Bitcoin prices are holding up well but the fact that many altcoins are witnessing profit booking suggests that the focus is shifting back to BTC.

Crypto traders seem to be approaching the Bitcoin halving without any fanfare. Bitcoin’s (BTC) price action has been marginally positive in the past few days but it has only recently overcome the sharp crash of March 12. When the markets approach an important event without the overhang of huge expectations, it does not have to worry about disappointment and large-scale liquidation of positions. This could turn out to be in favor of the bulls.

According to the Crypto Fear & Greed Index, trader’s sentiment that had remained in the “extreme fear” zone for seven weeks has improved to fear. As several nations discuss reopening their economies, traders might stop hoarding cash and start putting it to use over the next few days. Some percentage of the money is likely to flow into Bitcoin and other altcoins as they have largely held their own during one of the worst crises in decades.

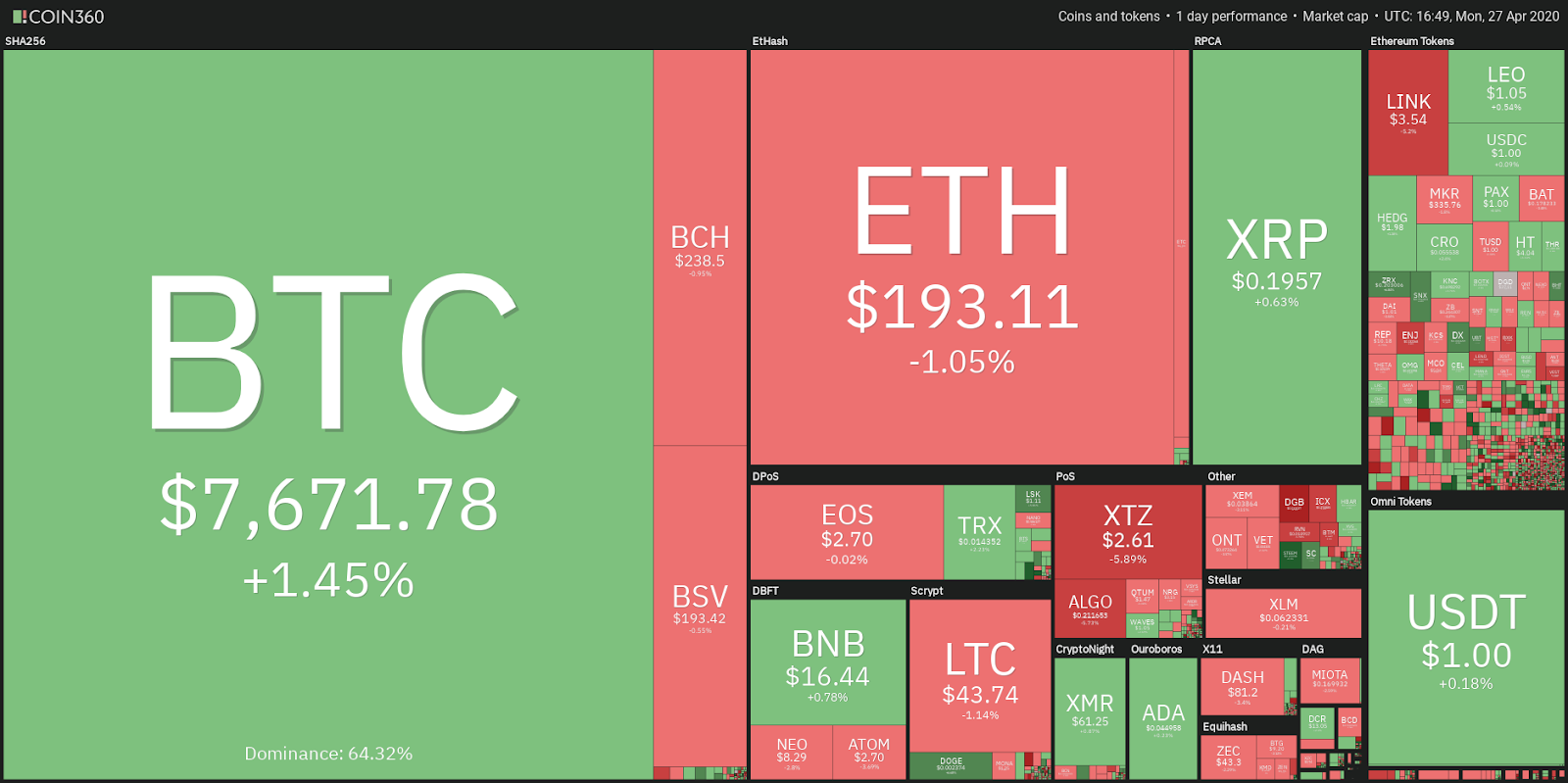

Daily cryptocurrency market performance. Source: Coin360

However, not everyone is bullish on the prospects of Bitcoin. In a recent interview, billionaire investor Mark Cuban said that he was bearish on Bitcoin. He said that his opinion would change only after if it becomes so easy to use Bitcoin that even “grandma can do it.” Until then, Cuban opines that bananas are easier to trade as a commodity compared to Bitcoin.

As Bitcoin’s halving is less than 15 days away, will the traders dump their altcoins and shift their attention only to Bitcoin or will the digital asset pull the whole sector higher? Let’s analyze the charts to find out.

BTC/USD

Bitcoin (BTC) was stuck close to $7,500 levels between April 23-25. The only positive thing was that the bulls did not allow the price to dip and sustain below the breakout level of $7,454.17 during the period.

BTC–USD daily chart. Source: Tradingview

This attracted buying on April 26, which helped the biggest cryptocurrency to resume the recovery. However, the bulls are struggling to push the price towards the immediate target of $8,000.

The current recovery has been gradual with several intermittent periods of consolidation. Even after breaking above resistance levels, the BTC/USD pair has failed to pick up momentum. This suggests a lack of confidence among the bulls that the rally is on a strong footing.

When the trend is weak, it is susceptible to a pullback on any adverse news. If bears sink the pair back below the breakout level of $7,454.17, a drop to the 20-day exponential moving average ($7,190) is possible.

If this support holds, the bulls will make another attempt to carry the pair to the $8,000-$8,175.49 resistance zone. Above this zone, the rally can extend to $9,200.

