Hackers stole more than $1.63 billion in cryptocurrency during the first quarter of 2025, with the Bybit exploit accounting for more than 92% of total losses, according to blockchain security firm PeckShield. PeckShield reported that over $87 million in crypto was lost to hacks in January, while February saw a dramatic spike to $1.53 billion, largely due to the Bybit attack. That incident was one of the largest crypto thefts to date. In addition to the Bybit hack, other attacks in February caused $126 million in losses. This included a…

Tag: 1.6B

Spot Bitcoin ETFs saw over $1.6b in outflows in the first half of March

U.S. spot Bitcoin exchange-traded funds recorded over $1.6 billion in net outflows during the first two weeks of March amid escalating U.S. trade tensions and broader market uncertainty. According to data from SoSoValue, the 12 spot Bitcoin (BTC) ETFs saw weekly outflows of $799.39 million and $870.39 million in the first two weeks of March, adding up to a total outflow of $1.67 billion over the period. These outflows marked the fifth straight week of net withdrawals, wiping out over $5.4 billion from these ETFs. In contrast, these Bitcoin ETFs…

As Bitcoin Eyes $80K, Futures Premium Soars and $1.6B Locked in Options Bet Points to Big Moves

As Bitcoin Eyes $80K, Futures Premium Soars and $1.6B Locked in Options Bet Points to Big Moves Original

Whales accumulated $1.6b in ETH in 7 days, exchange outflows surge

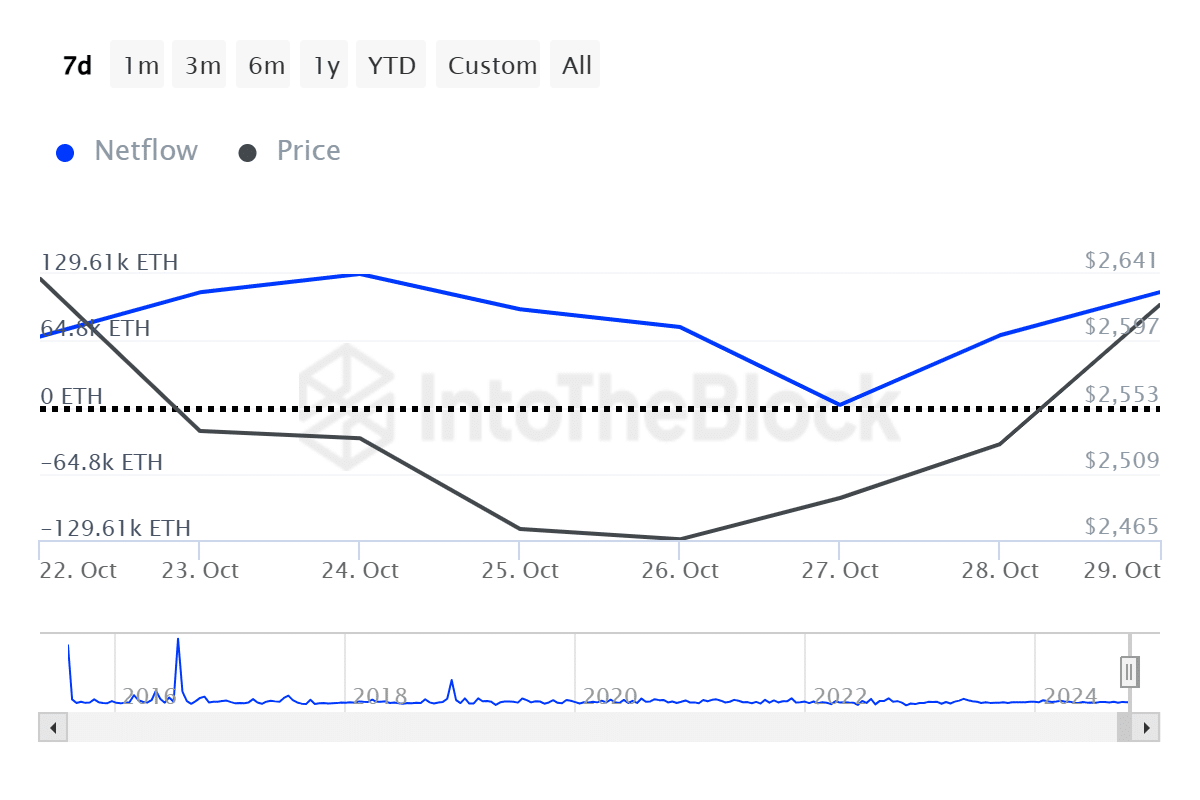

Ethereum whales have been accumulating the asset as the Oct. 23 price drop brought a buying opportunity. According to data provided by IntoTheBlock, large Ethereum (ETH) addresses saw a net inflow of over 598,000 ETH over the past week—worth $1.6 billion at the current price. The accumulation gained traction after the ETH price plunged from its local high of $2,765 between Oct. 21 and 23. ETH large holder net flows | Source: IntoTheBlock Ethereum gained 4% in the last seven days and is trading at $2,685 at the time of…

Bitcoin ETFs See $1.6B Inflows This Week – Is BTC Reaching A New ATH Soon?

