Polkadot (DOT) has been raising eyebrows for the past couple of months as the interoperability-focused altcoins has gained 625% in the past three months.

The promise that interoperability between blockchains will be a viable solution to the high Ethereum gas fees plaguing the crypto market has made Polkadot’s development of parachains attractive and the number of projects choosing to build on DOT continues to grow alongside it’s popularity as a staking platform.

Polkadot parachains operate similarly to the Ethereum 2.0 sharding proposal, which creates independent blockchains built for a particular purpose. Many projects building on Polkadot, like Moonbeam, Equilibrium, and Acala, develop their own parachains where the project’s tokens would act as a native currency used to pay for transactions.

According to data from Staking Rewards, over 63% of DOT coins in circulation are locked up in staking mechanisms. Meanwhile, the progress of Polkadot’s development seems ahead of its competitors. According to PolkaProject, a site which tracks development activity, there are currently over 370 projects actively building on the platform.

Polkadots aggressive pace of development and the looming expectation of the official parachain mainnet launch in 2021, DOT price has seen immense growth in its futures contracts.

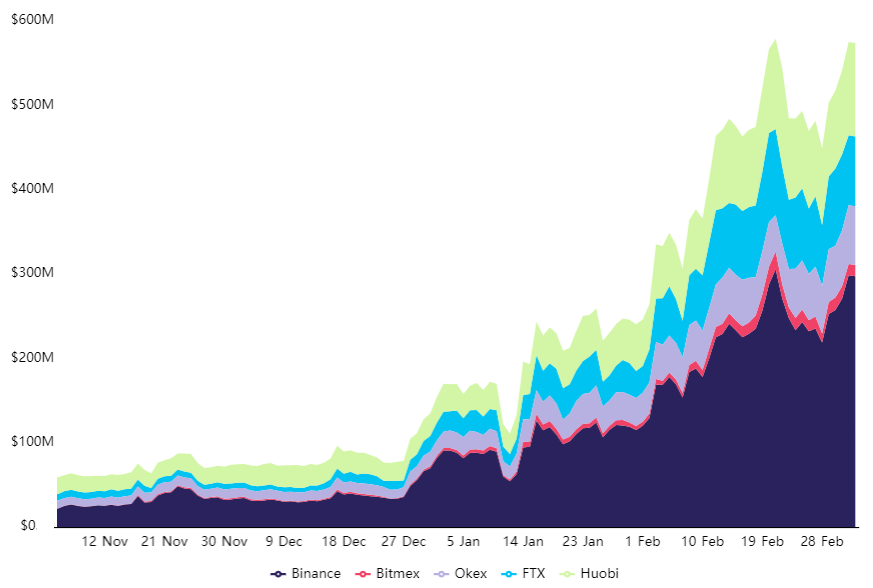

Over the past two months, DOT’s $73-million aggregate futures open interest grew by 690% to $575 million, becoming the fourth-largest derivatives market behind Bitcoin (BTC), Ether (ETH) and Cardano (ADA).

Surprisingly, Litecoin (LTC), which held third place since the dawn of futures contracts, lost its incumbent position. Moreover, data indicate that this was not purely a technical adjustment, as Polkadot’s on-chain and trading metrics vastly outperform Litecoin’s.

It is worth noting that DOT’s open interest faced a 23% cut between Feb. 21 and 27, as its price plunged 27% to $28.

DOT trading volume and on-chain metrics strengthen

Regardless of the price movement, low trading activity reflects a lack of interest from traders and a reduced inflow from new entrants.

Although starting from a much lower base three months ago, DOT’s trading volume soared in January, while Litecoin dropped by 50% after peaking at a $13 billion daily average. Meanwhile, DOT’s aggregate spot trading volume at exchanges has grown to $4.3 billion, a 660% increase.

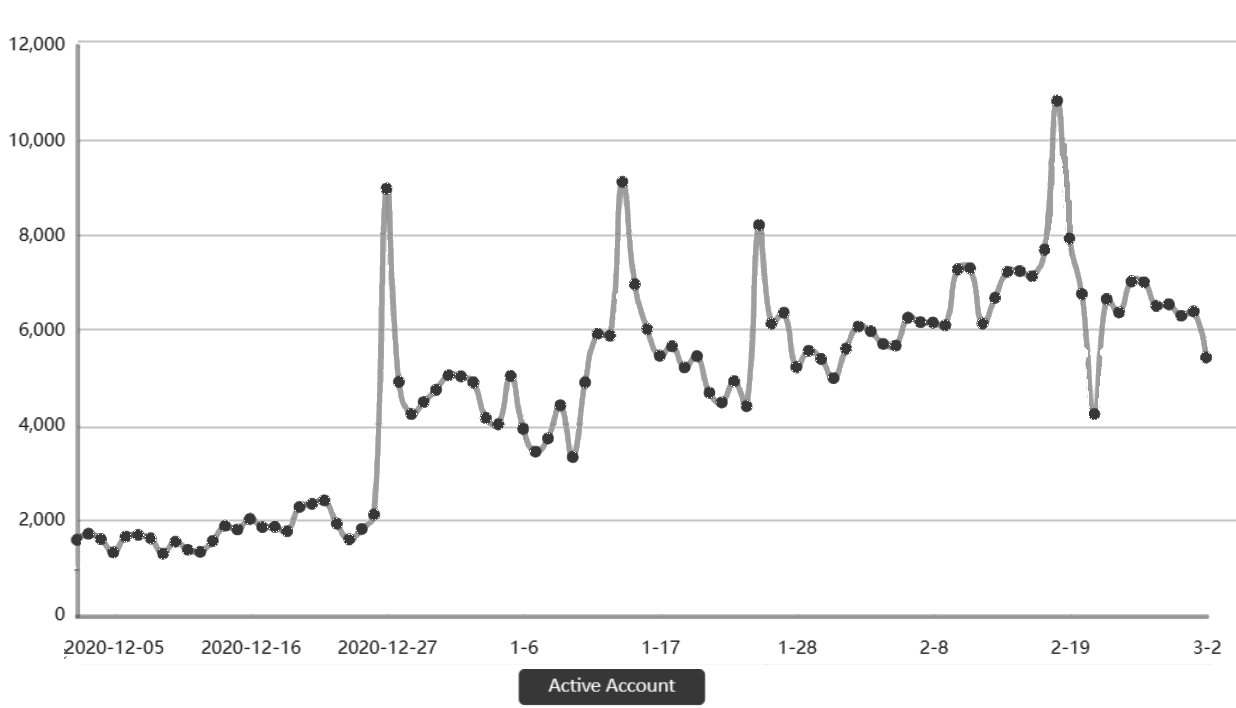

Polkadot’s on-chain metrics also provide insight into its rising use, growing from 1,600 daily active addresses to 6,000. The 275% growth for a network whose mainnet launch was less than eight months ago seems impressive.

It might take some time for Polkadot’s on-chain metrics to get closer to Litcoin’s and Cardano’s hundreds of thousands of active addresses but this is not problematic considering how nascent its technology is.

The VORTECS™ score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

In addition to surging open interest at major derivatives exchanges, the VORTECS™ score has risen to 80 on Feb. 26 and Feb. 27. Over the following five days, DOT price managed to rally by another 13%.

Polkadot’s “flippening” of Litecoin’s futures open interest signals that investors are far more interested in its scaling and interoperability potential, as opposed to Litecoin’s narrow-focused search for privacy through the integration of the MimbleWimble protocol.

As for the relatively small number of DOT’s active addresses, this should be monitored going forward, but as of now it shouldn’t hold back the token’s price appreciation.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.