The on-chain activity for stablecoins has increased 800% in the last 12 months according to market intelligence firm TokenAnalyst.

This growth is not surprising considering the overall growth of the stablecoin niche. The combined market cap for all stablecoins ranks third in size behind Bitcoin (BTC) and Ether (ETH) and ahead of XRP (XRP).

Over the past year, $290 billion of stablecoins were moved on-chain — in March alone $50.9 billion in value was transferred versus $6.2 billion in April 2019.

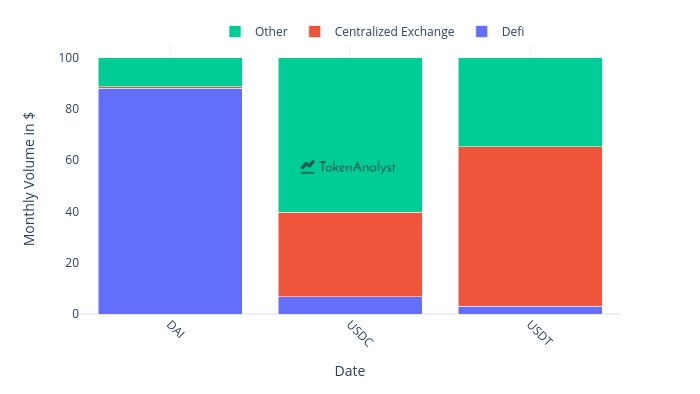

Source: TokenAnalyst

Dai is most DeFi

Despite the growth of the DeFi industry, more than half of the on-chain activity involves centralized exchanges. In fact, exchange-related activity outranks DeFi five to one.

Source: TokenAnalyst

Of the three stablecoins analyzed Tether (USDT), USDC (USDC) and Dai (Dai), the latter is by far the most “decentralized” with 88% of its on-chain activity qualifying as DeFi. This is because Dai itself is built on a DeFi protocol. On the other hand, 62% of Tether’s activity involves centralized exchanges.

The availability of a variety of stablecoins is useful for crypto investors as it provides a “parking” mechanism to shield their wealth from market volatility. Cashing out is an alternative strategy, but with stablecoins, the investor does not need to exit and re-enter the crypto world which can be inconvenient and incur additional costs.

With both the Dai stablecoin and the DeFi space, lately, exhibiting fragility, some degree of centralization may not prove to be such a bad thing after all.