Several top cryptocurrencies have broken below their critical support levels, suggesting that this could be the start of a deeper correction.

Fear gripped the markets on the news that Chinese authorities had raided the offices of the leading cryptocurrency exchange Binance. This negated all the positive effects that had accrued following President Xi Jinping’s endorsement of blockchain technology. Though Binance denied reports of any raids, price action within the sector has remained subdued.

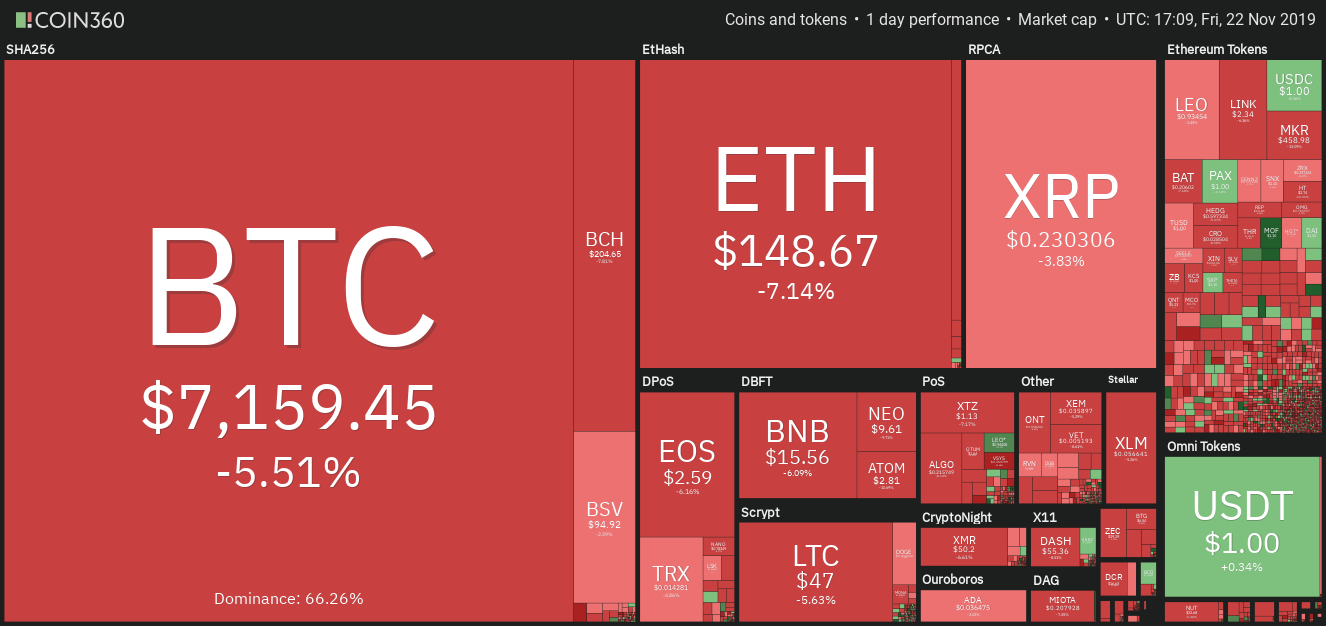

Daily cryptocurrency market performance. Source: Coin360

Naysayers will use these bearish moments to further spread panic among market participants by issuing outlandish targets on the downside. Peter Schiff believes that Bitcoin could plummet to $1,000 as it has formed a head and shoulders pattern. We, however, could not find the bearish pattern on the charts.

As we are bullish over the long-term, we view any fall as an opportunity to load up at lower prices. However, purchases should be done only after a bottom is confirmed because, during a panic, the prices can sell off easily. After the most recent fall, are any cryptocurrencies flashing buy signals? Let’s analyze the charts.

BTC/USD

Bitcoin (BTC) has broken below the critical support at $7,337.78, which is 61.80% Fibonacci retracement of the entire upside move from the yearly lows to the yearly highs. This is a bearish sign as it resumes the downtrend. If the bears can sink the price below the support line, a drop to $5,533.90 is possible.

BTC USD daily chart. Source: Tradingview

The moving averages have completed a bearish crossover and the RSI is in the oversold zone, which suggests that bears are in command.

However, the recent decline has pushed the RSI into deep oversold territory, which suggests that the selling has been overdone in the short-term. We might witness a sharp pullback in the next few days, which can be traded by the short-term traders.

For the positional traders, we will watch the price action for the next few days and suggest a long position if buyers return. Until then, we suggest traders remain on the sidelines.

ETH/USD

The selling pressure intensified in Ether (ETH) after it broke below the support at $173.841. Over the last 48-hours, Ether plummeted below the $161.056 to $151.829 support zone. This triggered our suggested stop loss on the long positions.

