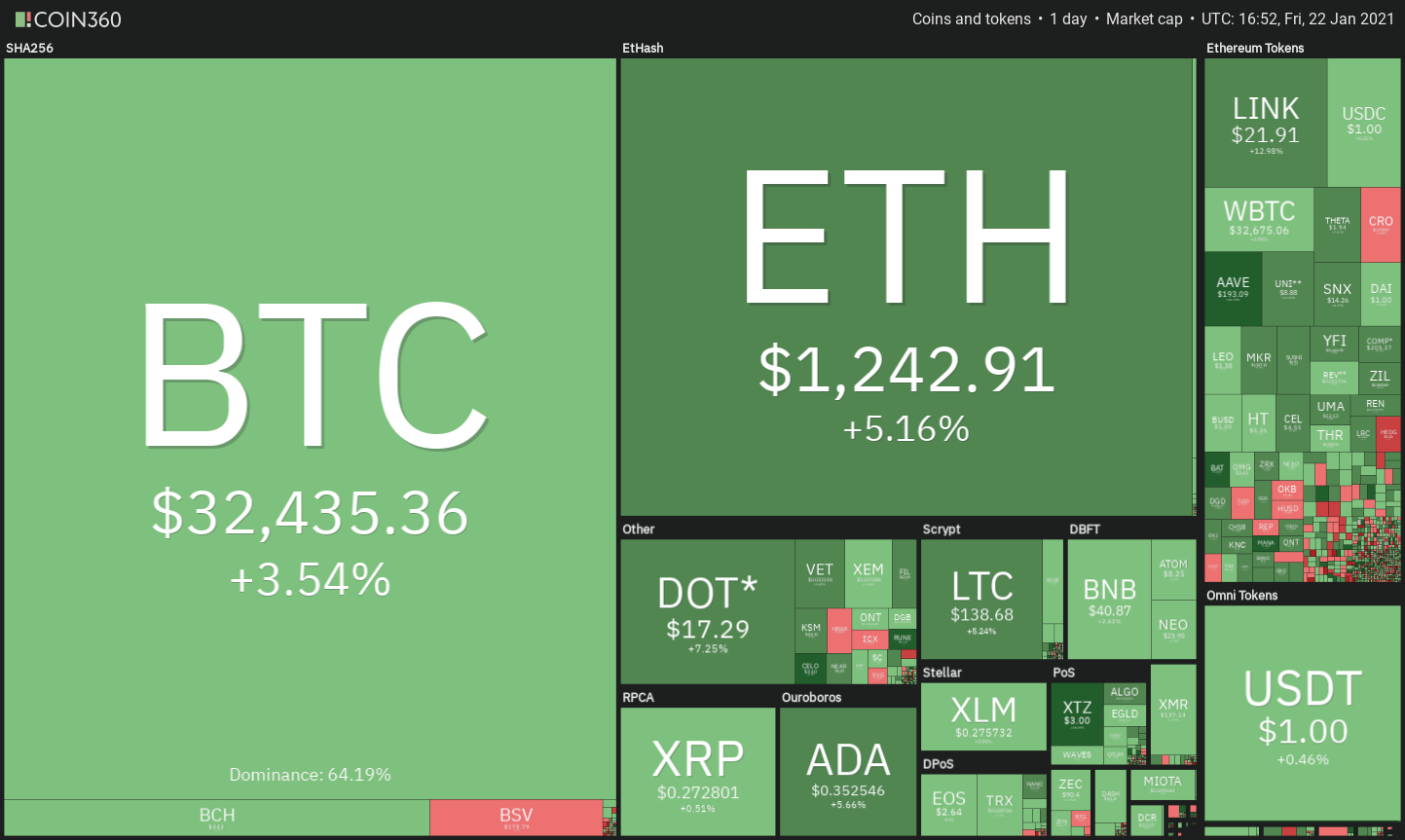

Bitcoin price has rebounded above a key trendline but resistance at higher levels may limit the recovery in altcoins.

