PayPal’s stock reached record highs on Monday, capping off a strong period of outperformance relative to the Nasdaq and broader U.S. stock market.

Since Nov. 12, the technology-focused Nasdaq has gained around 6.5%. The broad S&P 500 Index of large-cap stocks is up 3.5% over the same period.

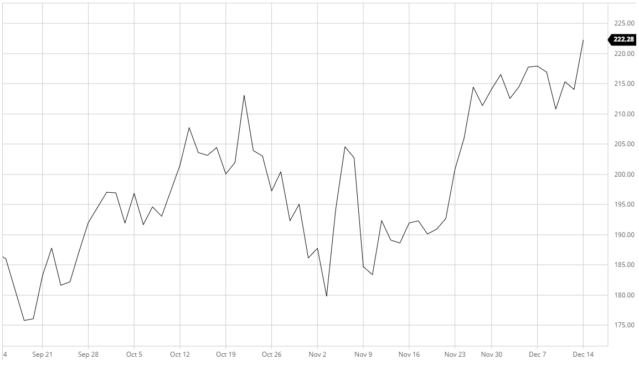

PayPal stock’s 3-month performance by barchart.com Although PayPal’s foray into crypto isn’t the only catalyst behind its vast outperformance, the merchant processor is well-positioned to capitalize on the growing adoption of digital assets. Some analysts have even speculated that a higher Bitcoin (BTC ) price could have a positive effect on PayPal’s prospects.

There’s also evidence that the payment processor may be positively influencing Bitcoin’s price. Recent industry data suggests PayPal may have scooped up as much as 70% of the newly mined BTC in the weeks leading up to its crypto platform going live in the U.S.

Although estimates vary, a 2019 survey of 5,000 people claimed that 6.2% of Americans above the age of 18 own Bitcoin. The survey said an additional 7.3% are planning to purchase BTC for the first time.

If these numbers are to be believed, cryptocurrencies could have a positive impact on PayPal’s business as more people gravitate to easy onramps. Case in point: Square’s Cash App has seen its revenue surge since enabling Bitcoin purchases. In fact, nearly 80% of Cash App’s third-quarter revenue was derived from fees charged on Bitcoin buyers.

Shares of PayPal Holdings (PYPL) have gained a whopping 17% since Nov. 12, the day the online merchant launched its crypto trading platform for eligible U.S. customers .

PayPal plans to launch its global crypto services in early 2021. CEO Dan Shulman asserted that it’s only a matter of time before his company starts supporting central bank digital currencies, or CBDCs , as they become available.

Original

Post navigation

<img width="640" height="360" src="https://fastcrypto.trade/wp-content/uploads/2025/08/1754197568_maxresdefault-840x473.jpg" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/08/1754197568_maxresdefault-840x473.jpg 840w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754197568_maxresdefault-649x365.jpg 649w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754197568_maxresdefault-500x280.jpg 500w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754197568_maxresdefault-768x432.jpg 768w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754197568_maxresdefault-100x56.jpg 100w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754197568_maxresdefault.jpg 1280w" sizes="(max-width: 640px) 100vw, 640px" />

<img width="480" height="360" src="https://fastcrypto.trade/wp-content/uploads/2025/08/1754193911_hqdefault.jpg" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/08/1754193911_hqdefault.jpg 480w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754193911_hqdefault-100x75.jpg 100w" sizes="(max-width: 480px) 100vw, 480px" />

<img width="640" height="360" src="https://fastcrypto.trade/wp-content/uploads/2025/08/1754186565_maxresdefault-840x473.jpg" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/08/1754186565_maxresdefault-840x473.jpg 840w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754186565_maxresdefault-649x365.jpg 649w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754186565_maxresdefault-500x280.jpg 500w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754186565_maxresdefault-768x432.jpg 768w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754186565_maxresdefault-100x56.jpg 100w, https://fastcrypto.trade/wp-content/uploads/2025/08/1754186565_maxresdefault.jpg 1280w" sizes="(max-width: 640px) 100vw, 640px" />

<link data-minify="1" rel='stylesheet' id='wp-block-library-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-includes/css/dist/block-library/style.min.css?ver=1734834998' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='contact-form-7-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/contact-form-7/includes/css/styles.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='easy-sidebar-menu-widget-css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/easy-sidebar-menu-widget/assets/css/easy-sidebar-menu-widget.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wp_automatic_gallery_style-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wp-automatic/css/wp-automatic.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wordpress-popular-posts-css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wordpress-popular-posts/assets/css/wpp.css?ver=1734804993' type='text/css' media='all' /><link rel='stylesheet' id='jquery-bxslider-css' href='https://fastcrypto.trade/wp-content/themes/supermag/assets/library/bxslider/css/jquery.bxslider.min.css?ver=4.2.5' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='font-awesome-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/assets/library/Font-Awesome/css/font-awesome.min.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='supermag-style-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/style.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='supermag-block-front-styles-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/acmethemes/gutenberg/gutenberg-front.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='the_champ_frontend_css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/super-socializer/css/front.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wp-paginate-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wp-paginate/css/wp-paginate.css?ver=1734804993' type='text/css' media='screen' />