Bitcoin’s price has been up dramatically since the very day popular exchange OKEx announced the suspension of all crypto withdrawal service on its platform. However, while some tie the two together, many market observers do not see a reason to associate the latest price rally with OKEx’s issues.

While the price of bitcoin gained significantly since the market sell-off in March, the most recent bullish run began just as OKEx said it suspended all crypto withdrawals because one of its key holders has “been out of touch.”

However, the suspension of withdrawals on OKEx had little impact on bitcoin’s price over the past month, said Ki Young Ju, chief executive officer of CryptoQuant.

“BTC’s price on OKEx is not that different from other exchanges,” he said. “…[P]eople can trade their BTC on OKEx despite the withdrawal suspension.”

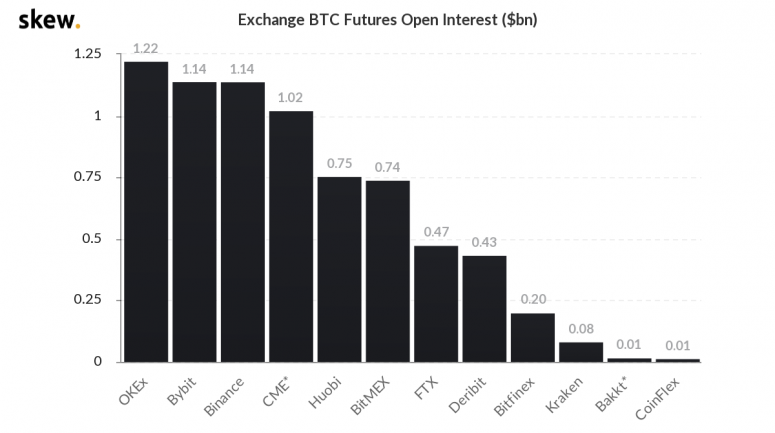

The Malta-based crypto exchange still remains the No. 1 position for bitcoin futures open interest, currently worth $1.22 billion, according to data source Skew.

OKEx said Thursday it will resume withdrawal service as soon as this week, after founder Mingxing “Star” Xu was said to have been released from police custody in China. Jay Hao, chief executive officer of OKEx, told CoinDesk its high open interest is a positive indicator for his company.

“These are encouraging signs that confidence in the exchange remains high and I believe that even if some users decide to withdraw their funds [as soon as withdrawals are open], which is their total and absolute right, they will soon come back to OKEx,” Hao said through a spokesperson on Telegram.

Decreased Chinese miners’ impact on prices

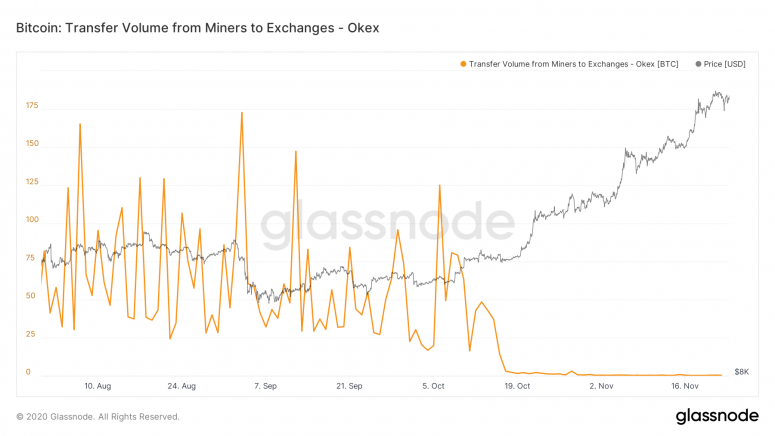

Bitcoin’s volume from miners to OKEx has also dropped to almost zero since the news came out, as data from Glassnode show.

The muted bitcoin transfer volume from miners to OKEx, whose users are largely Chinese, is in line with the argument that the price surge is partly due to drying up in supply. Miners in China are struggling to turn their bitcoin into cash because of a government crackdown on Chinese exchanges.

Darius Sit, founder of Singapore-based trading firm QCP, connects the situation for miners in China with the market, telling CoinDesk that instead of going to other platforms, miners may have been holding on to their bitcoins as prices continue to climb, causing a tightened bitcoin supply.

Yet, others have largely disagreed with such contentions, saying the supply of bitcoin affected by OKEx’s withdrawal suspension is relatively small.

“As a class, miners aren’t that large a group of sellers,” Ryan Watkins, bitcoin analyst at Messari, told CoinDesk in a Telegram message. “[They are] definitely not enough to drive the price up as high as it is.”

Instead, Watkins pointed out the recent bitcoin rally is mostly driven by the demand side, as institutional investors in North America have been buying bitcoin in large amounts.

The “perfect” timing of OKEx’s suspension and the price rally could be purely coincidental, Watkins added.

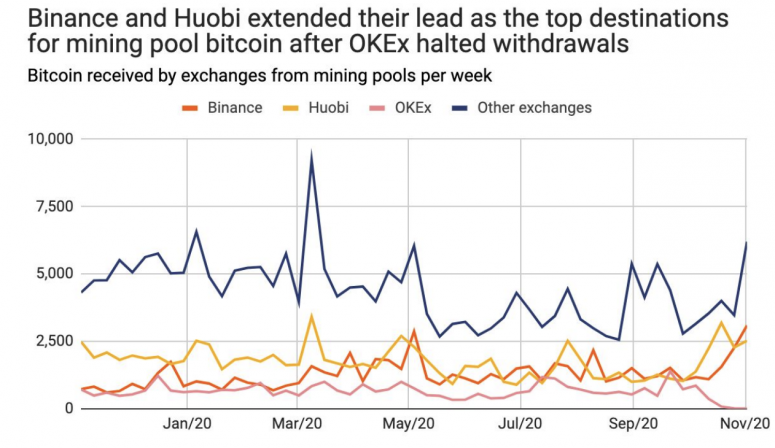

Data from Chainalysis also indicate that after mining pools stopped sending bitcoin to OKEx, their newly minted cryptocurrency instead flowed to Binance and Huobi, both of which are also widely used in China.

Binance, Huobi and OKEx in total received 46% of bitcoin sent to exchanges from mining pools in the past 12 months, according to a Nov. 12 report from Chainalysis.

Colin Wu, a journalist based in China who first reported the Chinese miners’ selling problem in his blog, told CoinDesk in a WeChat message that Western media outlets have largely “exaggerated” what he wrote, saying the difficulties Chinese miners have had selling bitcoin should have had a minor impact on the recent price rally.

“The misunderstanding is that Chinese miners stopped selling coins and caused bitcoin to rise, which is illogical,” Wu wrote in a tweet thread. “They did not stop selling coins. … It was just a little troublesome and the number of miners in China has been decreasing. Miners are moving to the United States and Kazakhstan.”