Conversely, if the bears sink the price below the 20-day EMA, a drop to the 50-day simple moving average ($6,676) is possible. The trend will turn negative on a break below $6,471.71.

The stops on 50% of the long positions can be kept at $7,000 while the rest can be trailed higher to $6,450. This move will reduce the risk and protect paper profits.

ETH/USD

Ether (ETH) rallied close to the psychological resistance at $200 on April 26 but could not break above it and reach the resistance of the ascending channel at about $207. This suggests that the bears are defending the $200-$207 resistance zone.

ETH–USD daily chart. Source: Tradingview

The bears will now attempt to drag the ETH/USD pair to the 20-day EMA ($175.7) and below it to the support line of the ascending channel. The 20-day EMA is sloping up and the RSI is in the positive zone, which suggests that buyers have the upper hand.

If the bulls buy the dip to the 20-day EMA or the support line of the channel, the pair will continue its upward journey inside the channel. The pair will pick up momentum on a break above the channel and will turn weak on a drop below the channel. Therefore, the stop-loss on the long positions can be trailed higher to $160.

XRP/USD

XRP has been trading above the 20-day EMA ($0.189) for the past four days but the bulls have not been able to carry the price to the top of the $0.17372-$0.20570 range. This suggests that the bulls are in no urgency to buy as they are not certain about the next uptrend.

XRP–USD daily chart. Source: Tradingview

If the XRP/USD pair dips below the 20-day EMA, a drop to the bottom of the range at $0.17372 is likely. This is a critical support to watch out for because if this gives way, the trend will shift in favor of the bears. Hence, the stop-loss on the long positions can be kept at $0.170.

Conversely, a strong rebound off the 20-day EMA will signal renewed buying interest. If the bulls can drive the price above $0.20570, a new uptrend is likely. The first target to watch out for is $0.25 and then a rally to the long-term downtrend line at $0.28.

BCH/USD

Bitcoin Cash (BCH) has been struggling to break above the overhead resistance of $250 for the past four days. This shows that the bears are aggressively defending this resistance. Currently, the altcoin is attempting to hold the 20-day EMA ($234.69).

BCH–USD daily chart. Source: Tradingview

If the BCH/USD pair bounces off the 20-day EMA, the bulls will once again try to drive the price above $250. If successful, a move to $280.47 is likely.

However, if the bears sink the pair below the 20-day EMA, a drop to $215 and below it to $200 will be on the cards. A break below $200 will complete the bearish head and shoulders pattern, which will be a huge negative. Therefore, the stop-loss on the long positions can be retained at $197.

