Bitcoin ATMs are not currently governed by EU money laundering regulations, and arrests coordinated by Spanish police and Europol in May are bringing new focus to this loophole. A group of eight Spanish and Latin American individuals have been arrested, along with several of their associates, for using crypto ATMs to fund drug traffickers in Columbia. While large cryptocurrency exchanges worldwide are subject to increasing oversight and regulation, bitcoin ATMs often fall in legal gray areas, prompting debate amongst regulators and crypto users alike.

Also read: Crypto Terminals Offer Venezuelans a Bridge to Economic Prosperity

Trouble in Vancouver

Back in June, police in Canada commented that the convenient crypto exchange hubs effected by bitcoin ATMs are “an ideal money-laundering vehicle.” According to a report from the Vancouver P.D. to the police board in February:

The other issue with unregulated Bitcoin ATMs is that they are an ideal money laundering vehicle. Since there are no requirements to register any customer details, it is easy to see how cash can be transferred into Bitcoin and vice versa. A user can also launder an unlimited amount of money using smaller transactions so as not to arouse suspicion, like they would at a regular bank.

Now, the mayor himself is pushing for direct bans on the ATMs. This is notable since the first ever bitcoin ATM was installed in a Vancouver coffee shop in 2013. The city is currently host to over 70.

Japan’s Clampdown

Japan, often known as the world leader for crypto adoption and regulation, has already tackled the issue with a set of iron-fisted legal protocols of its own. Though just years ago Tokyo bitcoiners could easily find multiple ATMs allowing easy exchange from bitcoin to fiat or vice versa, the April 2017 Payment Services Act changed all this.

Many small business owners who had previously hosted the machines experimentally, or as a service to growing crypto-savvy customer bases, found themselves slapped with heavy licensing fees and tedious legal restrictions. Areas like the Roppongi district—once a small, but rapidly burgeoning hub of crypto ATM exchange—saw the machines essentially “ripped out” as a result of Japan’s FSA clampdown.

In Japan, where digital assets like bitcoin and others are officially recognized as legal currency, this is not surprising. ATMs in other regions, however, continue to afford users relative autonomy and privacy in transaction.

United States Regulations

Similar in some sense to the regulatory climate in Spain regarding ATMs, America’s licensing requirements for merchants are still in flux. Every state—other than Montana—has a licensing requirement, but not every state agrees on what bitcoin actually is. The cryptocurrency wedges itself as a kind of monkey wrench in the gears of traditional policy, owing to its unique characteristics and technological capabilities.

Unlike Japan, it’s still pretty clean and easy to make an ATM exchange in the states. Users don’t need to worry about each and every single transaction’s realized gains or losses for tax purposes. Where in the U.S. bitcoin is treated similar to a stock, and subject to capital gains tax, in Japan every last miniscule transaction must be recorded, and the gains calculated for later reporting.

Crypto ATMs Across the Globe

There are an estimated 5,000 crypto ATMs globally, servicing locales subject to remarkably diverse regulatory and legal frameworks. How these machines should be managed is fiercely debated, though governing bodies tend to agree on the swelling capacity for use in criminal enterprise. With a forecasted compound annual growth rate of 56.9% from 2019 to 2026, it’s not hard to see why.

Companies like the United States’ Genesis Coin, General Bytes in the Czech Republic, and Lamassu in the U.K., are all leading industry players in the field of ATM manufacturing. Even established legacy system ATM manufacturers like Japanese Oki have entered the market in the recent past.

Government Reaction to Illegal Use

When Indian exchange company Unocoin tried to install India’s first bitcoin ATM in 2018, the company’s co-founder was swiftly arrested by the cyber crime unit of the CCB (Central Crime Branch) which stated:

The ATM kiosk installed by Unocoin in Bengaluru’s Kempfort Mall has not taken any permission from the state government and is dealing in cryptocurrency outside the remit of the law.

According to Unocoin, they were actually trying to help with legal adoption in the context of regulatory hurdles, as users could make withdrawals and deposits in BTC, but not buy or sell. In fact, at the time of the arrest the ATM was not even operational yet.

Regarding the Spanish scandal, EU regulations are now being proposed to take effect in 2020, which would include exchanges and online wallet custodians becoming subject to new anti-money laundering laws. As such, KYC policies and similar measures vetting users and customers are likely to become more widespread in the near future.

Privacy Concerns

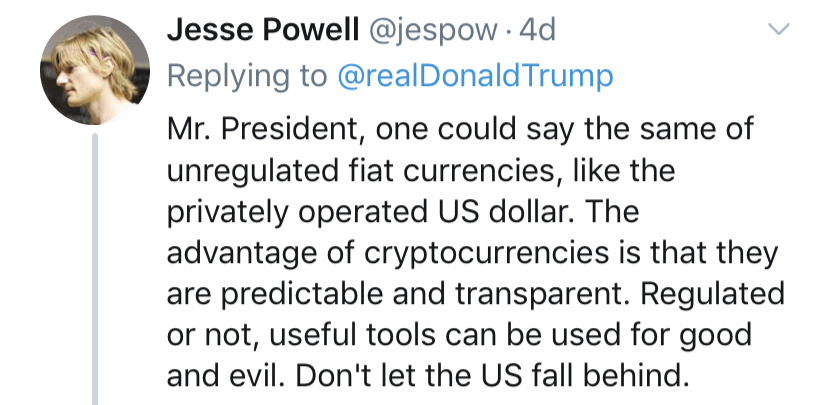

Arguably the most vital function of bitcoin and other cryptos is the ability to effect quick, low fee, and relatively private P2P transactions. Some users are growing uneasy as tighter regulatory measures sap this functionality, and seem to force the asset back into legacy-type, cumbersome processing channels. On the heels of recent criticism from U.S. President Donald Trump, claiming bitcoin facilitates money laundering and criminal activity, some privacy-minded users are beginning to sound off.

Bitcoin ATMs have up until now provided—at least in some measure—a relative safe haven for private, autonomous exchange of crypto, as well as direct and simple means for onboarding new users.

The Spanish Laundry Cycle

Laundering money with these machines, however, is not so simple. The busted scammers in Spain had used false identities to set up two bitcoin ATMs in a Madrid office, claiming to be a center for crypto exchange and remittances. When connected Colombian drug lords sold their product in Europe, the illicit euros were deposited into these ATMs. The crypto was then directed back to the cartels, and finally exchanged for “clean” Colombian pesos.

To facilitate this relatively straightforward-sounding loop, however, the group was utilizing a complex and layered network of cartel-connected bank accounts and corporations. Though Spain is home to just around 80 bitcoin ATMs, authorities are nonetheless concerned and are urging swift action in the face of this scheme coming to light.

What do you think about bitcoin ATM regulations? Let us know in the comments section below.

Image credits: Shutterstock, Twitter

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.