Aggressive profit-booking sent Bitcoin (BTC) spiraling below $29,000 on Jan. 21 but was this a sign that institutional investors dumped their positions? This is one of the main questions bothering traders because large institutional inflows primarily led the run-up to $42,000.

Cointelegraph contributor Marcel Pechman analyzed derivatives data from various exchanges, which showed professional traders might have purchased at lower levels. The fall seems to have particularly hurt the excessively leveraged traders, resulting in $460 million worth of liquidations at derivatives exchanges.

Data from CryptoQuant shows that Bitcoin’s biggest mining pool, F2Pool, witnessed daily outflows of 10,000 Bitcoin for three days in a row, starting Jan. 17.

Although the outflows do not mean the miner has dumped the entire quantity, it shows a possible intent to reduce a portion of the inventory. This could have attracted selling from traders, fearing a sharp fall if the miners flooded the open market with BTC.

Currently, Bitcoin is rallying back toward $34,000 but is the current rebound a dead cat bounce or a resumption of the uptrend?

Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USD

Bitcoin held the 20-day exponential moving average ($34,146) on Jan. 20, but the bulls could not push the price back into the symmetrical triangle, which shows a lack of demand at higher levels. The bears renewed their selling on Jan. 21 and broke the 20-day EMA support decisively. This is the first indication that the bullish momentum has weakened.

The BTC/USD pair has bounced off the 50-day simple moving average ($28,103) today, but the rise could face resistance at the 20-day EMA. If the pair turns down from the 20-day EMA, it will suggest the sentiment has changed from buy on dips to sell on rallies.

If the next dip breaks below the 50-day SMA, the correction could deepen to the 61.8% Fibonacci retracement level at $22,106.73. Such a move may delay the resumption of the uptrend.

Contrary to this assumption, if the bulls can propel the price above the 20-day EMA, the pair could rise to the downtrend line. A breakout of this resistance could result in a retest of the all-time high at $41,959.63.

ETH/USD

Ether (ETH) plummeted below the $1,300 support and the 20-day EMA ($1,142) on Jan. 21, but the bulls defended the uptrend line today. The buyers are currently attempting to drive the price above the $1,300 resistance.

If they succeed, the ETH/USD pair could retest the all-time high at $1,438. A breakout and close above this resistance will suggest the uptrend has resumed. The next target objective on the upside is $1,675.

However, if the price turns down from the overhead resistance, the pair could consolidate in a range for a few days before starting the next trending move. The bears will be back in the game if the pair turns down and breaks below the uptrend line.

DOT/USD

Polkadot (DOT) is currently consolidating in an uptrend. The bulls have not allowed the price to dip below the 38.2% Fibonacci retracement level at $14.7259, suggesting that the traders are not rushing to the exit as they expect the uptrend to resume.

The upsloping moving averages and the relative strength index (RSI) near the overbought zone suggest the bulls are in command. If the buyers can thrust the price above the $18 to $19.40 overhead resistance zone, the uptrend could resume. The next level to watch on the upside is $24 and then $30.

If the price turns down from the overhead resistance, the DOT/USD pair may remain range-bound for a few more days. The pair could turn negative if the bears sink and sustain the price below the 20-day EMA ($13.25).

XRP/USD

XRP slipped below the $0.25 support today, but the bears could not sustain the lower levels. The bulls purchased the dip and are currently attempting to push the price above the 20-day EMA ($0.29).

If they manage to do that, the XRP/USD pair may rise to the downtrend line, which has acted as a stiff resistance on two previous occasions. If the price once again turns down from this resistance, the bears will try to sink the pair below $0.25 and complete the descending triangle pattern. If that happens, the pair could drop to $0.169.

On the other hand, if the bulls can push the price above the downtrend line, the pair may rise to $0.385. A breakout of this resistance could start a new uptrend, but if the price turns down from this level, the pair may continue to consolidate between $0.25 and $0.385 for a few more days.

