Trump Media is targeting up to $12 billion in capital through a sweeping SEC filing, accelerating its bitcoin acquisition strategy and positioning for massive crypto-fueled expansion. Trump Media Seeks SEC Approval to Raise up to $12 Billion to Advance Bitcoin Holdings Trump Media & Technology Group Corp. (Nasdaq, NYSE Texas: DJT), founded and majority-owned by […] Source CryptoX Portal

Tag: 12B

Cardano’s ADA Price Leaps to 2.5-Year High of 90 Cents as Whale Holdings Exceed $12B

The price has risen 22% this week, taking the month-to-date gain to 152%. That has raised the token’s market capitalization to $30.85 billion, making it the world’s 10th-largest digital asset. In contrast, the CoinDesk 20 Index (CD20), a measure of the broader crypto market, has advanced 14% this week and 58% this month. Source

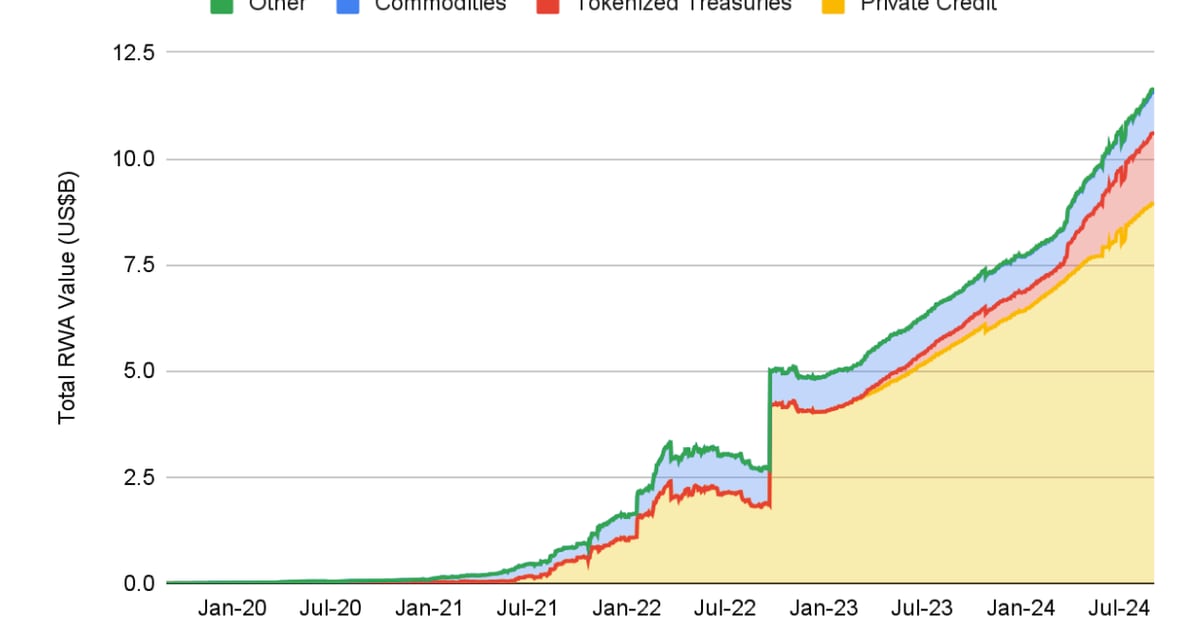

Tokenized RWA market surpasses $12b, led by U.S. treasuries

The market for tokenized real-world assets, excluding stablecoins, has surged past $12 billion, according to Binance. This growth is largely driven by tokenized U.S. Treasuries, with significant participation from major financial institutions such as BlackRock and Franklin Templeton, according to a Binance Research report released on Sept. 13. This total excludes the $175 billion stablecoin market, which remains separate from RWAs. Tokenization is the division of traditionally illiquid assets, such as real estate, government bonds, and commodities, into fractions, making them more accessible to a wider range of investors. It…

Tokenized Real-World Assets, Excluding Stablecoins, Hit Record High of Over $12B: Binance Research

Besides, Figure, a fintech company providing lines of credit collateralized by home equity, accounted for most of the market value of the on-chain private credit market. However, excluding Figure, the sub-sector has still experienced growth in terms of active loans, led by Centrifuge, Maple, and Goldfinch. Source