Este artículo también está disponible en español. Bitcoin is holding strong above $67,000 after setting a new local high of around $68,300, fueling excitement among investors. This bullish momentum is driven by price action and supported by key market data signaling a potential uptrend continuation. Related Reading Daan, a top crypto analyst, shared crucial insights showing that Bitcoin ETFs have been buying heavily for the past four days. This surge in institutional demand is a positive signal for the market, as it could further propel Bitcoin toward new all-time highs.…

Spot Bitcoin ETFs see four straight days of inflows, surpassing $1.6b, Ether ETFs rebound

Spot Bitcoin ETFs in the U.S. marked their fourth straight day of net inflows, while spot Ether ETFs reversed course, moving back into net positive flows. Data from SoSoValue shows that the 12 spot Bitcoin ETFs recorded net inflows of $458.54 million on Oct. 16, marking the fourth consecutive day of positive inflows. Over this period, the funds have accumulated more than $1.63 billion. BlackRock’s IBIT, the largest Bitcoin ETF by assets under management, continues to dominate, posting the highest net inflow for the second straight day. On Oct. 16,…

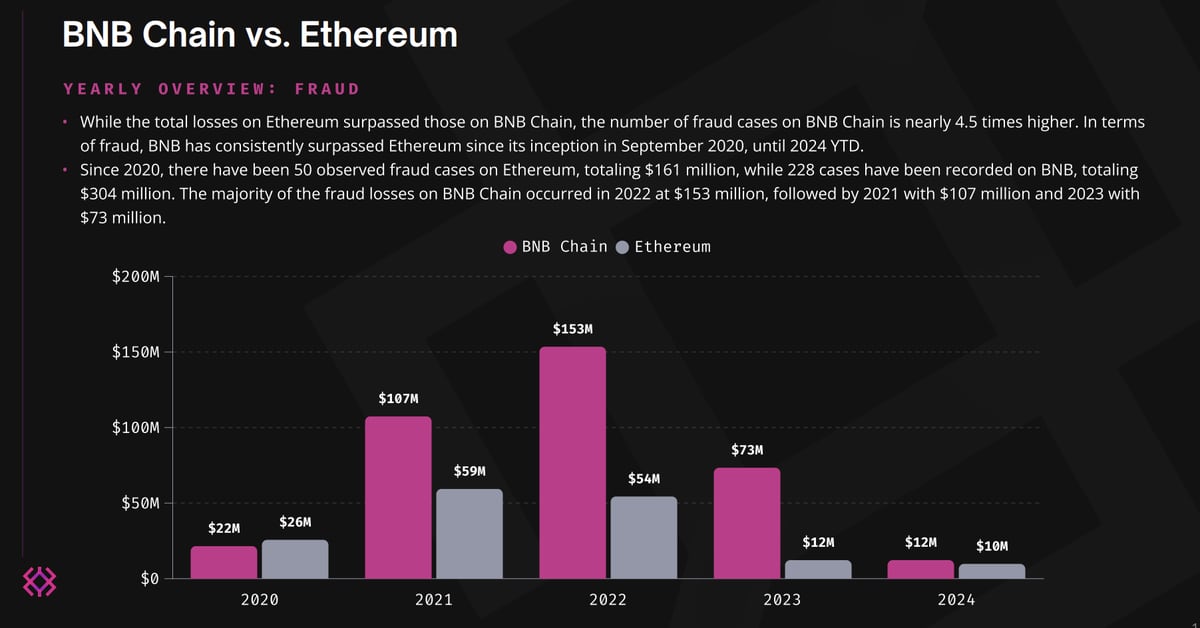

Hacks, Rug Pulls Cost BNB Chain $1.6B Since Inception: Immunefi

More than $1.6 billion has been lost to hacks and rug pulls on BNB Chain since 2017, making it the primary target for criminals, Immunefi said. Source

Grayscale’s Bitcoin ETF hits $1.6b outflows hours before halving

Grayscale’s spot Bitcoin ETF continued a five-day outflow sprint leading to the halving, a code change that occurs every four years to help maintain BTC scarcity. Data gathered by SoSoValue showed $89.9 million in Grayscale exits, bringing GBTC’s total net outflows to $1.6 billion since trading opened back in January. For all 10 spot Bitcoin (BTC) ETFs, cumulative outflows were recorded as $4.3 million, as Fidelity and BlackRock garnered demand to offset some of GBTC’s liquidations. Fidelity’s FBTC net inflows came in at $37.3 million, outpacing $18.7 million, boasted BlackRock’s…

$1.6B Bitcoin Disappears from Exchanges,Will BTC Price React

BTC price peaked at $52,858 on Feb. 15, bringing its monthly gains to 24.3%, an unusual trend in Bitcoin exchange flows suggests more dramatic action could follow. Bitcoin price has entered a new 2024 peak in the last four days, dating back to Feb. 12. Investors shifted $1.6 billion in Bitcoin into long-term storage Thanks to heightened buying pressure from investors piling funds into the newly launched spot ETFs, Bitcoin has added over $200 billion to its market capitalization within the first half of February. However, looking beyond the flashy…

Genesis granted court permission to sell $1.6b Grayscale GBTC shares

Grayscale’s GBTC may experience new sell pressure and outflows following a ruling in the Genesis bankruptcy case on Feb. 14. U.S. Bankruptcy Judge Sean Lane ruled that Digital Currency Group (DCG) subsidiary Genesis has been approved to offload shares from Grayscale crypto products, including its converted Bitcoin ETF GBTC, its Ethereum Trust (ETHE), and its Ethereum Classic Trust (ETCG). Judge Lane’s verdict allows the defunct lender to liquidate 35 million GBTC shares worth around $1.6 billion. Each share traded at around $46 when the ruling was issued. The bankrupt lender…