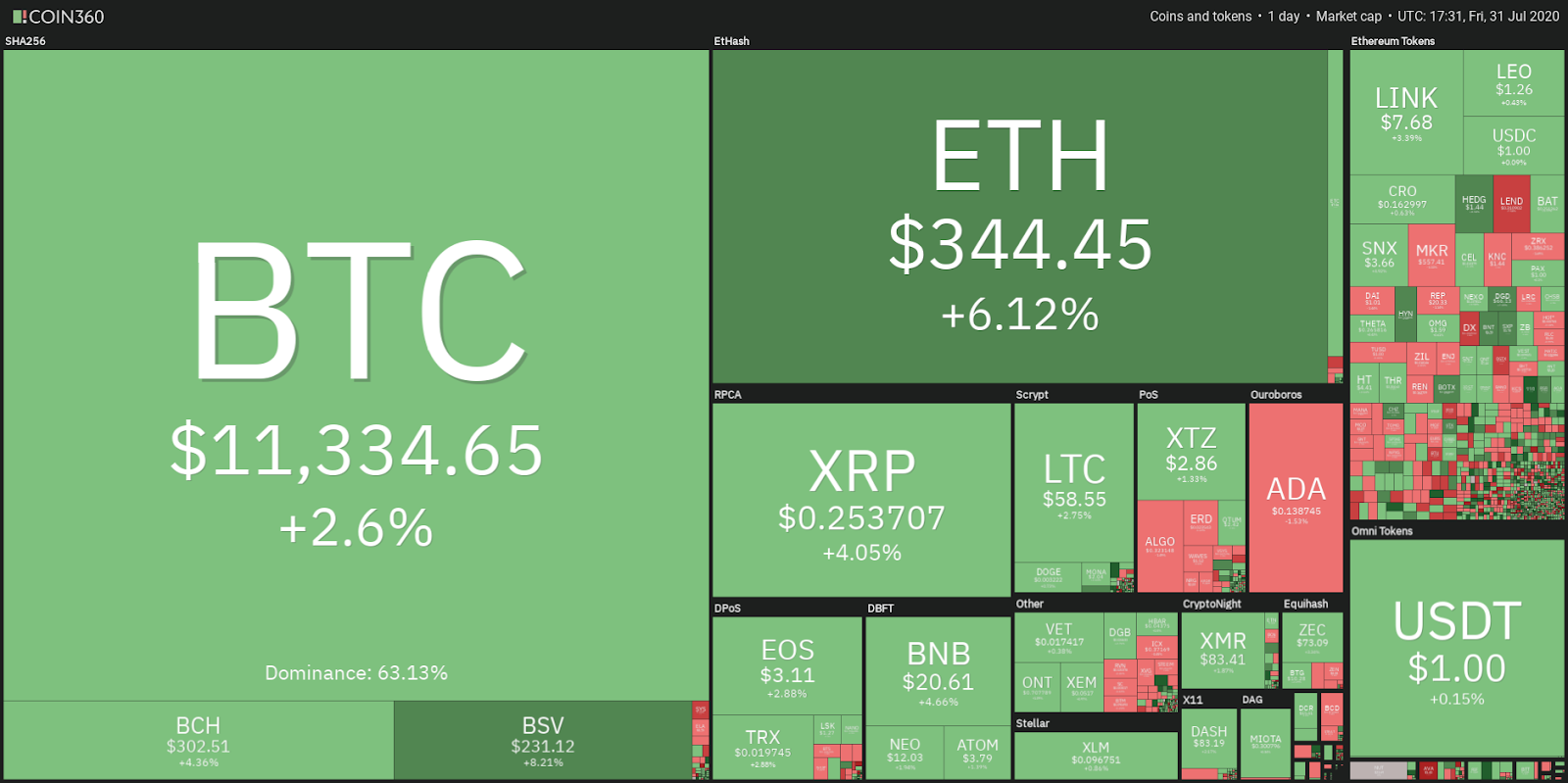

Bitcoin finally broke through the $11.2K resistance and Ethereum’s continued strength is likely to pull several altcoin prices higher.

