Asset manager Grayscale added 18 times more Bitcoin (BTC) than miners added to the supply in just one day on Jan. 18.

As various data sources confirm, Grayscale, which remains the biggest institutional buyer in the Bitcoin space, purchased a total of 16,244 BTC ($607 million) on Monday.

BTC buys accelerate again

The giant sums are some of the biggest on record and are an order of magnitude above what even Grayscale was attempting just last week. The company previously saw daily buys but stopped over the holiday period and reduced its allocations in the first week of the new year.

Monday’s activities bring its total assets under management (AUM) to almost $23 billion. As Cointelegraph reported, the total increased tenfold during 2020.

“Grayscale were buying $251 M of #Bitcoin on avg per week in Q4 2020,” Danny Scott, CEO of United Kingdom-based cryptocurrency exchange CoinCorner, tweeted.

“Last week they did $700 M in 1 day… And today $590 M… Pay attention.”

Unashamedly bullish on Bitcoin

The move underscores both Grayscale’s continued faith in Bitcoin as a long-term play and that of institutions choosing Bitcoin over any other form of macro asset.

Despite mixed messages from fellow asset manager Guggenheim, set to begin its BTC exposure this month, industry sources state that public announcements hide the true extent of institutional involvement.

“There is huge institutional demand and most of it is silent,” Gemini exchange co-founder Tyler Winklevoss said last week while berating gold bug Peter Schiff for claiming that players were actually not interested in Bitcoin.

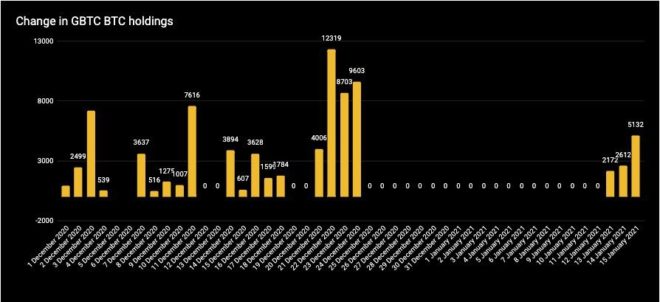

Data from on-chain analytics resource CryptoQuant meanwhile reveals changes in Grayscale’s buying habits, with late 2020 seeing the largest short-term increase in BTC holdings for the year.

Earlier, analysts at JPMorgan argued that inflows into the Grayscale Bitcoin Trust would need to maintain $100 million per day in order for Bitcoin to have a chance at reclaiming $40,000 price levels.