Crypto Markets Have Seen $12B of Net Inflows This Year, JPMorgan (JPM) Says

Spot bitcoin (BTC) exchange-traded funds (ETFs) have led the way, attracting $16 billion of net inflows, the report said. This number, when combined with Chicago Mercantile Exchange (CME) futures flows plus capital raised by crypto venture capital funds, increases the total inflow into digital asset markets this year to $25 billion. Source BitcoincryptoexchangeExchanges CryptoX Portal

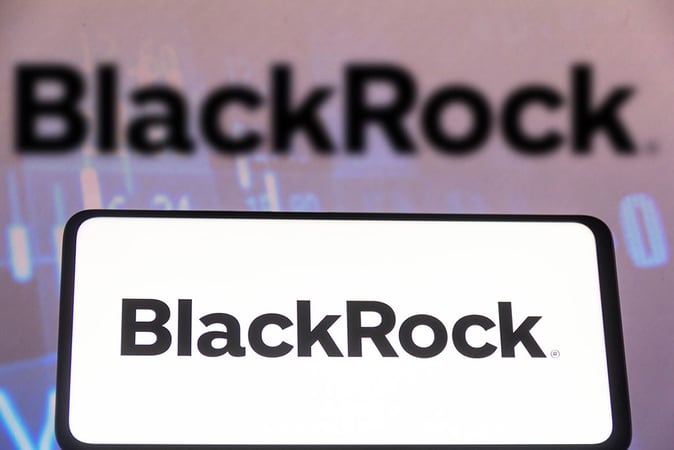

BlackRock Reveals $4.63B in Q4 2023 Earnings Report, Acquires Global Infrastructure Partners for $12B

Figures reported by BlackRock for Q4 2023 beat the expectations of analysts as the company also purchased Global Infrastructure Partners. Giant asset manager BlackRock Inc (NYSE: BLK) has announced earnings for Q4 2023, with figures beating Wall Street expectations. According to reports, BlackRock had profit of $0.15, and $9.66 per share for earnings adjusted for restructuring and amortization costs. Also, the total revenue for BlackRock Inc’s Q4 2023 was $4.63 billion, which met expectations on Wall Street. In addition to BlackRock’s figures for Q4 2023, the company also announced the…

Binance CEO reportedly lost $12b amid regulatory problems

The fortune of the founder and head of the largest crypto exchange, Binance, Changpeng Zhao, decreased by $12 billion amid problems with the trading platform. The Bloomberg Billionaires Index cut its earnings estimate for the Binance cryptocurrency exchange by 38% amid falling platform sales. As a result, Zhao’s wealth decreased by $11.9 billion to $17.3 billion. In addition to losing his fortune, Zhao reset the wealth of the founder of the FTX crypto exchange, Sam Bankman-Fried. In November 2022, the founder of Binance announced that he was liquidating the token…

Binance Founder CZ's Wealth Falls About $12B as Trading Revenue Slumps: Bloomberg

Changpeng Zhao’s wealth dropped to $17.2 billion from a previous estimate of $29.1 billion. Source

Changpeng Zhao Loses Another $12B of His Fortune amid Regulatory Scrutiny

Zhao’s woes and those that are related to his exchange have been largely a result of the ongoing lawsuits against them. Binance co-founder and CEO Changpeng Zhao continues to see his fortune slashed after he reportedly lost another $11.9 billion, according to the Bloomberg Billionaires Index. This brings his total fortune loss from the January 2022 peak of $97 billion to around $80 billion. Zhao Is Losing His Wealth, Here’s Why As of publication, Zhao’s crypto empire is now worth a measly $17.3 billion, a far cry from what it…

Binance founder CZ’s fortune gets slashed $12B, while SBF is still at $0

Binance co-founder and CEO Changpeng “CZ” Zhao has seen his net worth slashed by $11.9 billion amid falling trading volumes at his exchange. On Oct. 26, the Bloomberg Billionaires Index cut Binance’s revenue estimates by 38% amid a slump in exchange volumes which knocked Zhao down to 95th place on the rich list. Zhao’s net worth is now a paltry $17.3 billion, registering an 82% drop from its $96.9 billion peak in January 2022, where he was ranked 11th among the world’s richest people. Zhao’s net worth peaked at $96.9…