The bulls are not waiting for a deeper correction before buying, which shows that the momentum remains strong and the uptrend intact.

A report by investment management firm VanEck shows that Bitcoin can greatly improve the “risk and return reward profile of institutional investment portfolios.” The research shows that even a small allocation to Bitcoin in a portfolio mix of 60% equity and 40% bonds enhanced the cumulative return.

The best portfolio return was seen with an investment of 3% in Bitcoin, 58.5% in equity and 38.5% in bonds. When Bitcoin was compared with traditional assets such as the U.S. dollar and gold, Bitcoin showed more features that are desirable from an asset class to be used as money.

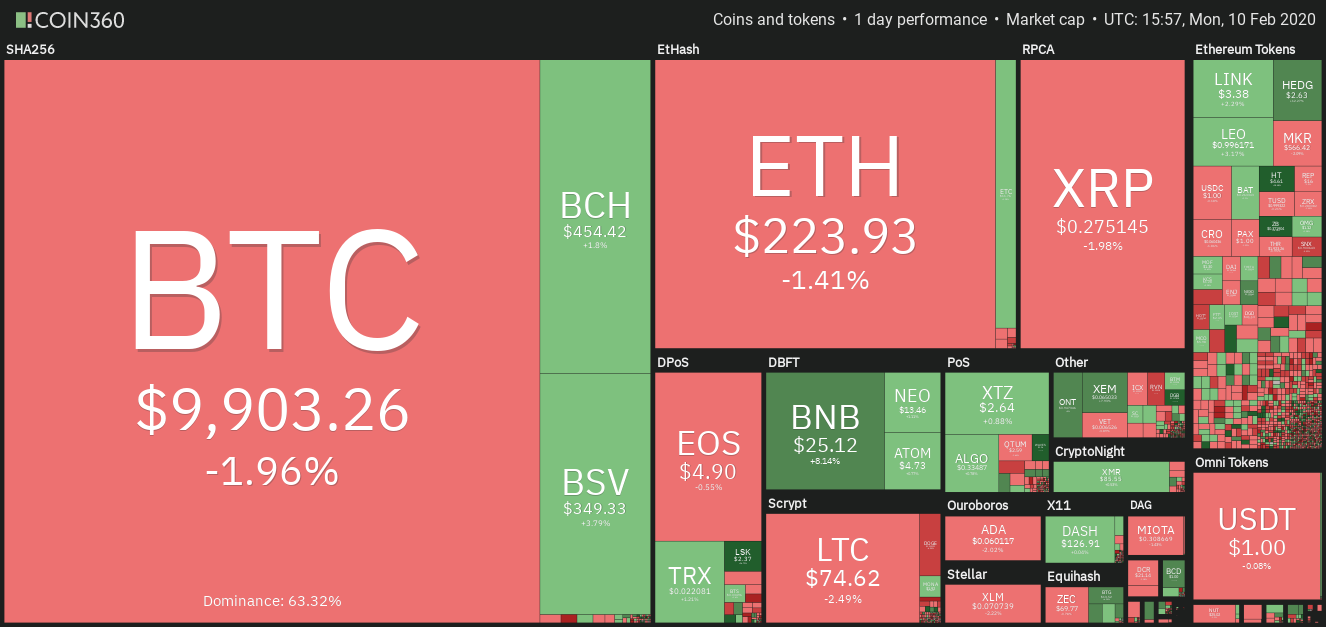

Daily cryptocurrency market performance. Source: Coin360

Another Japanese lawmaker said that the government should expedite work on launching a digital yen. The head of the banking and finance systems research commission at Japan’s Liberal Democratic Party, Kozo Yamamoto, said that the nation should launch a digital yen as soon as possible to counter the digital yuan being worked upon by China. This shows how central banks are recognizing the advantages of digitization and are working towards it.

After the sharp rally of the past few days, several major cryptocurrencies are showing signs of tiring out. Let’s analyze whether this is a short-term top or is it a minor correction after which the market will resume its uptrend.

BTC/USD

Bitcoin (BTC) has turned down from $10,188.97. This shows that bears are defending the overhead resistance at $10,360.89 aggressively. Due to the failure of the bulls to scale this level, the short-term traders are also likely to book profits.

BTC USD daily chart. Source: Tradingview

The bears can drag the price to the 20-day EMA at $9,600 but we expect the buyers to step in and defend this level.

If the BTC/USD pair bounces off the 20-day EMA, the bulls will once again attempt to push the price above the overhead resistance at $10,360.89. If successful, a move to the long-term downtrend line at $11,500 is possible.

Conversely, if the bears sink the price below the 20-day EMA, a drop to $9,097.15 is possible. A break below this level will turn the trend in favor of the bears. Therefore, the traders can book partial profits at the current levels and keep the stop loss on the remaining long positions at $8,900.

ETH/USD

Ether (ETH) has turned down from $230.612. We had expected the bears to aggressively defend the $223.999-$235.70 zone. Therefore, we had suggested traders book partial profits in this zone.

ETH USD daily chart. Source: Tradingview

The first level to watch on the downside is the previous resistance of $197.75, which will now act as strong support. If the price bounces off this support, the ETH/USD pair might consolidate between $197.75-$235.70 for the next few days.

