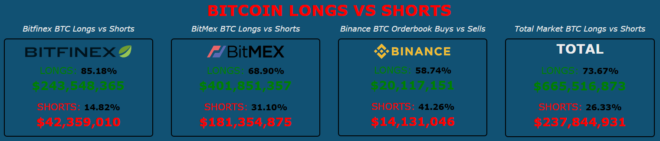

Currently, Bitcoin traders are overall net long. But talk of a second wave has memories of March’s flash crash fresh on the mind.

Source: blockchainwhispers.com

The European Centre for Disease Prevention and Control has issued a stark notice over the rise in infection rates. As a result, throughout Europe, authorities are taking into consideration the possibility of a second lockdown.

With that, some analysts and industry observers are warning that a sudden market crash could be on the cards in the near term.

Rich Dad, Poor Dad author, Robert Kiyosaki, believes a market crash is imminent. In a recent tweet, he drew attention to the underlying problem of crippling US debt.

Despite his pessimism, he still maintains the view that long term, the anti-fiats will come out on top.

What happens when vaccine is proven? Gold silver Bitcoin will CRASH. Buying opportunity. Real problem NOT Pandemic. Real problem massive US debt. US Bankrupt. $28 T balance sheet debt. $120 T off balance sheet social obligations. Gold silver Bitcoin best investments long term.

— therealkiyosaki (@theRealKiyosaki) September 15, 2020

This is a view shared by Bitcoin miners. Despite the uncertain macro picture, it has never been as difficult, as it is now, to mine Bitcoin.

The latest data shows Bitcoin mining difficulty reached a new all-time high yesterday. This represents a 47% increase since the start of the year.

Source: twitter.com

As such, in spite of Bitcoin’s failure to close above $11k, miners appear unfazed by either near term price action or talk of a second wave.

Bitcoin daily chart with volume. (Source: BTCUSDT on tradingview.com)

Bitcoin Mining Difficulty Increase Suggests Bullish Sentiment

Although May’s halving seems like a long time ago, the immediate effect of it saw mining difficulty drop as scores of miners were unable to sustain profitable operations.

Cutting rewards in half was enough to drive small miners, with inefficient equipment and/or high costs, out of the mining game.

Some believed the mining exodus would trigger a death spiral for the price of Bitcoin. At the time, Zach Resnick, Partner at VC firm Unbound Capital, painted a picture of woe from the drop off in mining difficulty. He summarized it as follows:

“As the halving cuts the block reward, a large number of miners will leave the network. As the network hash rate drops, the block time increases, the network becomes congested. This, in turn, makes Bitcoin less attractive, as participants do not want to wait forever to have their transactions processed. This leads to the Bitcoin price falling, which pushes more miners off the grid. This process repeats itself until the network dies.”

With yesterday’s jump in mining difficulty, more miners than ever before are working to secure the Bitcoin network. This decisively puts paid to any notion of a mining death spiral as a result of the halving.

What’s more, historical data shows there is a degree of positive correlation between Bitcoin mining difficulty/hash rate and the BTC price.

However, regardless of miner’s optimism, the bigger picture cannot be ignored entirely. As such, the longs should proceed with caution.