MicroStrategy CEO Michael Saylor is singing the praises of Bitcoin once more. This time, Saylor talks approvingly of its convenience, as well as its capacity to keep all parties honest.

But above all, in a recent interview, he said no-one can take it from you. Not even the taxman.

“You can tell everyone to go f*ck themselves. You can put it in your head, memorize the frickin key, right, and it’s here. And then, the classic Bitcoiner response is, oh, yeah my Bitcoin, I lost it in a boating accident…”

Tax Proposals Make Cryptocurrency Less Appealing

In recent weeks, the issue of tougher regulation, and more specifically taxation of cryptocurrency, has reared its head. While most people accept taxation as a necessary cost of living within a civilized society, the point in question is, how much is enough?

This is especially relevant considering proposals from the Biden administration, which could see the tax burden of cryptocurrency investors increased. They are considering an all-encompassing wealth tax, as well as a tax on unrealized capital gains.

Professionals claim current guidance on cryptocurrency tax rules is confusing at the best of times. What’s more, the matter is compounded by a whole host of innovations such as chain-splits, airdrops, token swaps, and staking, which require tax authorities to rethink their rulings.

When combined with more tax proposals, the prospect of investing in Bitcoin and cryptocurrency is much less appealing.

Saylor Claims Despite Threat of Regulation and Taxation, Bitcoin is Still The Superior Investment Strategy

With this in mind, the MicroStrategy CEO courted controversy by saying if his tax burden were too much, he would say he lost his Bitcoin.

“At the end of the day, if you push me too far, I lost it, it’s gone, sorry. Tax that.”

More than likely, Saylor’s comments were made to push the envelope in illustrating the irrelevance of tax and regulation against the bigger picture of Bitcoin’s investment potential.

When asked about regulatory clampdowns on Bitcoin, Saylor passed it off as FUD. And more importantly, FUD that’s based on things that haven’t happened yet, and may not happen at all.

“Over the next decade, the most logical challenge for people in the Bitcoin community is regulatory FUD. You’ll just see fear, uncertainty and doubt about, what if a regulator does something that’s bad. I don’t know what it is, but what if they do it.”

His underlying message was that as a superior store of value, Bitcoin will still appreciate regardless of how regulators and tax authorities treat it.

“If Bitcoin is [a] better store of value than bonds, stocks, real estate, gold, silver, and derivatives, and every flavor of cash, then there’s no reason why it shouldn’t absorb $100 trillion of monetary energy, regardless of, what if you apply all the regulations to it…”

Recent murmurings of tax increases for cryptocurrency investors have created a sense of FUD. But, as Saylor points out, long term, this has no bearing on Bitcoin’s store of value proposition.

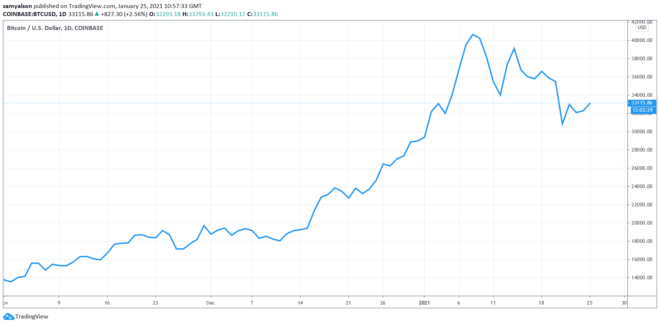

Source: BTCUSD on TradingView.com