Economists are divided on the consequences of record low interest rates across the globe and the incessant money printing by the central banks. However, one thing that most experts agree upon is that investors should get out of paper money and invest in hard assets.

Gold has been the traditional safe haven asset which is preferred by institutional investors looking to hedge their portfolio or protect their purchasing power.

However, in this digital age, crypto enthusiasts believe that Bitcoin (BTC) is a better bet than gold. Fidelity Digital Assets believes that the “decentralized settlement network and its digitally scarce native asset” makes Bitcoin a potential store of value.

Daily cryptocurrency market performance. Source: Coin360

The crypto naysayers are quick to point out that the majority still do not consider Bitcoin as a safe haven asset. While this is true, an increasing amount of institutional money has been gradually flowing into the crypto space lately.

If retail traders wait until all the institutions step in, then it might be too late. Therefore, retail traders should realize the potential of the asset class and benefit from the early-bird advantage they hold over institutional traders.

BTC/USD

Bitcoin (BTC) had been trading close to the $11,000 level for the past three days, which is a positive sign. This suggests that the bulls are in no hurry to book profits and are not allowing the bears to have their way.

The BTC/USD pair has formed a small ascending triangle pattern and if the bulls can sustain the price above $11,377.55, the uptrend is likely to resume. There is a minor resistance at $12,304.37, which might again lead to a minor correction or consolidation.

However, as long as the price stays above the upsloping 20-day exponential moving average ($10,077), the advantage remains with the bulls.

Contrary to the assumption, if the pair turns down and breaks below the triangle, it could retest the $10,500 level once again. A break below this level will be a huge negative.

ETH/USD

In a strong uptrend, the corrections usually do not last for more than three to five days. Ether (ETH) corrected on July 28 and followed that up with an inside day candlestick pattern on July 29, which showed indecision among the bulls and the bears.

ETH/USD daily chart. Source: TradingView

However, with the sharp up move and breakout above $332.931 on July 30, the bulls have asserted their supremacy.

The ETH/USD pair has an immediate target objective of $366, which might act as a stiff resistance because the relative strength index is deep in the overbought territory, but if this level is scaled, the next leg of the up move can reach $480.

On the downside, $305 is likely to act as a strong support. A break below this level will be the first indication that the bears are back in the game.

XRP/USD

XRP reached the pattern target of the breakout from the inverse head and shoulders setup on July 29 when it reached the $0.25 level. After an inside day candlestick formation on July 30, the bulls have resumed the up move today.

XRP/USD daily chart. Source: TradingView

If the bulls can sustain the price above $0.25, the XRP/USD pair is likely to start its journey towards the next target at $0.284584. The upsloping 20-day EMA ($0.216) suggests that the trend has turned in favor of the bulls.

During a change in trend from down to up or range-bound to up, the RSI can stay in the overbought zone for a long time, hence, this should not be a reason alone to become bearish. However, traders should remain cautious.

A break below the 20-day EMA will be the first indication that the uptrend has lost momentum.

BCH/USD

Bitcoin Cash (BCH) has not picked up momentum after breaking out of the $280.47 level, which shows some hesitation among the bulls. However, the positive sign is that the bulls have not allowed the price to dip back below the $280.47 level, which will now act as a strong support.

BCH/USD daily chart. Source: TradingView

The bulls have pushed the price above the $280.47–$300.38 resistance zone. If they can sustain the BCH/USD pair above this zone, the up move is likely to pick up momentum and rally to $360 and then $400.

However, the RSI is close to the 80 level, which has resulted in a pullback during the previous two occasions, hence, the pair might enter a correction or consolidation near $360.

This bullish view will be invalidated if the bears sink the pair back below $280.47 and sustain the lower levels for three days. Such a move could keep the pair range-bound for a few more days.

