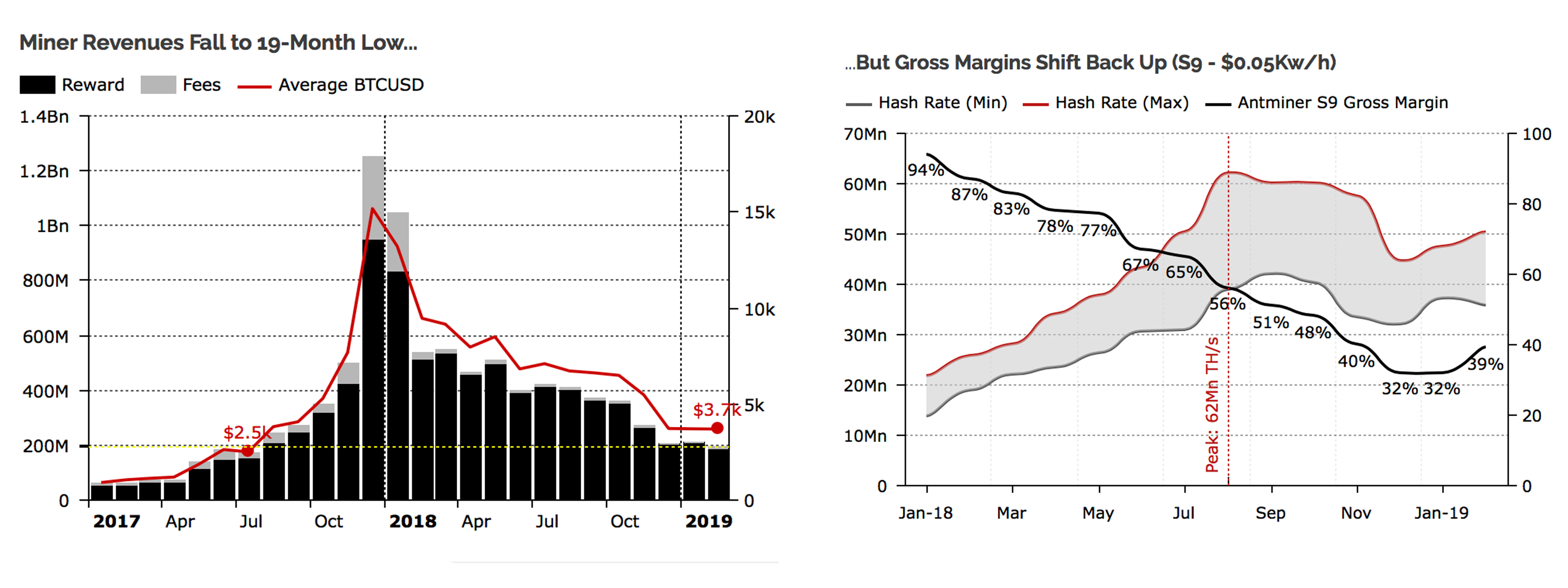

Mining operations that process SHA-256 coins like BTC and BCH saw revenues slashed due to the bear market lows at the end of 2018. Revenues continued to fall into the new year, but over the last few weeks, network hashrates have been climbing again. A report published on March 4 details that even though mining profits dropped to a 19-month low in February, gross margins still grew by 39 percent.

