Historical data shows that some miners began to sell Bitcoin (BTC) at the end of July, leading to increased selling pressure in the cryptocurrency market.

Eventually, the dominant cryptocurrency fell steeply from mid-August, recording a 13% fall and since then BTC has struggled to retake the $12K mark.

Bitcoin selling by miners from 2017-2020. Source: CryptoQuant

According to CryptoQuant CEO Ki Young Ju, continued selling by miners might not be enough to prevent a bull run. On-chain data analysis firms closely observe the movements of miners and whales because they hold significant amounts of BTC.

Willy Woo, an on-chain analyst, explained that miners represent one of the two external sources of selling pressure for Bitcoin. He previously said:

“There’s only two unmatched sell pressures on the market. (1) Miners who dilute the supply and sell onto the market, this is the hidden tax via monetary inflation. And (2) the exchanges who tax the traders and sell onto the market.”

When miners start selling their Bitcoin holdings, typically to cover expenses, it could trigger a correction in the cryptocurrency market.

For instance, From Aug. 17 to Sept. 5, the price of Bitcoin dropped from $12,486 to $9,813. During that time, several whales sold Bitcoin right at $12,000 and the same behaviour was observed amongst miners.

The selling pressure coming from miners and whales noticeably has been attributed to the current crypto market slump but in the longer term, Ki explained it is not enough to stop a prolonged bull run.

If miners abruptly sell a significant amount of BTC, it could cause a severe correction as a small price movement could trigger liquidations from heavily-leveraged traders. Hence, even a relatively small sell-off by miners could theoretically cause massive price swings.

Ki says the intensity of the sell-off from miners was not strong enough to halt future bull runs. He said:

“Miner Update: Some miners began selling at the end of July, but I think in the long-run, miners didn’t sell BTC large enough to stop the next bull-run.”

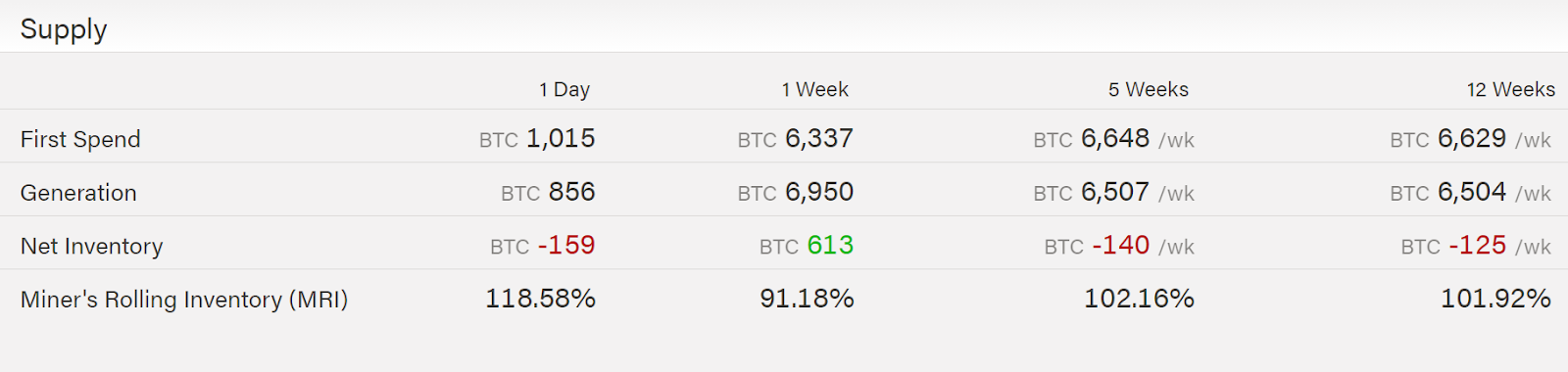

According to ByteTree, the net inventory of Bitcoin miners declined by 125 BTC per week in the last 12 weeks. The data indicates that miners sold approximately $1.362 million BTC per week week atop the BTC that they mined and sold.

Amount of BTC mined and sold in the last 12 weeks. Source: ByteTree

As Ki emphasized, the data shows that miners sold substantial amounts of BTC, but not in amounts that were irregular to normal behaviour.

Post-halving bull cycle remains a possibility

Bitcoin is still hovering above the critical $10,000 technical support level despite multiple attempts by bears to drop the price below the key level.

