Bitcoin (BTC) could see further downward price pressure this week as network difficulty is set to drop the most in five months.

Data from data resource BTC.com estimates that difficulty will drop by 8.3% at the next automatic readjustment in four days’ time.

Difficulty set to repeat June readjustment

The mining difficulty is an essential measure of the competition among miners in finding block subsidies, and by extension, the overall health of the mining sector.

Automatic readjustments meanwhile fulfill an even more important function, allowing Bitcoin to sustain itself regardless of price action or other circumstances.

In June, difficulty dipped 9.3% following a previous 6.3% decrease, the latter marking the culmination of miner upheaval after Bitcoin’s block subsidy halving event in May.

The halving cut the block subsidy by 50%, producing a drastically different profit dynamic for miners operating on tight margins or with older equipment. The two consecutive downward adjustments opened up opportunities for less efficient miners once again, and difficulty corrected upward by almost 15% thereafter.

The latest fall, meanwhile, has been attributed to the end of the so-called “hydro season” for Chinese miners. This occurs each October, when rainfall in China’s Sichuan province eases and cheaper hydroelectricity dries up, pushing up costs.

Claiming Bitcoin’s final price hurdle

The knock-on effect, coming at a time when Bitcoin tried and failed to crack $14,000 resistance for the first time in almost 18 months, may be a longer withdrawal from that essential level.

As Cointelegraph reported, hardly any technical resistance levels lie between $14,000 and Bitcoin’s all-time highs of $20,000 from 2017.

On Tuesday, developer Matt Odell summarized the process on Twitter:

“Rainy season ended in china -> increased energy prices for hydro -> hash rate falling as miners transition to cheaper power -> blocks mined less frequently until difficulty adjustment.”

Odell was discussing another result of reduced miner activity — larger Bitcoin transaction fees, which have spiked almost 200%.

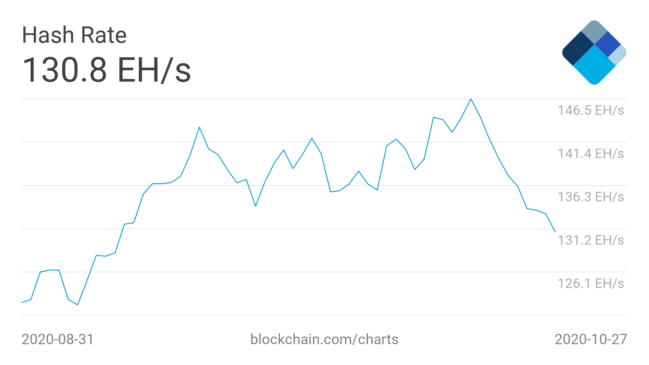

After June, price action slowly fell in line with both difficulty and Bitcoin network hash rate. Thereafter, as both metrics picked up, price staged a comeback of its own, bolstering a popular theory that price follows fundamentals and, in particular, hash rate.

Bitcoin 7-day average hash rate 60-day chart. Source: Blockchain

Zooming out, Lina Seiche, managing director of Bitcoin media outlet BTC Times, drew attention to the hash rate’s overall strength.

“The #Bitcoin hash rate is up 18% since the third halving, 9,300% since the second halving, and 554,000,000% since the first halving,” she tweeted this week.