Also read: An In-Depth Look at Ethereum’s Maker and Dai Stablecoin

The Silver Lining

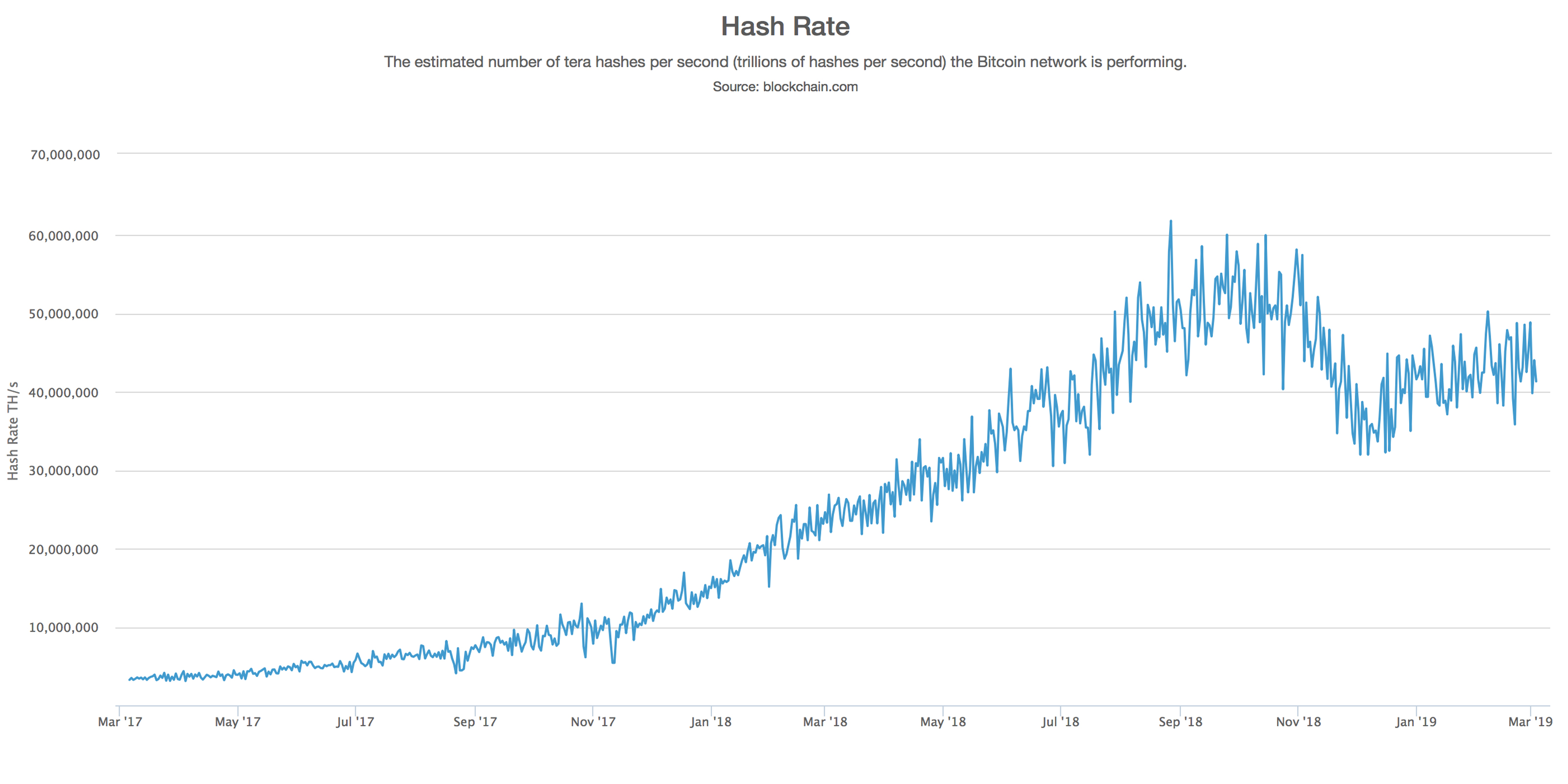

Cryptocurrency mining is a competitive industry and miners who process the SHA-256 consensus algorithm (BCH and BTC) have seen some deep losses in recent months. Despite the falling price last August, Bitcoin Cash (BCH) and Bitcoin Core (BTC) networks’ combined hashrate surpassed 65 exahash per second (EH/s). On Dec. 2, 2018, BCH and BTC hashrates averaged less than 32 EH/s, losing half of their processing power from their all-time high. Since then, combined hashrate is now averaging roughly 45 EH/s with BCH capturing 1.25 EH/s of the total share.

As far as profits are concerned, according to a new report by research publication Diar, miner margins are trending back into growth. Diar’s report details that BTC miner revenues dropped to a 19-month low, losing 10 percent overall this February. The research explains that BTC miners accumulated $295 million in fees alone in December 2017 but they are now gathering $195 million for both rewards and fees.

Diar’s study adds that a slew of smaller operations have been “put out to pasture” and the researchers believe most of the equipment running has been at a loss. However, not all of the news is bad for the mining industry as gross margins increased quite a bit in February.

