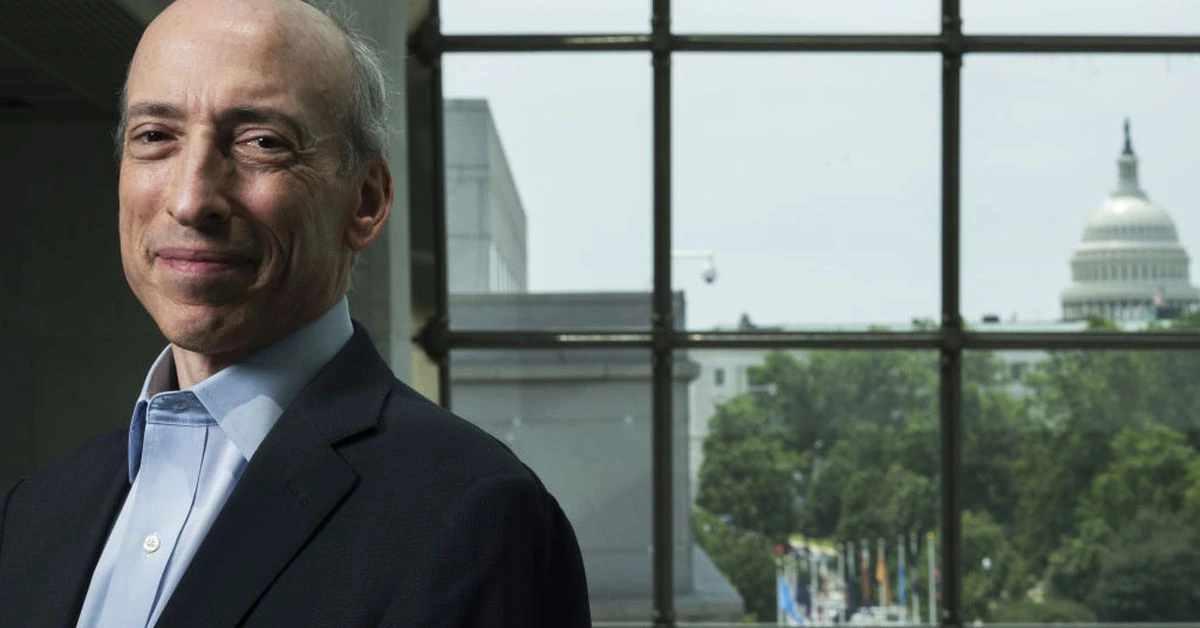

Proponents of a bitcoin ETF believe the product will be more widely accessible for individuals interested in bitcoin than the actual cryptocurrency is, by giving investors a regulated alternative to the underlying digital asset. The first product will track bitcoin futures, rather than the price of bitcoin directly, however. SEC Chair Gary Gensler indicated he believes futures-based products might provide stronger investor protections due to the laws they operate under.

SEC Approves Bitcoin ETF, Opening Crypto to Wider Investor Base