The bears have been unable to capitalize on the breakdown of critical support levels and this suggests that the current dip could be a bear trap.

The total crypto market capitalization has bounced from the $180 billion mark. We anticipate a strong support in the $168 billion to $183 billion range because the market cap had consolidated in this range in April of this year, before moving higher. So, on the way down, we expect this range to act as a strong support.

Although Bitcoin (BTC) has started this leg of the down move, it is interesting to note that it has not given up its crypto market dominance, which remains above 66%. This shows that the altcoins are unlikely to go against Bitcoin’s main trend. For an altcoin season to start, Bitcoin should at least stop falling.

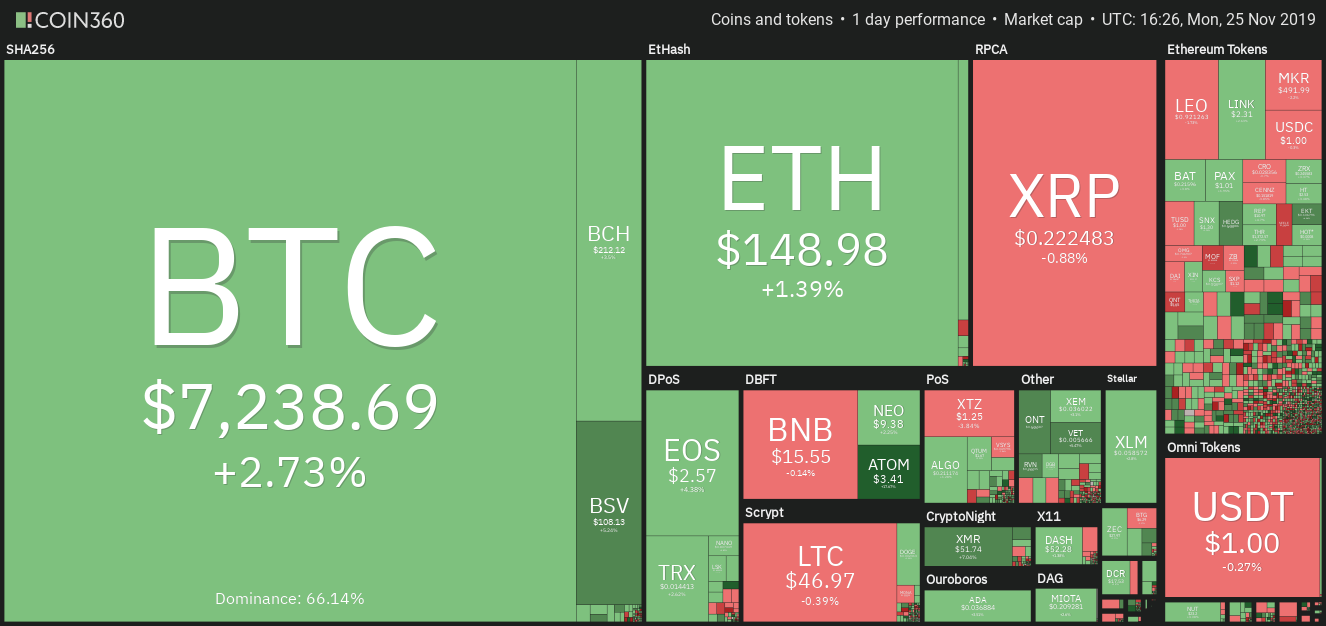

Daily cryptocurrency market performance. Source: Coin360

Data from Google Trends shows that the recent plunge in Bitcoin prices generated greater interest among consumers as searches for “Bitcoin” hit its highest level since late October. This shows that market participants are viewing this current dip as a buying opportunity in light of the forthcoming Bitcoin halving event next year.

We believe that the current dip is showing signs of a bear trap. However, buying in a falling market can lead to quick losses. Therefore, traders can wait for the price to stop falling and signal a reversal before buying. Let’s look at the critical levels traders should watch out for.

BTC/USD

The bulls are attempting to defend the support line. This line had acted as a strong support previously, hence, we anticipate a bounce off it. If Bitcoin (BTC) rises above $7,337.78, it can rally to the 20-day EMA, from where we expect the prices to turn down once again.

BTC USD daily chart. Source: Tradingview

If the next dip is held above the recent lows of $6,512.01, it will signal a bottom, which can offer a buying opportunity with a good risk-to-reward ratio.

However, contrary to our assumption, if the BTC/USD pair fails to rise above the overhead resistance zone of $7,337.78 to $7,702.87, it will indicate a lack of buyers. In that case, the possibility of a break below $6,512.01 increases. If this level breaks down, the next support is at the 78.60% Fibonacci retracement level of $5,533.90.

We believe that the current fall is a bear trap and a good buying opportunity for both traders and investors. However, we would wait for the decline to end and a reversal pattern to form before recommending a trade in it.

ETH/USD

The sharp fall in the past few days had dragged the RSI into oversold territory, which suggested that the selling had been overdone. Ether (ETH) is currently attempting a pullback from $131.484 levels.

We expect the pullback to face resistance at $151.829 and above it at the 20-day EMA. If the price reverses direction from the overhead resistance and slumps below $131.484, a drop to the next support at $120 is possible.