ADA/USD

Cardano (ADA) broke below the $0.34 support on Jan. 21 and the 20-day EMA ($0.30) today, but the bulls purchased at the support line of the ascending channel, which shows demand at lower levels.

The buyers are currently attempting to sustain the price above the $0.34 overhead resistance. If they succeed, a retest of $0.3971995 is likely. The upsloping moving averages and the RSI in the positive zone suggest bulls have the upper hand.

A breakout and close above $0.40 could resume the uptrend with the next target objective at $0.50. This bullish view will invalidate the price turns down and breaks below the channel. The next support on the downside is the 50-day SMA at $0.22.

LTC/USD

Litecoin (LTC) has formed a head and shoulders pattern that will complete on a breakdown and close below $120. The strong rebound off the 50-day SMA ($122.80) today suggests the bulls are defending the $120 support.

The current bounce could face selling at the downtrend line. If the price turns down from this resistance, the bears will again try to break the neckline at $120 and complete the head and shoulder pattern. If they succeed, the LTC/USD pair could drop to $100 and then to $70.

This negative view will invalidate if the bulls push the price above the downtrend line. The momentum could pick up above $160 and result in a retest of $185.5821. A breakout of this resistance may resume the uptrend.

LINK/USD

Chainlink (LINK) rebounded sharply from just below the 20-day EMA ($18.18) today, which shows the bulls are actively buying on dips. The upsloping 20-day EMA and the RSI in the positive territory suggest bulls are in command.

If the bulls can sustain the price above $22, the LINK/USD pair could retest the all-time high at $23.767. A breakout and close above this resistance may resume the uptrend, with the next target at $27 and then $30.

Contrary to this assumption, if the price turns down from the overhead resistance, a few days of consolidation is possible. The trend will turn in favor of the bears if they can sink the pair below $17.

BCH/USD

Bitcoin Cash (BCH) broke below the uptrend line on Jan. 21, and the altcoin dropped close to the 50-day SMA ($375) today. The 20-day EMA ($459) has flattened out, and the RSI near the midpoint suggests a few days of range-bound action.

If the bulls push the price back above the 20-day EMA, the BCH/USD pair could rise to $539. The bears are likely to mount a strong defense at this level. If the price turns down from this resistance, the pair may remain stuck between $539 and $370 for a few days.

On the contrary, if the current bounce turns down from the 20-day EMA, the bears will again try to sink the price below the $370 support. If they succeed, the pair may correct to $275.

BNB/USD

The bulls defended the 20-day EMA ($40.82) on Jan. 20 but renewed selling on Jan. 21 sent Binance Coin (BNB) tumbling to the support line of the ascending broadening wedge pattern.

The bears tried to sink the price below the pattern today but strong buying by the bulls has pushed the price to the 20-day EMA. If the bulls can propel the price above the 20-day EMA, it will indicate accumulation at lower levels. This could result in a rally to $44 and then to $47.2187.

Contrary to this assumption, if the price turns down from the current levels and breaks below the support line, it will suggest traders are selling at the 20-day EMA, which indicates a bearish sentiment. If the 50-day SMA ($35.95) cracks, the BNB/USD pair could correct to $30 and then to $26.7273.

XLM/USD

Stellar (XLM) plunged below the $0.26 to $0.325 range on Jan. 21, indicating the balance had shifted in favor of the bears. The sellers tried to sink the price to the 50-day SMA ($0.205) today, but the buyers arrested the decline at $0.228112.

The bulls are currently attempting to push the price back inside the range. If they succeed in sustaining the price above the 20-day EMA ($0.264), it will suggest the break below the range was a bear trap.

If the bulls can sustain their buying and push the price above $0.325, the XLM/USD pair could resume the uptrend and rally to $0.40

On the other hand, if the pair again turns down and breaks below $0.26, it will suggest the sentiment has turned negative, and traders are selling on minor rallies. This could pull the price down to the 50-day SMA.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.