By CCN Markets: Ripple (XRP) has attempted a pullback after dropping more than 12-percent over the past weekend.

The XRP-to-dollar exchange rate established a cycle low of $0.371 on Sunday at 1600 UTC. The downside action pushed XRP’s market capitalization to as low as $16.04 billion, down 11.47-percent from its Saturday peak level. At its year’s highest, XRP’s market capitalization was $19.67 billion.

XRP today underwent a small upside correction, surging a little above 5.5-percent to settle an intraday high towards $0.392 at 0700 UTC. Nevertheless, the jump appeared without substantial volume, hinting a weakening momentum. The move attested to a stronger interim bearish sentiment in the XRP market this June, with the asset’s month-to-date losses extending to 20-percent from just 7-percent last week.

Major Bank Turns Down XRP

Siam Commercial Bank, Thailand’s largest commercial bank, on June 5, hinted that it is going to use XRP in their Ripple-based cross-border payment service. The asset’s rate surged by as much as 11.40-percent on BitStamp on the news.

Nevertheless, the bank issued a contradictory tweet a day later, stating that they “are so sorry for the previous information of the previous post” and that they “have no plan on using XRP.” The price fell by as much as 12.75-percent 24 hours after the contradictory tweet.

It appears that traders bought the rumor of Siam accepting XRP in the future, believing that the asset’s demand from Thailand’s largest commercial bank would pitch a strong long-term bullish case. With Siam backing away from its statement, the same traders who bought the XRP at a weekly low could have decided to exit their positions at an interim profit, thus causing a dip in the market.

At the same time, the XRP plunge followed a market-wide correction sentiment, with bitcoin, the world’s leading cryptocurrency, dropping more than 7-percent since June 7.

Opportunities

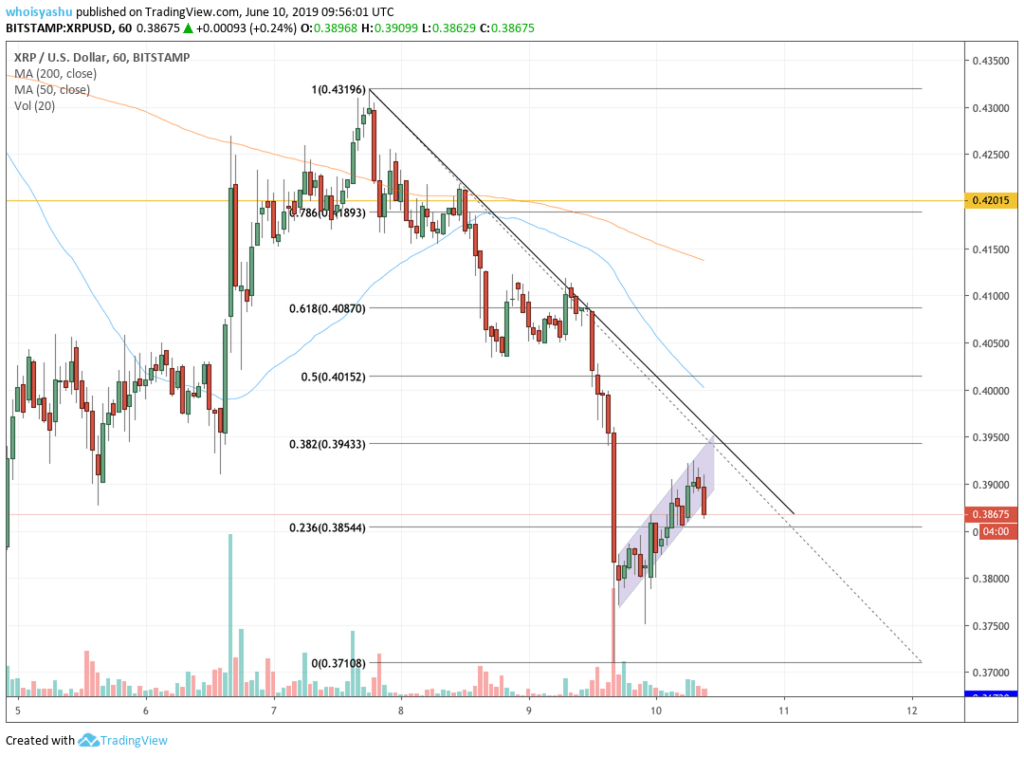

The XRP-to-dollar exchange rate is currently trending upwards in a parallel channel, which appears like a bear flag from a broader look. The pattern could survive as long as the pair tests either $0.394 or the descending trendline (in black) as resistance.

A failure to break above either of these upside levels could prompt XRP to pullback and retest the flag support (an opportunity for short entry). Accompanied by a larger volume, the price can even break below the flag support to test $0.385 as interim support, and $0.371-0.375 range as its primary downside target.

Nevertheless, a successful close above $0.394 or the descending trendline would bring $0.401 in view as the primary upside target (a decent long opportunity).

At its current price, the XRP-to-exchange rate is still 56-percent up from its cycle low of $0.251.

Click here for a real-time Ripple (XRP) price.