A break above $235.70 will start a new uptrend that can carry the price to $289.221 and above it to $318.238. On the other hand, if the price slips below the critical support at $197.75, it can drop to $173.841. Therefore, we suggest traders keep the stop-loss on the remaining long positions at $190.

XRP/USD

XRP has turned down from the long-term downtrend line, which is a negative sign. It shows a lack of buyers at higher levels. The price can now dip to the first support at the 20-day EMA, which is at $0.256.

XRP USD daily chart. Source: Tradingview

If the price bounces off the 20-day EMA, the bulls will try to break above the downtrend line. If successful, the next level to watch on the upside is the $0.31503-$0.34229 resistance zone. The bears will once again mount a stiff resistance in this zone.

However, if the price drops below the 20-day EMA, the XRP/USD pair can decline to $0.2326. Therefore, the traders can keep the stop loss on the long positions at $0.245.

BCH/USD

Bitcoin Cash (BCH) has been trading around the $450 levels for the past few days. This shows that the demand is drying up at higher levels but the positive thing is that the bulls are still not closing their positions in a hurry.

BCH USD daily chart. Source: Tradingview

However, this tight range trading is unlikely to continue for long. If the BCH/USD pair does not resume its up move soon, the short-term traders are likely to book profits that can drag the price to the support line of the ascending channel at $400. A break below the channel will be the first sign of weakness.

On the other hand, if the bulls can push the price and sustain above $460, the rally can extend to $500. Both moving averages are sloping up and the RSI is in the overbought zone, which suggests that the bulls have the upper hand.

BSV/USD

The bulls propelled Bitcoin SV (BSV) above the symmetrical triangle on Feb. 8. This shows that the uptrend has resumed. The next level to watch on the upside is the lifetime highs at $458.74.

BSV USD daily chart. Source: Tradingview

However, if the bulls fail to sustain the price above $337.80, a drop to the 20-day EMA at $293.2 is possible. If the price bounces off this level, the bulls will again attempt to resume the up move.

Conversely, if the price dips below the 20-day EMA, the BSV/USD pair can drop to $236. If this support holds, the pair might remain range-bound between $236-$337.80 for a few days.

LTC/USD

Litecoin (LTC) turned down from $78.4145 on Feb. 9. The bears will now try to drag the price to the support at $66.1486. We expect this support to hold. Both moving averages are sloping up and the RSI is close to the oversold zone, which suggests that bulls have the upper hand.

LTC USD daily chart. Source: Tradingview

If the price bounces off $66.1486, the bulls will again try to scale above $80.2731. If successful, the uptrend will resume and the next level to watch on the upside is $96.439.

However, if the price again turns down from $80.2731, the LTC/USD pair can remain range-bound for a few days. A break below $66.1486 will signal weakness.

EOS/USD

EOS broke above the stiff overhead resistance at $4.8719 on Feb. 9. This is a huge positive as it shows that the bulls are keen to buy at higher levels. If the price sustains above this level, a rally to $6 is possible.

EOS USD daily chart. Source: Tradingview

Currently, the bears are attempting to drag the price back below $4.8719. If the price sustains below $4.8719, it will signal that the breakout was a bull trap. Below this level, the drop can extend to the $4.24 to $4.0 support zone.

A bounce off the support zone will keep the EOS/USD pair range-bound for a few days. The pair will turn negative on a break below $4.0.

BNB/USD

The momentum in Binance Coin (BNB) carried it above the overhead resistance level of $23.5213 on Feb.9. This is a huge positive as it shows demand at higher levels. If the bulls can sustain the price above $23.5213, a move to $29 is possible.

BNB USD daily chart. Source: Tradingview

However, the rally of the past few days has pushed the RSI deep into overbought territory, which points to a possible consolidation or a minor correction in the next few days. The first support to watch on the downside is the $23.5213 to $21.80 zone.

A bounce off this zone will signal strength and will increase the possibility of a rally to $29. On the other hand, if this zone gives way, the decline can extend to the 20-day EMA at $19.84. The traders can trail the stops on 50% of the long position to $21 and keep the rest at $19.

XTZ/USD

The bulls aggressively purchased the dip to $2.01 on Feb. 8 and have successfully pushed the price above the first overhead resistance at $2.50. Tezos (XTZ) can now move up to the next resistance at $2.90.

XTZ USD daily chart. Source: Tradingview

The rally of the past few days has pushed the RSI deep into the overbought territory, which suggests that the XTZ/USD pair is backed by momentum. If the momentum can carry the price above $2.90, the rally can extend to $3.35.

However, when the RSI is deeply overbought, it increases the possibility of a correction. The first support on the downside is $2.25 and below it $2.0.

ADA/USD

The bulls are facing resistance close to the overhead resistance at $0.065229. The failure to propel the price above this level has attracted profit booking by the short-term traders. Cardano (ADA) can now dip to the first support at $0.0560221.

ADA USD daily chart. Source: Tradingview

If the ADA/USD pair bounces off $0.0560221 or from the 20-day EMA at $0.0543, the bulls will make another attempt to push the price above $0.065229. If successful, a move to $0.08 will be on the cards.

On the other hand, if the bears can sink the price below the 20-day EMA, a drop to $0.0461161 is possible. Therefore, the traders can keep the stops on the remaining long positions at $0.054.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.