Stripe will now offer debit cards, bank accounts and other products to online merchants and vendors who use its payment processing platform.

American financial services provider and also software as a service (SaaS) company, Stripe Inc has teamed up with some of the leading financial institutions to provide banking as a service, dubbed Stripe Treasury. Some of the financial institutions that Stripe has partnered with include Goldman Sachs, Citigroup, and Barclays Bank. Whereby, the partnership with Goldman Sachs will help its new service reach out to more Americans, while the other partnerships work on global reach.

Notably, Stripe will now offer debit cards, bank accounts and other products to online merchants and vendors who use its payment processing platform.

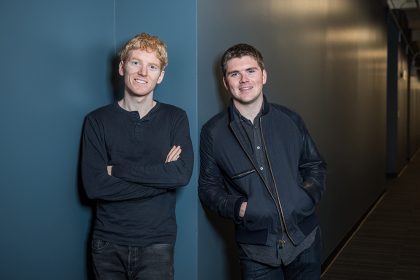

“If you are a Goldman Sachs or a Citi or one of these firms, you are watching the fact that new businesses live their lives online,” said John Collison, Stripe’s co-founder and president, told the WSJ.

Into Details of Stripe Services

To facilitate a seamless payment system, Stripe will use its API applications through the Stripe Treasury software. Apparently, Canadian e-commerce platform, Shopify has been dubbed as an early adopter of Stripe’s new financial service. Notably, as early as next year Shopify Balance accounts will be available to thousands of merchants that use Stripe’s software.

Tui Allen, Senior Product Lead for Banking at Shopify, noted that the new Stripe service will help it strengthen its payment system.

“By building across Stripe’s payments and banking infrastructure, we’ve been able to give Shopify merchants access to critical financial products that meet their needs, like faster access to funds and rewards, helping them further grow their businesses,” he stated.

Speaking through a press release, Hari Moorthy, Goldman Sachs global head of transaction banking said that the partnership is groundbreaking for internet businesses seeking to scale their ventures.

“The millions of ambitious, fast-growing businesses in the Stripe ecosystem will soon discover a dramatically improved end-to-end digital banking experience,” he explained.

With Stripe Treasury, users can now create an FDIC insurance-eligible account that earns interest. In addition, the account can support remote check deposits, facilitates ACH and wire transfers to pay employees and vendors.

One of the notable aspects of the Stripe Treasury is the fact that it can allow the user to create an account that can be topped by transfers of payments. Also, the merchants who use Stripe Treasury can pay on-demand its workers through an interest-earning stored-value account to offer immediate access to their earnings.

During the pandemic, Stripe has worked to widen its scope of revenue collection. Whereby earlier this year it expanded to global markets including Europe, Romania, Cyprus, Bulgaria, Czech Republic, and Malta. In October, the company acquired a Nigerian payment processor Paystack for over $200 million.

A financial analyst who sees positive income in both directions of the market (bulls & bears). Bitcoin is my crypto safe haven, free from government conspiracies.

Mythology is my mystery!

“You cannot enslave a mind that knows itself. That values itself. That understands itself.”