Bitcoin (BTC) has started to decouple from the U.S. stock market index S&P 500 according to crypto statistician Willy Woo.

First signs of de-coupling behaviour spotted between BTC and stocks.

Buying from an influx of new users provides price support preventing speculators from trading the correlation downwards.

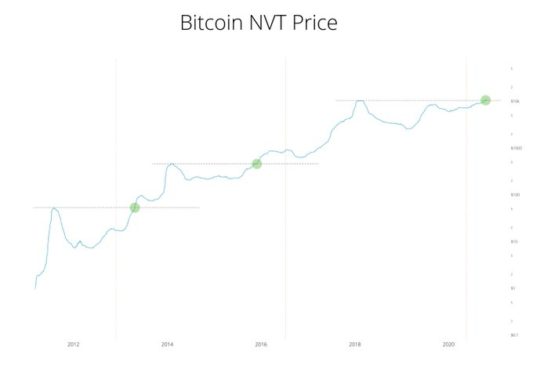

NVTP approximates a valuation for BTC with organic investor velocity on the blockchain. pic.twitter.com/AvilB9cfdD

— Willy Woo (@woonomic) October 29, 2020

Predicting this behavior in late September, he asserted that Bitcoin will break ties with traditional markets due to an influx of new users:

“Bitcoin will decouple from traditional markets soon, but driven by its internal adoption s-curve (think startup style growth) rather than changes in perceptions as a hedging instrument by traditional investors.”

Referring to Network Value to Transaction Ratio (NVT), an indicator Woo introduced in 2017, the analyst said that Bitcoin’s NVT price has shown clear price support despite the S&P falling sharply over recent days.

The NVT can be likened to Bitcoin’s P/E (price to earnings) ratio, however since Bitcoin has no earnings in the literal sense, Woo replaced the P/E values with network value (Bitcoin’s market cap) and daily USD on-chain transaction volume.

Two days ago, Bitcoin’s NVT price (price support) crept into new all-time-highs above $11,000.

Woo added that the indicators suggest Bitcoin could begin reclaiming its status as a “safe-haven” asset should stocks continue to fall:

“What this test shows is that if stocks crash, Bitcoin powered by its large adoption s-curve, swallowing ever more capital, will present perfectly good safe haven properties.”

On Oct 26, Morgan Creek Digital co-founder Anthony Pompliano claimed “Bitcoin is the ultimate safe haven” and the market is proving it,” adding that Bitcoin “could not be more uncorrelated” with the stock market.

Not everyone agrees that Bitcoin had any decoupling to do: analyst Scott Melker Tweeted in May that stocks and Bitcoin are “not correlated now, and they weren’t correlated before.”

Early last week, crypto investor Chris Dunn suggested a negative correlation between stocks and BTC had started, prompting Woo to reiterate his stance of Bitcoin as a safe alternative to traditional assets:

“Makes sense that BTC will continue to be correlated in short time frame trading; but not in the longer time frames. BTC is a safe haven, just that ‘risk-on’ (meaning it’s very new) is skewing this fact.”

However, some analysts have suggested that an excessive preoccupation with the correlation between BTC and the S&P 500 could be dangerous. Analyst Michaël van de Poppe said that when things get messy, as they did in March this year, “all correlations tend to go towards 1,” adding:

“Since then, gold, silver & Bitcoin have been resilient for any downwards move and showing strength apart from the equity markets. Don’t pin yourself on those correlations.”