The United States Securities and Exchange Commission will reevaluate its recent round of bitcoin ETF rejections.

This Wednesday, August 22, 2018, the SEC denied 9 ETF proposals from ProShares, GraniteShares and Direxion in three separate orders. But consistent with a rule that allows the SEC’s Chairman and Commissioners to review decisions delegated to its staff, these disapproval orders are up for reviewal.

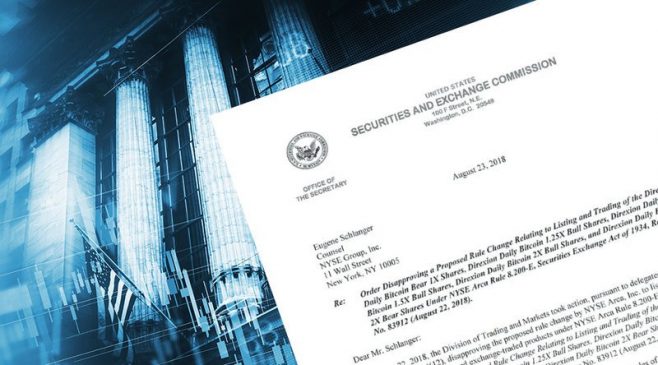

A letter written by SEC secretary Brent J. Fields to Eugene Schlanger of the New York Stock Exchange details the technicalities of this process:

“On August 22, 20 18, the Division of Trading and Markets took action, pursuant to delegated authority, 17 CFR 200.30-3(a)( l2), disapproving the proposed rule change by NYSE Arca, Inc. to list and trade the shares of the above-referenced exchange-traded products under NYSE Arca Rule 8.200-E, Commentary .02, Order Disapproving a Proposed Rule Change Relating to Listing and Trading of the Direxion Daily Bitcoin Bear IX Shares, Direxion Daily Bitcoin l. 25X Bull Shares. Direxion Daily Bitcoin 1.5X Bull Shares, Direxion Daily Bitcoin 2X Bull Shares,and Direxion Daily Bitcoin 2X Bear Shares Under NYSE Arca Rule 8.200-E, Securities Exchange Act of 1934. Release No. 839 12 (August 22, 2018). This letter is to notify you that, pursuant to Rule 43 1 of the Commission’s Rules of Practice, 17 CFR 201.431, the Commission will review the delegated action.

“In accordance with Rule 43 1 (e), the August 22 order is stayed until the Commission orders otherwise. The Office of the Secretary will notify you of any pertinent action taken by the Commission,” the letter concludes.

At this time, it is unclear when the Commission’s order will be released to the public.

SEC Commissioner Hester Peirce, whose outspoken criticism of the SEC’s treatment of bitcoin ETF filings has made her a darling of the industry’s followers, tweeted the developments earlier today.

In her tweet, she explains that “the Commission (Chairman and Commissioners) delegates some tasks to its staff. When the staff acts in such cases, it acts on behalf of the Commission. The Commission may review the staff’s action, as will now happen here.”