This is a pattern that has repeated itself over crypto’s decade-long history. Back in 2017, crypto’s hottest trend was the ICO, or initial coin offering. In the way that a traditional company might issue new shares of stock to the public through an initial public offering, crypto companies were trying to issue new cryptocurrencies as a kind of fundraising mechanism. Eventually, the Securities and Exchange Commission decided ICOs amounted to unregistered securities offerings. If it looks like a security and walks like a security, it’s probably a security.

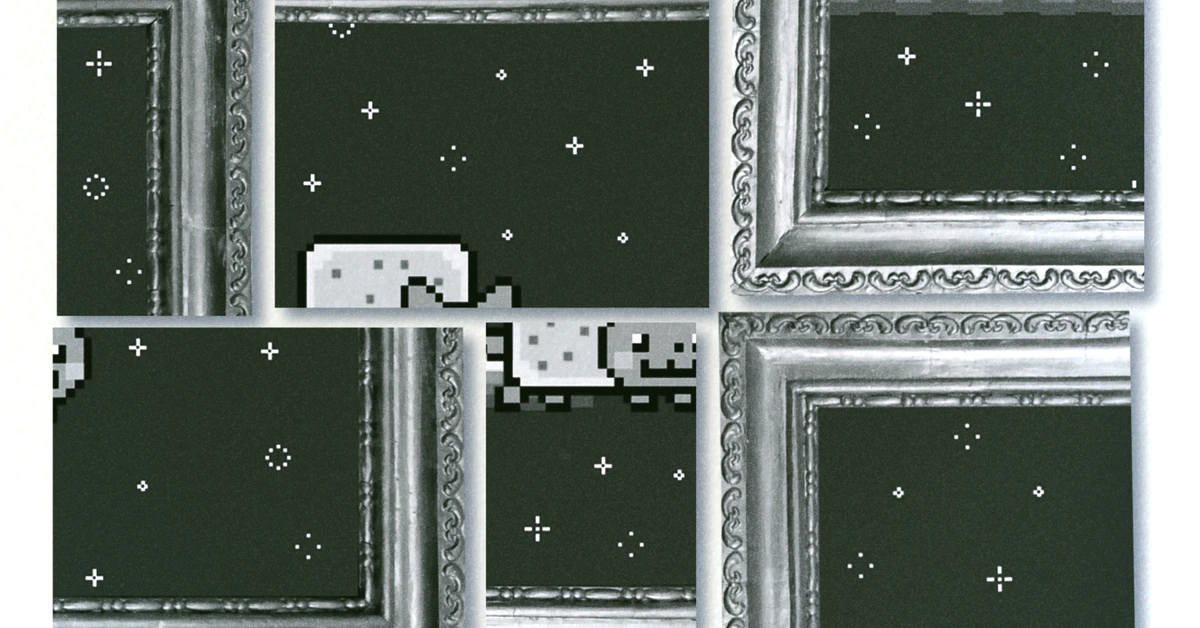

Some NFTs Are Probably Illegal. Does the SEC Care?