“The increase in competition has also minimized gross margins from 94% at the start of 2018, down to 32% a year later,” Diar’s study details. “The silver lining, perhaps, is that gross margins grew to 39% in February.”

Half of the Top BCH Miners Also Mine the BTC Chain

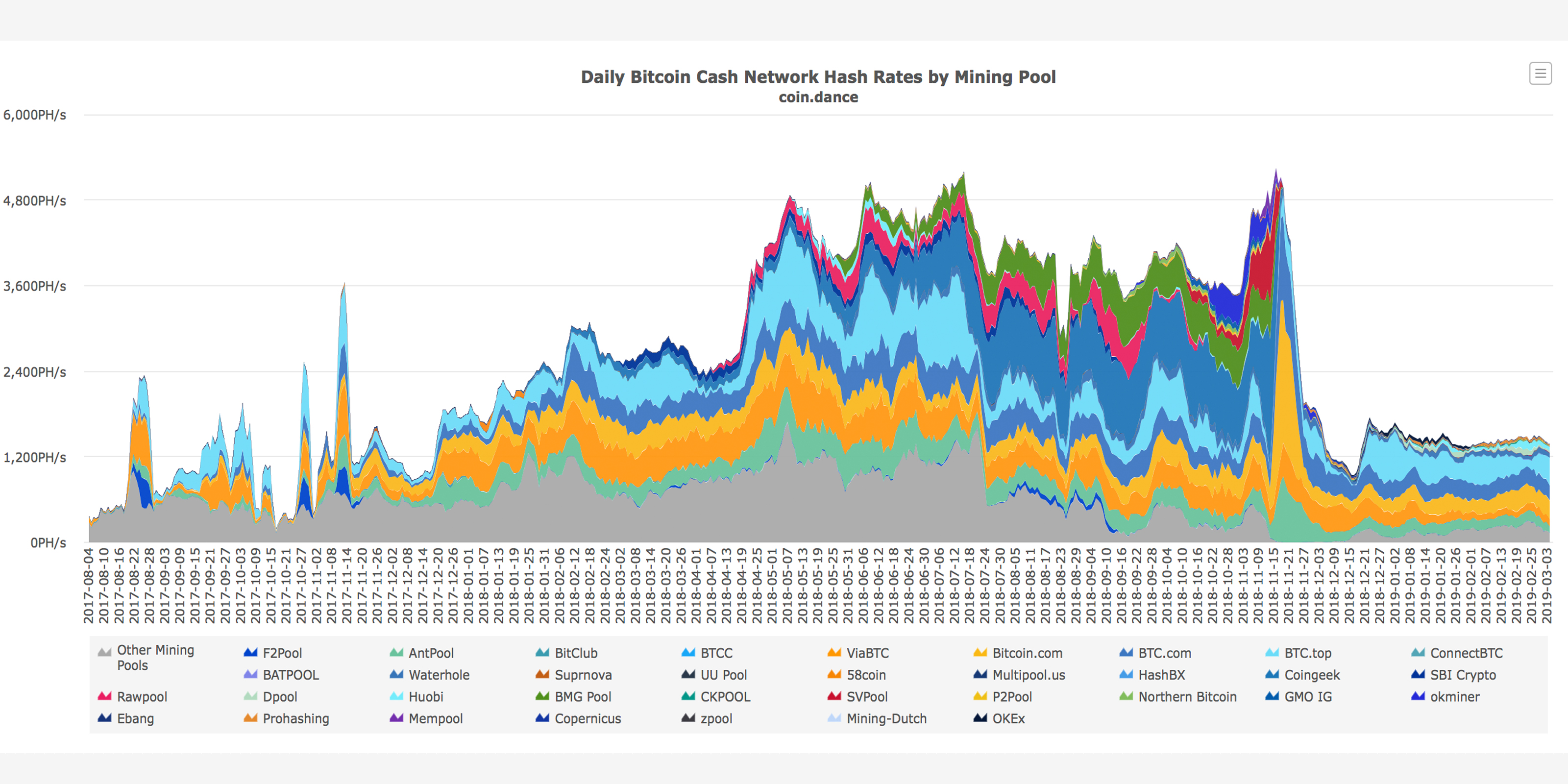

Data stemming from Blockchain.com’s BTC hashrate distribution shows 14 decent sized operations processing the chain’s hash and 23 percent is captured by unknown miners. There are 13 pools mining the BCH chain and more than 10 percent of that coverage is also run by unknown mining pools.

