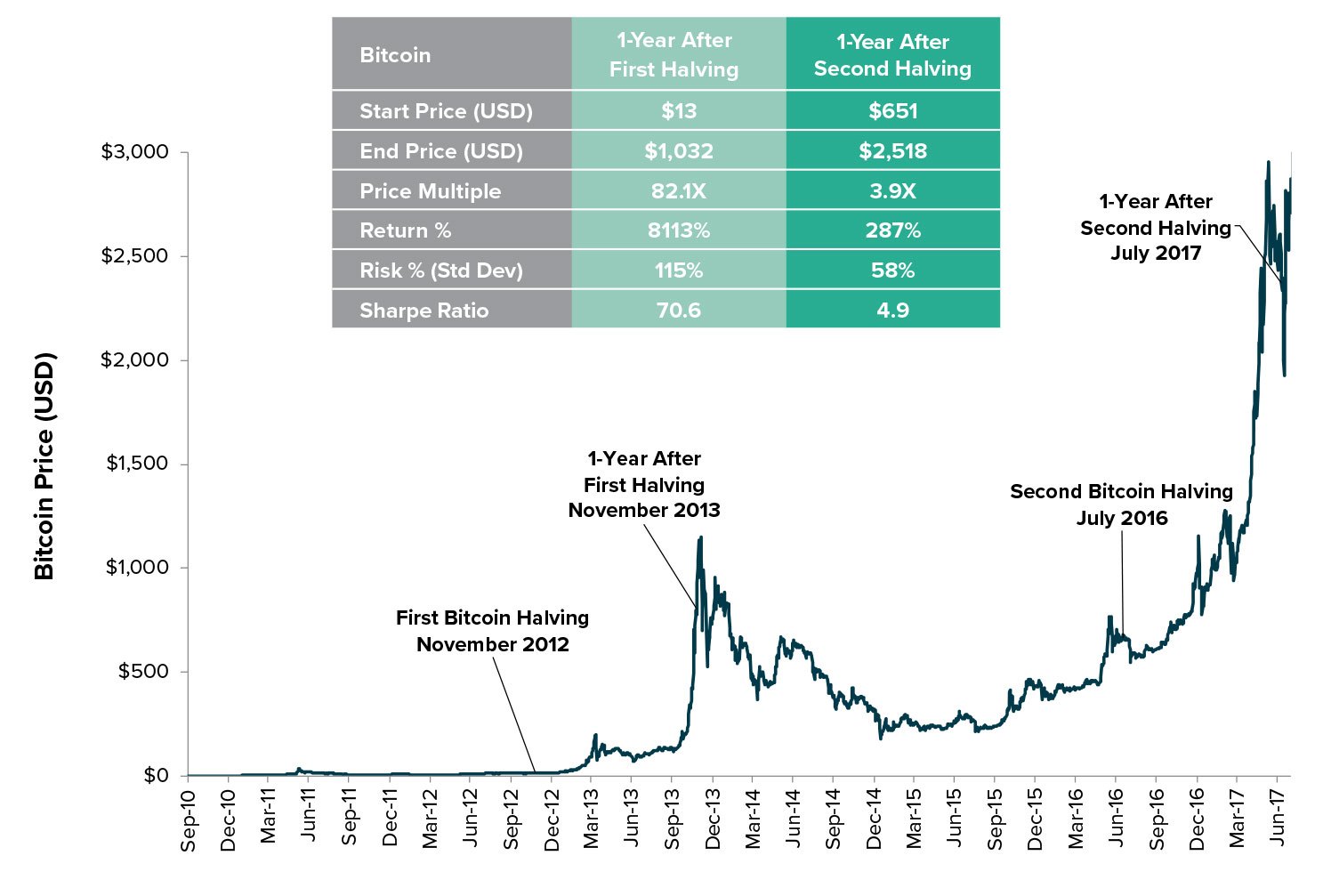

Historically, the bitcoin price has tended to recover a year before and after the block reward halving, a mechanism that decreases the rate in which new bitcoin is produced by miners by half.

Grayscale, an investment firm that oversees more than $2 billion in assets under management in products such as the widely utilized Bitcoin Investment Trust (GBTC), sees the halving offering an attractive entry point for investors.

Is bitcoin block reward halving not priced in?

Since its inception in 2009, the block reward halving of bitcoin has been considered a crucial fundamental factor in the long term price trend of the asset.

As the supply of bitcoin in the global exchange and over-the-counter (OTC) market drops, if the demand remains the same or rises, the halving has historically caused the value of the asset to increase.

Considering the importance of halving in the long term trend of bitcoin, Grayscale said in a research paper that it may offer both institutional and retail investors an attractive entry point into the asset class.

“For investors with a multi-year investment horizon and a high-risk tolerance, the confluence of discounted prices, improving network fundamentals, strong relative investment activity and the upcoming halving may offer an attractive entry point into Bitcoin. This is especially relevant for investors building core strategic positions in Bitcoin over time,” the Grayscale research read.

Since the block reward halving occurs every four years and the time frame in which the halving is executed is publicly disclosed, the argument that the block reward halving is priced into the market has been consistently made in the past several years.

The bitcoin price has consistently recovered prior to block reward halvings in the past (source: grayscale.co)

However, in its study, Grayscale found that many investors it interviewed were not aware of the block reward halving and the potential impact it could have on the price of the asset.

Grayscale added:

The halving is close enough that it’s time to start talking about it more seriously, but far enough out in the future that it’s unclear whether it’s priced into the market efficiently. In fact, based on anecdotal conversations with market participants, we were surprised to learn that many of them were not even aware of this event.

Major fundamental factor on the horizon

The next bitcoin block reward halving is estimated to occur by May 2020. Currently, about a year before its halving, bitcoin is up substantially year-to-date and is demonstrating strong momentum in what many analysts consider as the start of a bull market.

Although short-term volatility is expected given the gain of the bitcoin price in the past six months, the macro trend of the asset remains positive as shown by key technical indicators.

The 3-day Guppy Multiple Moving Average (GMMA), a technical indicator often used to spot changes in the long term trend of an asset, signaled a positive trend for bitcoin as the price hit $8,700 last week.

“I’ve been waiting for this for weeks to confirm the bull trend While the 1-Day Guppy can give fake-outs, the 3-Day is a nice signal for continuation and that dips are buying The last time the 3D flipped green it led to a 25 month uptrend,” technical analyst Josh Rager said.