BSV/USD

Bitcoin SV (BSV) has broken out of the $227 resistance, which is a huge positive. If the altcoin closes (UTC time) above $227, a new uptrend is likely.

The 20-day EMA ($195) has turned up and the RSI is in the overbought zone, which suggests that the bulls have the upper hand. The target objective of this up move is $308 but the bears might pose a stiff challenge at $260, which could result in a minor correction or consolidation.

This bullish view will be negated if the BSV/USD pair fails to sustain above $227 and plummets back below $200. Such a move could keep the pair range-bound for a few more days.

LTC/USD

Litecoin (LTC) made an inside day candlestick pattern on July 29, suggesting indecision among the bulls and the bears. This uncertainty was cleared on July 30 when the altcoin formed an outside day candlestick pattern and the bulls asserted their supremacy with a positive close.

LTC/USD daily chart. Source: TradingView

The first level that might offer stiff resistance to the bulls is $64 but if the bulls do not allow the price to dip below $56, then it will indicate strength and increase the possibility of a breakout of the overhead resistance. If that happens, the LTC/USD pair could rally to $80.

This bullish view will be invalidated if the pair turns down from the current levels and plummets below $51.

ADA/USD

The bulls are facing stiff resistance close to the $0.15 level and are struggling to keep Cardano (ADA) above the $0.1380977 support, which suggests profit-booking by short-term traders.

ADA/USD daily chart. Source: TradingView

If the bears sink the price below the 20-day EMA ($0.13) support, it could attract further selling by the bulls that can result in a fall to the next support at $0.11.

Such a move will indicate that the uptrend has ended in the short-term and could result in a consolidation for a few days. The bearish divergence on the RSI is a negative sign as it suggests that the momentum has weakened.

Contrary to this assumption, if the ADA/USD pair rebounds off the 20-day EMA, it will indicate that the bulls are buying the dips. They will then try to push the price above the $0.15–$0.1543051 resistance zone. If they succeed, the uptrend is likely to resume with the next target being $0.173.

CRO/USD

Crypto.com Coin (CRO) has been consolidating in a strong uptrend for the past few days, which suggests that the bulls are in no hurry to book profits yet, as they expect higher levels in the next few days.

CRO/USD daily chart. Source: TradingView

A break above $0.169481 will resume the uptrend with the next target being $0.20. Although there is a minor resistance at $0.174114, it is likely to be crossed. Both moving averages are trending up and the RSI remains in the overbought zone, suggesting advantage to the bulls.

This bullish view will be invalidated if the CRO/USD pair turns down and breaks below the 20-day EMA ($0.15). Such a move will indicate profit booking by the bears and could result in a deeper correction to the 50-day simple moving average at ($0.133).

BNB/USD

Binance Coin (BNB) remains bullish but it lacks momentum, which suggests that the higher levels are not attracting aggressive buying from the bulls. Unless the altcoin picks up momentum, it could face stiff resistance at $21.7628.

BNB/USD daily chart. Source: TradingView

Any pullback is likely to find support at the 20-day EMA ($18.80), which is rising up. If the BNB/USD pair rebounds off this support, the bulls will try to carry the price above $21.7628. If they succeed, the rally could extend to $24.

Conversely, if the bears sink the price below the 20-day EMA, it will be a negative sign as it will indicate that the bulls are not buying the dips. In such a case, a drop to the breakout level of $18.20 is possible.

EOS/USD

The bears are defending the critical overhead resistance of $3.1104 but they have not been able to sink EOS to the immediate support at $2.83, which is a positive sign. A consolidation close to the resistance usually resolves to the upside.

EOS/USD daily chart. Source: TradingView

A breakout and close (UTC time) above $3.2 is likely to attract buyers who have been waiting for a trending move to start. Above this level, the first target to watch out for is $3.8811 and then $4.40.

Contrary to this assumption, if the EOS/USD pair turns down from the current levels and plummets below $2.83, then the range-bound action is likely to extend for a few more days.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.