At the time of writing, it is 0.7 percent more profitable to mine on the BTC chain and profitability differences between both ledgers have been fairly stable. Today six of the top BCH mining operations are also leading BTC pools as well. The slight spike in spot market price and gross margins has bolstered the distribution of hashrate significantly between both networks.

Next Generation Miners Could Keep Operations Going

The mining analysis by Diar details that now that gross margins have increased, mining operations can spend “capital expenditure on the latest mining equipment in order to stay ahead.”

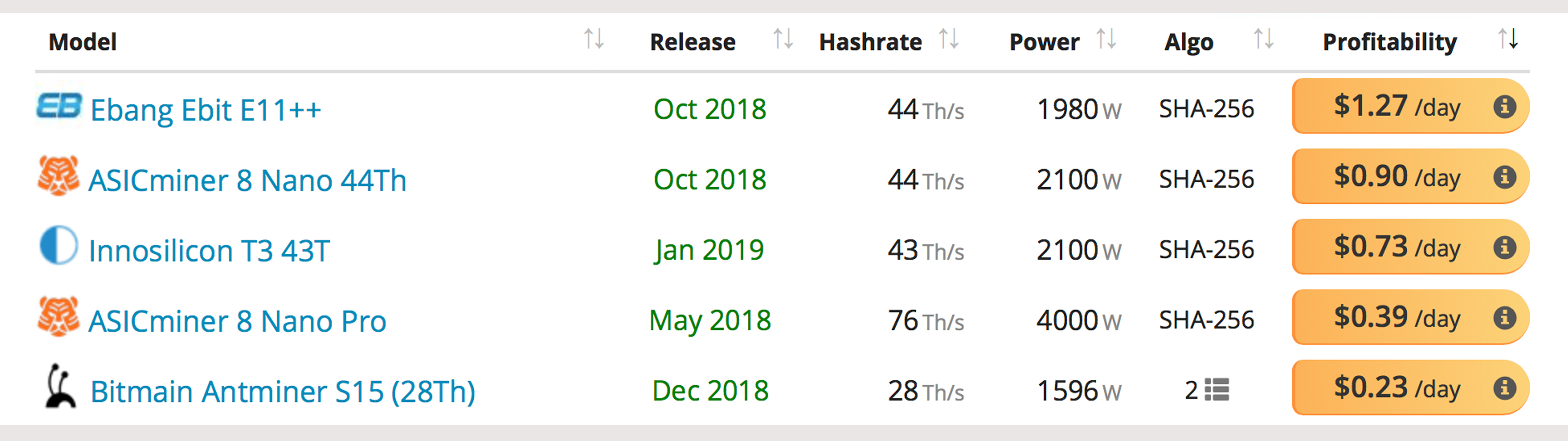

“Bitmain’s latest flagship miner that began shipping at the start of the year, the S15, has already sold out twice-over with the next batch set for shipment in April,” explains the study. “It is likely then that hash power continues to increase in the coming month’s bar a massive price drop — But at current Bitcoin prices, the capital requirements would still be to miners benefit with the S15 averaging 84% more return than its predecessor, the S9.”

Other sources show that the top five next-generation SHA-256 miners are profiting by at least $0.25 to $1 a day. Mining rigs like the Ebang Ebit E11s, Bitmain’s S15, Innosilicon Terminators, and the Asicminer Nanos are pulling in small daily profits. Miners are hoping prices will increase because they have a lot of skin in the game and the 80-90 percent losses between both of the largest SHA-256 assets in existence has hurt them. While the boatloads of money from fees and the 2017 bull run is a distant memory, 39 percent growth in gross profits is likely to be received as a breath of fresh air.

What do you think about miners’ revenue and hashrate showing some growth? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Pixabay, Asicminervalue.com, Diar Research, Blockchain.com, and Coin Dance Cash.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH, and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.