The Spanish Prosecution office says it is investigating Arbistar for allegedly running a bitcoin trading scam with preliminary findings suggesting $1 billion in investors’ funds cannot be accounted for. The disappearance of investor funds has affected 32,000 families that are failing to access their savings that are invested with Arbistar, a bitcoin trading platform.

Problems for Arbistar investors started after the bitcoin trading platform abruptly froze investor accounts before ceasing operations in September. At the time, executives at Arbistar claimed an error on one of its crypto trading bots caused the bitcoin trading platform to pay more in profits than were actually due. In a statement soon after freezing investor accounts, Arbistar said the error, which went undetected for close to a year, left the trading platform in a financial hole.

Now according to Spanish media reports, the police in Tenerife, where Aribistar has its tax headquarters, has “already opened investigations into the company.” The police also want to “know the destination of the (missing) funds.”

Meanwhile, some of the investors affected by Arbistar’s freezing of accounts insist the bitcoin trading platform is a pyramid scam. Nevertheless, the director and owner of Arbistar, Santiago Fuentes disputes this characterization as he defends the blockade on investor accounts:

It is just a computer error that we have to settle, liquidate and continue with our businesses.

Fuentes, who earned the nickname “Spanish Madoff” after his prosecution and subsequent acquittal in another scam case, agrees that about 32,000 families are affected. Interestingly, Fuentes confirms that he is in hiding at an undisclosed location in Tenerife for “security reasons.” However, he denies accusations that he has disappeared.

On the other hand, when asked about the actual figure of bitcoins that cannot be accounted, the Arbistar director again denies that nearly $1 billion worths of coins are missing. Instead, he claims that the actual value “does not reach even a tenth of what is speculated by some of those affected.” According to Fuentes, the actual figure of bitcoins that cannot be accounted for “could be around 10,000 bitcoins” which he says translates to almost $103 million.

Finally, Fuentes says he hopes that the scheduled launch of Arbistar 2.0 will “ensure those affected will recover their investment in six or twelve months.”.

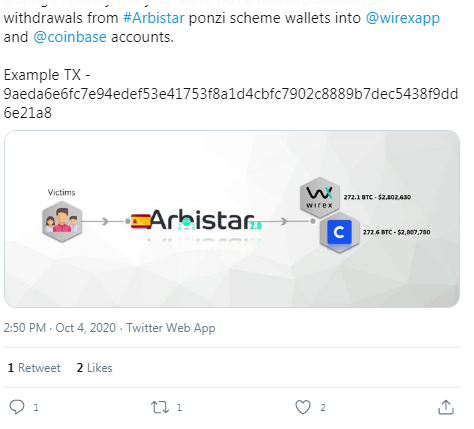

Meanwhile, in another twist to the story, one blockchain intelligence firm, Whitestream claimed it has uncovered “massive withdrawals from Arbistar Ponzi wallets into Wirex and Coinbase.” This occurred in February.

In a Twitter post on October 4, the Whitestream team said:

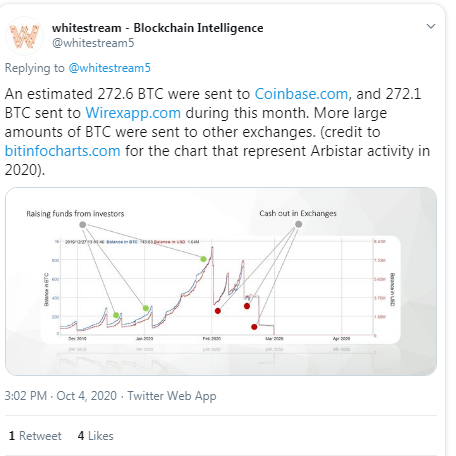

“An estimated 272.6 BTC were sent to Coinbase.com, and 272.1 BTC sent to Wirexapp.com during this month (February). More large amounts of BTC were sent to other exchanges.”

To support the claims, Whitestream provides data (Bitinfocharts) that appears to show “cash outs” at exchanges immediately after investor fundraising activities.

The blockchain intelligence firm’s CEO, Itsik Levy tells News.bitcoin that after analyzing Arbistar activity on the Blockchain, they determined that:

In that period of time Arbistar had an estimated 18,000 Bitcoin addresses that represent their customer deposits, they were involved in 17,500 transactions. Between July 2019 to March 2020 Arbistar received around 2,600 BTC $26,000,000.

However, after the large cashouts in March 2020, Levy says they observed that Aribistar “changed the Blockchain wallets infrastructure in order to gain more privacy on the blockchain, the new wallets infrastructure is active until today – October 2020.”

Still, the CEO says they “are currently analyzing the new wallet structure of the company in order to understand where the lost funds are.”

What do you think of Fuentes’ remarks about the missing bitcoins? Share your views in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.