ETH USD daily chart. Source: Tradingview

A break below $151.829 is a bearish sign because it resumes the downtrend in the ETH/USD pair. The next stop is likely to be $120. With the recent fall, the RSI has dipped into the oversold territory, hence, a pullback is possible. We expect the recovery attempt to hit a wall at the previous support turned resistance zone of $151.829 to $161.056.

XRP/USD

XRP has declined close to the critical support at $0.22. The 20-day EMA is sloping down and the RSI is in oversold territory, which shows that bears are in command. However, the fall in the past few days has been rapid, hence, we anticipate the bears to book profits at the current levels.

XRP USD daily chart. Source: Tradingview

The pullback is likely to hit a wall closer to $0.24508 and above it at the 20-day EMA. If the next downturn breaks below $0.22, a drop to $0.18 is possible.

Contrary to our assumption, if the bulls push the price above the moving averages, it will indicate that the XRP/USD pair might remain range-bound for a few more days. A strong bounce off the current levels might offer a buying opportunity for short-term traders. However, we will wait for signs of buying to emerge before recommending a trade in it for the positional traders.

BCH/USD

The bears are attempting to defend the support at $203.36. If this support breaks down, Bitcoin Cash (BCH) can plunge to the next support at $166.98. With 20-day EMA sloping down and RSI in oversold territory, advantage is clearly with the bears.

BTC USD daily chart. Source: Tradingview

Conversely, if the BCH/USD pair bounces off the current levels, it might face selling at the moving averages. If the bulls can push the price above the moving averages, the pair could remain range-bound for a few more days. As the sentiment is to sell the rallies, we will wait for the price to confirm a bottom formation before proposing a trade in it.

LTC/USD

Litecoin (LTC) broke below the $50 to $47.1851 support zone today, which triggered our recommended stop loss on the long positions. If the bears can sustain the price below $47, the downtrend will resume. The next support on the downside is $36.

LTC USD daily chart. Source: Tradingview

Alternatively, if the LTC/USD pair rebounds off the current levels, the bulls will try to keep it inside the $47 to $66 range for a few more days. The short-term traders can watch the price action at the current levels and initiate long positions to take a quick counter-trend trade. However, this is risky, hence, we suggest positional traders remain on the sidelines.

EOS/USD

EOS has continued its journey southwards. It has broken below the support at $2.9980 and is close to the critical support at $2.4001.The 20-day EMA has turned down and the RSI is close to the oversold zone, which shows that bears are in command.

EOS USD daily chart. Source: Tradingview

As the EOS/USD pair had bounced off $2.4001 on two previous occasions, we anticipate the bulls to defend the support once again. A strong bounce off $2.4001 might keep the pair range-bound for a few more days. We will watch the price action at $2.4001 and then recommend a trade if we find a reliable buy setup.

BNB/USD

Binance Coin (BNB) sliced through the strong support at $18.30 on Nov. 20. This attracted further selling, which plunged the price to the critical support at $14.2555, thus triggering our suggested stop loss on the long positions.

BNB USD daily chart. Source: Tradingview

The bulls are currently attempting to defend the support at $14.2555. If successful, the BNB/USD pair might rise to the overhead resistance level of $16.50 and above it $18.30. Alternatively, if the next dip breaks below $14.2555, a drop to $11.30 is possible. We will wait for the buyers to show interest in BNB before suggesting a trade in it.

BSV/USD

Bitcoin SV (BSV) has picked up momentum after breaking below the descending channel. The bears have pushed the price below the critical support at $107. There is a minor support at $92.693 below which a decline to $78.506 is possible.

BSV USD daily chart. Source: Tradingview

Both the moving averages are close to completing a bearish crossover and the RSI is near the oversold zone. This suggests that supply far outweighs demand. We will wait for a new buy setup to form before recommending a trade in it.

XLM/USD

Stellar (XLM) plunged below the immediate support at $0.062122 on Nov. 21. Both moving averages are on the verge of a bearish crossover and the RSI is close to over oversold levels. This shows that bears have the upper hand.

However, the price had bounced off the support at $0.056 on two previous occasions, hence, we anticipate the bulls to defend this support once again.

XLM USD daily chart. Source: Tradingview

If the price bounces off $0.056, the XLM/USD pair can move up to the moving averages where it is likely to encounter stiff resistance. Conversely, if the bears sustain the price below $0.056, the pair can decline to $0.051014. We will wait for a new buy setup to form before proposing a trade in it.

TRX/USD

Tron (TRX) has broken below the support line of the descending channel. Both moving averages are on the verge of a bearish crossover, which indicates that sellers are in command. Every recovery attempt is likely to be sold into.

TRX USD daily chart. Source: Tradingview

If the bears can sustain the TRX/USD pair below $0.0136655 a retest of $0.0116262 is possible. Conversely, if the bulls defend the critical support at $0.0136655, a rise to $0.0175 is possible. We will wait for a new buy setup to form before suggesting a trade in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.