BSV/USD

Bitcoin SV (BSV) has been trading inside a tight range of $187.16-$203.40 for the past four days. This suggests that both the buyers and the sellers are not placing large bets as they are uncertain about the next directional move.

BSV–USD daily chart. Source: Tradingview

A break below $187.16 can drag the price to the next critical support at $170. A breakdown of this support will sway the advantage in favor of the bears. Below $170, the next support on the downside is at $146.20. Therefore, the traders can protect their long positions with stops at $165.

The BSV/USD pair could attract buyers after a breakout above $203.40. Above this level, a move to $227 is likely.

LTC/USD

Though the bulls pushed Litecoin (LTC) above the overhead resistance of $43.67 on April 24, they have not been able to carry the price to the next level of $47.6551. This suggests a lack of buyers at higher levels.

LTC–USD daily chart. Source: Tradingview

Currently, the LTC/USD pair has dipped to the 20-day EMA ($42.69). If the pair can bounce off this support, the bulls will make another attempt to rally to $47.6551.

Conversely, a break below the 20-day EMA can drag the pair to $40 and below it to $35.8582 levels. For now, the stops on the long positions can be kept at $35. If the pair shows weakness, the traders can contemplate closing half of the position at $39.50.

EOS/USD

The bulls have not been able to push EOS above the overhead resistance of $2.8319 for the past four days. This suggests that the bears are defending this level. If the price turns down and breaks below $2.586, a drop to $2.3314 is possible. That will keep the altcoin range-bound for a few more days.

EOS–USD daily chart. Source: Tradingview

On the other hand, if the EOS/USD pair takes support at the 20-day EMA ($2.60) and breaks above $2.8319, a rally to the $3.1802-$3.3324 zone is possible. Above this zone, the up move can extend to $3.8811.

The pair will turn negative on a break below the support at $2.3314. Therefore, the traders can retain the stop loss on the long positions at $2.20.

BNB/USD

Binance Coin (BNB) has been gradually moving higher in the past few days. The 20-day EMA ($15.39) is sloping up and the relative strength index is in the positive territory, which suggests that bulls have the upper hand.

BNB–USD daily chart. Source: Tradingview

However, the slow pace of rise suggests that the bulls are cautious in their purchases. Currently, the bears are posing a stiff challenge at $16.8183.

If the BNB/USD pair turns down from the current levels but bounces off the 20-day EMA, the bulls will once again attempt to push the price above $16.8183. If successful, a rally to $21.50 is possible.

However, if the bears sink the pair below the 20-day EMA, a drop to the next support at $13.65 is likely. The traders can trail the stops on the long positions to $14.50.

XTZ/USD

Tezos (XTZ) broke above the overhead resistance of $2.7529 on April 25 but the bulls could not build up on the breakout. This shows that the bears are aggressively defending this level, as suggested in the previous analysis.

XTZ–USD daily chart. Source: Tradingview

The bears will now try to sink the XTZ/USD pair to the 20-day EMAv($2.30), which had acted as a strong support on two previous occasions (marked as ellipse on the chart).

If the pair bounces off this support once again, the bulls will attempt to push the price above the recent highs of $2.8969. If successful, a rally to $3.2712 is possible. Therefore, the traders can keep the stop loss on the remaining long positions at breakeven.

This bullish view will be invalidated if the pair breaks below the 20-day EMA. Such a move can drag the price to the next support at $2.0618.

XLM/USD

Stellar Lumens (XLM) has overtaken Chainlink (LINK) as the tenth largest cryptocurrency in terms of market capitalization. Hence, it has been included in our analysis today.

XLM–USD daily chart. Source: Tradingview

The XLM/USD pair picked up momentum on a break above $0.052443 on April 22 and quickly rallied to the next target objective of $0.062805 on April 23. However, since then, the bears have been aggressively defending this overhead resistance.

Repeated attempts by the bulls to break out and sustain above $0.062805 have failed in the past four days. Nevertheless, the positive thing is that the bulls have not given up much ground, which increases the possibility of the resumption of the up move.

The 20-day EMA is sloping up and the RSI has been trading in the overbought zone, which suggests that the bulls are in command. On a break above the $0.062805-$0.066102 resistance zone, a rally to $0.073434 is possible. Conversely, if the bears sink the pair below $0.060, a drop to the 20-day EMA ($0.053) is likely.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.