ETH USD daily chart. Source: Tradingview

Alternatively, if the price quickly climbs and sustains above $151.829, it will indicate that the current fall was a bear trap. We will wait for the price to sustain above $151.829 before turning positive. Above $151.829, the ETH/USD pair can rally to the moving averages.

XRP/USD

XRP made a new lifetime low of $0.20041, which is a bearish sign. The straight fall from $0.31503 has plunged the RSI into deeply oversold territory. This indicates that the selling has been overdone and a relief rally is likely. The first level to watch on the upside is the 20-day EMA, which is sloping down. If the momentum carries the price above the moving averages, a rally to $0.31508 is possible. However, we give it a low probability of occurring.

XRP USD daily chart. Source: Tradingview

We expect the bears to defend the 20-day EMA aggressively. If the next dip plummets below $0.20041, the XRP/USD pair will resume its downtrend and can decline to $0.18. Conversely, if the bulls keep the price above $0.22 during the next fall, it will indicate that the current fall was a bear trap. We do not find any reliable buy setups, hence, we suggest traders remain on the sidelines.

BCH/USD

The bulls have been defending the critical support at $203.36 for the past three days. We expect a pullback from the current levels that can carry Bitcoin Cash (BCH) to $241.85, which is likely to act as a stiff resistance.

BCH USD daily chart. Source: Tradingview

If the price turns down from the 20-day EMA and plunges below $192.52, the downtrend will resume and a decline to $166.98 is possible. However, if the next dip holds above $203.36, it will confirm a bottom. We will wait for the confirmation of a bottom before proposing a trade in the BCH/USD pair.

LTC/USD

Litecoin (LTC) plunged to a low of $42.0599 from where the bulls have started a pullback. We expect the bears to defend the $47.1851 to $50 resistance zone. Above this zone, the next level to watch will be the 20-day EMA.

LTC USD daily chart. Source: Tradingview

If the price turns down from the overhead resistance levels, the bears will attempt to sink the LTC/USD pair below the recent lows. If successful, the pair can drop to $36. Alternatively, if the next dip does not break below the recent lows of $42.0599, it might offer a buying opportunity We will wait for a reversal pattern to form before recommending a trade in it.

EOS/USD

EOS has corrected to the critical support at $2.4001. This level had seen buying emerge on two previous occasions, hence, we anticipate a bounce off it once again. The first level to watch on the upside will be the 20-day EMA and above it $3.69.

EOS USD daily chart. Source: Tradingview

Conversely, if the bears sink and sustain the EOS/USD pair below the support at $2.4001, a retest of the yearly low is possible. The downsloping 20-day EMA and the RSI in oversold territory, suggesting that bears are in the driver’s seat.

BNB/USD

Binance Coin (BNB) is bouncing off the critical support at $14.2555, which is a positive sign. It shows that the bulls are aggressively defending this level. The pullback can move up to the moving averages and above it to $21.2378.

BNB USD daily chart. Source: Tradingview

Conversely, if the bears sink the price below $14.2555, the BNB/USD pair will resume its down move. The next support on the downside is much lower at $11.30. The downsloping moving averages and the RSI in oversold zone suggest that bears are in command. We will wait for the pair to form a reversal pattern before recommending a trade in it.

BSV/USD

Bitcoin SV (BSV) is attempting to rebound off the support at $92.693. This is a positive sign as it shows that the bulls are keen to initiate long positions at lower levels. The pullback will pick up momentum on a break above the moving averages. Above the moving averages, a rally to $155.380 is possible.

BSV USD daily chart. Source: Tradingview

Nonetheless, we anticipate the BSV/USD pair to face stiff resistance at the moving averages. If the price turns down from this level, the bears will once again try to break below the support at $92.693. If successful, a drop to $78.506 is possible. We do not find any reliable buy setups at current levels, hence, we remain neutral on the pair.

XLM/USD

Stellar (XLM) is finding support in the $0.056 to $0.051014 support zone. This is a positive sign as it shows that the bulls are keen to buy close to key support levels. A rebound from the current levels will face stiff resistance at the 20-day EMA.

XLM USD daily chart. Source: Tradingview

The moving averages have completed a bearish crossover and the RSI is near the oversold territory, which suggests that bears have the upper hand. A break below $0.051014 will be a huge negative as it will resume the downtrend.

Conversely, a breakout of the moving averages will be the first signal that the downtrend is over and the XLM/USD pair might remain range-bound between $0.051014 and $0.088708. This is a large range that can be traded but we will wait for a new buy setup to form before recommending a trade in it.

TRX/USD

The bulls have been aggressively defending the $0.0136655 support for the past three days. Though Tron (TRX) broke below the support, the bears could not capitalize on it. This shows demand at lower levels. However, with the 20-day EMA sloping down and the RSI close to oversold territory, the advantage is with the bears.

TRX USD daily chart. Source: Tradingview

Any recovery attempt from the current levels is likely to face stiff resistance at the 20-day EMA. If the next down move convincingly breaks below $0.0136655, the TRX/USD pair can drop to $0.0116262.

Our bearish view will be invalidated if the bulls push the price above the 20-day EMA. We will wait for the price to signal a turn around before proposing a trade in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.