The resilience of Bitcoin amidst a heightened level of selling pressure suggests a cautiously bullish trend in the long term.

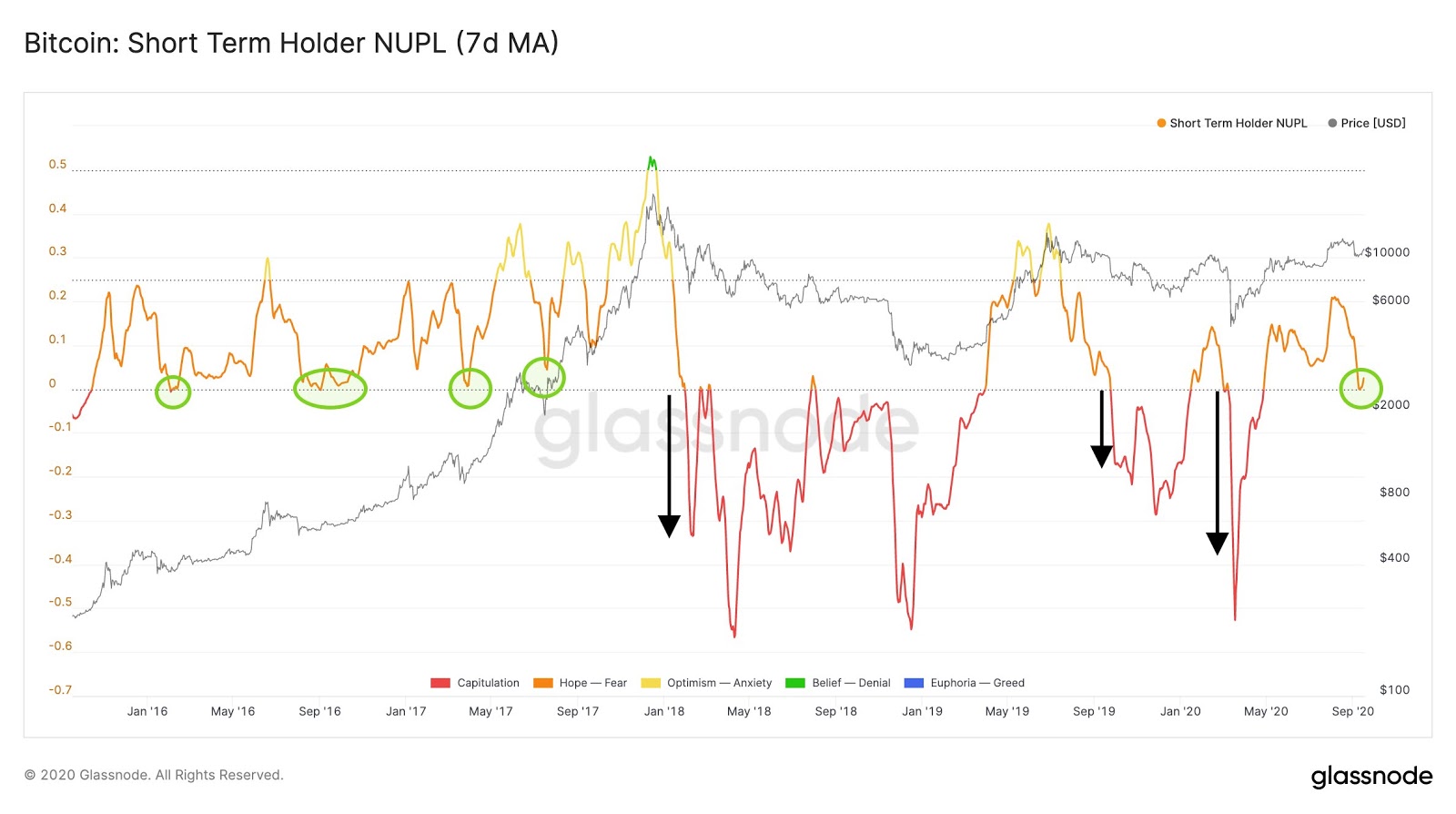

The Bitcoin short-term holder NUPL. Source: Glassnode

Several on-chain metrics also indicate that now is a healthy accumulation phase for Bitcoin. Rafael Schultze-Kraft, the CTO at Glassnode, said:

“Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) with a #bullish signal here imo. That bounce of the 0-line was important, is very characteristic for previous bull markets, and historically a good buying opportunity.”