With an average 6% loss and a 10% correction in the weekly chart for Bitcoin, Cardano (ADA), XRP, and others, the crypto market has been trading in choppy waters for the past days. The uncertainty has brought a change in the sentiment, as traders prepare for further downside.

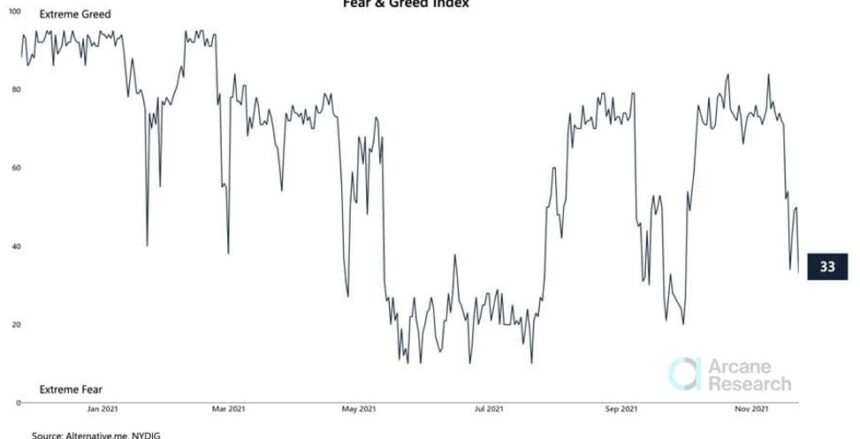

Data from Arcane Research records a flipped in the Fear and Greed Index, the indicator has quickly moved from “Greed” to “Fear” as Bitcoin and other major cryptocurrencies in the top 10 by market cap retested critical support levels.

Bitcoin had a particularly bad week in terms of performance as an increase in volatility caused the price to fluctuate in a range between $55,4000 and $60,000. On the other hand, Ethereum has showed more strength as it has been able to quickly bounce back from its low and into the mid area around its current levels.

Related Reading | TA: Bitcoin Holds Key Support, Why BTC Remains At Risk of Sharp Decline

As Arcane Research noted, the crypto market’s sentiment is still far from suggesting a cycle top. Despite the downside pressure, fundamental remains for future appreciation as most cryptocurrencies successfully retested their monthly lows. Arcane Research noted the following:

(…) in bull markets, the Fear and Greed Index indicate “greed” or “extreme greed” for more extended periods with short periodical visits to the “fear” area, just like we saw this spring. Therefore, a “fear” level is not necessarily a signal that the current bull market is over (…).

Why The Crypto Market Could Need More Blood Before New ATHs

The short term paints a very different picture for Bitcoin and the rest of major crypto. The U.S. Dollar Index (DXY) has been showing strength as the market trends downwards.

However, as analyst Justin Bennett pointed out, the U.S. currency could have found a local top. This could provide some breathing for crypto and allowed them to return to their previous high or take another shot at critical resistance price points.

Despite the above, traders still need to maintain caution. Although there has been a reset across the crypto market, the derivatives sectors still show signs of being overheated with most exchanges recording neutral funding rates that quickly turn positive on breakouts to the upside.

Related Reading | This Bitcoin Metric Hints At Bottom, Is BTC Out The Woods?

Thus, why Jarvis Labs believes Bitcoin and the crypto market could re-entered price discovery once funding rates turn negative, as it did in September 2021. This could dip the Fear and Greed Index further down the fear levels into Extreme Fear.

#BTC funding rate on Binance still hovers around neutral values. Best to wait for a few days of negative funding regime as it did in September end before sizing up. pic.twitter.com/AJ5bKDr29k

— JarvisLabs (@Jarvis_Labs_LLC) November 23, 2021

On that note, pseudonym trader Rekt Capital believes Bitcoin has showed little signs of strength. Another run into the lows could bring the whole market down with BTC’s price. The analyst said:

Let’s see how the Daily closes But investors are only fearful at the moment. A breakdown from here would certainly make them extremely fearful (…). Greed drives price up. Fear drives price down. Extreme Greed precedes tops. Extreme Fear precedes bottoms. Bitcoin probably needs to reach extremely fearful investor sentiment before it finally bottoms and reverses.