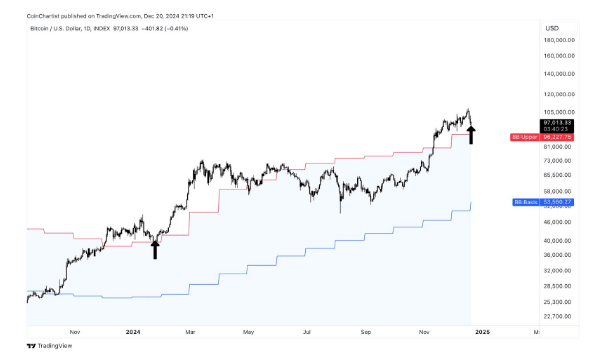

Bitcoin (BTC) has travelled an eventful path since its creation in 2009. TradingView.com recently unveiled a BTC chart showing major events in the digital asset’s history, alongside the cryptocurrency’s ever-changing price.

Released on Tuesday, the chart points out potentially significant events on Bitcoin’s price path, showing a “consolidated history of Bitcoin overlaid on the de facto crypto charts (by TradingView),” the platform’s general manager, Pierce Crosby, told Cointelegraph.

TradingView’s team intends to update the chart every 14 days — though if major news breaks, the team says they will adjust the metrics sooner. Clicking various bubbles on the chart produces an explanation of each event. The site also lists events in blog-like form below the chart.

Crosby said:

“TradingView Timelines have been a unique undertaking by our core visualization team and show us the importance of putting ‘news in context’ (the corresponding chart). We expect this logic will become much more mainstream in the coming years to prove the relevance of a given news story. This is just the first step.”

Worth less than $1 in its earliest days, the digital asset rocketed up past $40,000 in 2021. Many major events have occurred along that price path, such as the Mt. Gox ordeal.

“Our initial observations show the immediate impact of historical events on the price of the asset,” Crosby said. The BTC timeline shows a barrage of events, although the most recent headlines focus on the numerous price hurdles broken by the asset.

“Looking at some of the early historical events, they are dwarfed by the price action in 2015 – 2017 the first period of time when current events captured the mainstream imagination of investors,” Crosby observed from the chart.

Such a timeline adds a tool for discussions on Bitcoin’s price as it pertains to events and possibly correlated reactions. “Looking solely at BTC price movements in the market gives an incomplete view of why its price fluctuates the way it does, in a seemingly volatile manner,” Crosby said, adding:

“Timelines is the first comprehensive source to share price movements along with corresponding real-life events, so investors can understand why there are certain spikes or dips, helping inform them for the future and giving them a deeper understanding of the asset they’re trading.”