Key Notes The stock rally coincided with US House passage of two major crypto bills addressing market oversight and stablecoin regulation. Robinhood’s recent European launch of tokenized US stocks trading has fueled investor optimism about digital asset adoption. Market analysts warn that severe liquidity constraints in the $27 million tokenized equities market could limit widespread adoption. Robinhood (HOOD) stock briefly hit $112 on Friday, July 18, surging to a new record high and pushing the company’s market capitalization beyond the $100 billion threshold. The milestone marks a 38% gain over…

Tag: Billion

XRP Open Interest Just Hit A Fresh ATH Above $10 Billion, Will Price Follow Next?

XRP Open Interest (OI) has surged to a new all-time high, surpassing $10 billion across major crypto exchanges. This jump in futures activity comes as the XRP price climbs toward $3.48, its highest level in years. Historically, rising Open Interest has often coincided with significant price rallies, suggesting the potential for further upside in XRP’s trajectory. XRP Open Interest Records New ATH Reports from Coinglass have revealed that the total Open Interest in XRP futures has climbed to a fresh ATH of $10.49 billion, reflecting a sharp increase in trading…

Stolen Funds Hit $2.7 Billion In H1

As the market soars with bullish momentum, crypto theft has also seen a record-breaking performance during the first half of this year. A recent report revealed that stolen funds from services so far have surpassed the numbers from previous years. Related Reading Stolen Crypto Service Funds Hit $2B In 6 months On Thursday, Chainalysis shared its “2025 Crypto Crime Mid-Year Update,” revealing that digital assets theft this year has been “more devastating” than the entirety of 2024, with over $2.7 billion worth of funds stolen from crypto services so far.…

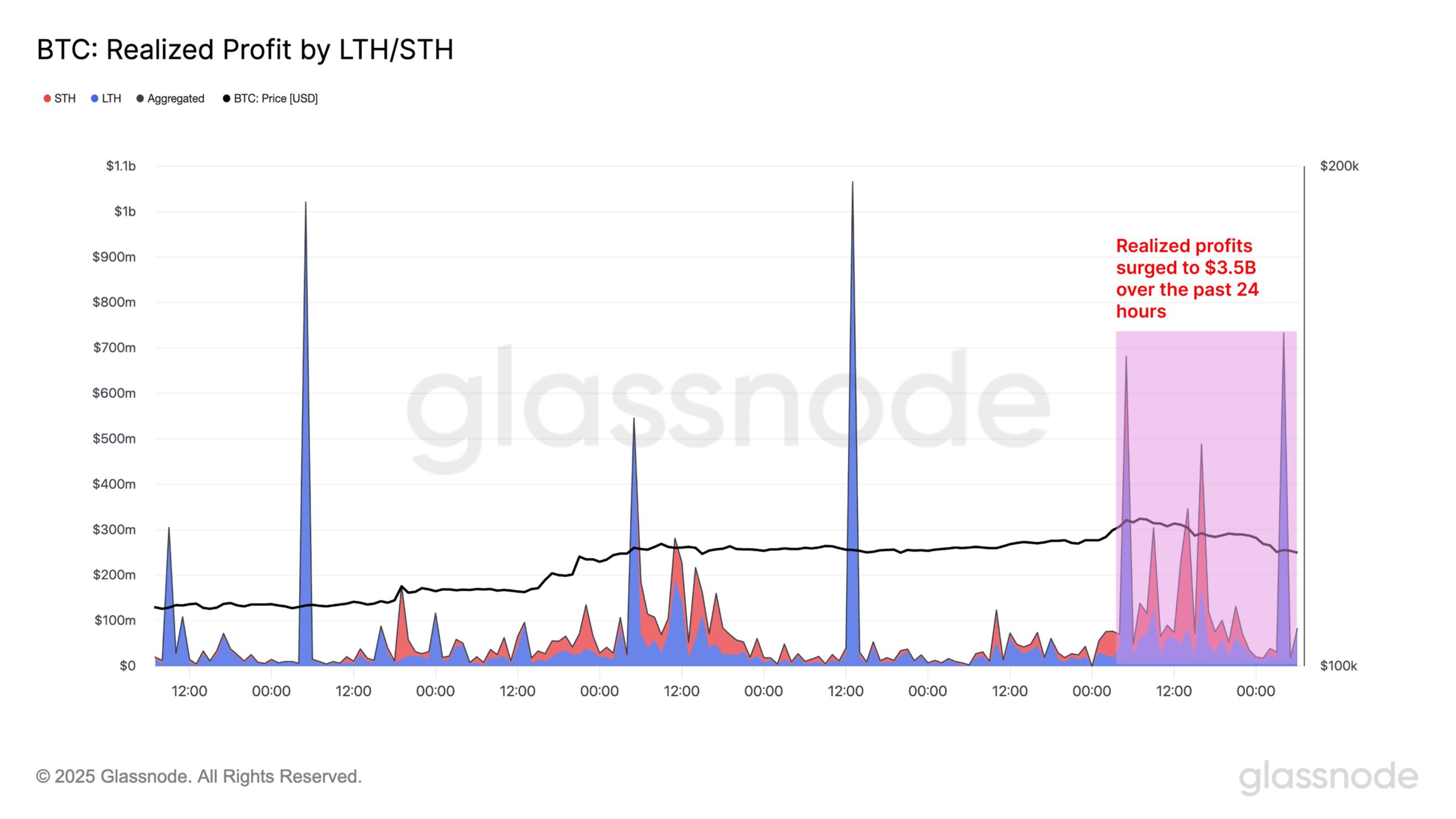

Bitcoin Falls Below $117,000 Amid $3.5 Billion Profit-Taking Frenzy

The Bitcoin price has slipped under $117,000 as on-chain data shows the network has observed one of its largest profit realization days of the year. Bitcoin Long-Term Holders Did The Major Share Of Profit-Taking In a new post on X, the on-chain analytics firm Glassnode has talked about the latest trend in the Bitcoin Realized Profit indicator for the short-term holders and long-term holders. The “Realized Profit” measures, as its name suggests, the total amount of profit that the BTC investors are realizing through their transactions. The metric works by…

ETF Surge: Bitcoin and Ether ETFs Attract $3.6 Billion in Weekly Inflows

Bitcoin and ether exchange-traded funds (ETFs) continued their historic run with $2.72 billion and $907.99 million in net weekly inflows, respectively. This marks the fifth consecutive green week for bitcoin ETFs and the ninth for ether ETFs. Record-Breaking Momentum: Bitcoin and Ether ETFs Extend Green Run The momentum is undeniable. As digital assets soar, so […] Original

Trump’s Bitcoin Bet Pays Off: US BTC Reserves Jump Nearly $7 Billion in Just 4 Months

According to the records, ever since U.S. President Donald Trump signed the executive order officially launching the Strategic Bitcoin Reserve, the government’s stash of bitcoin has ballooned by nearly $7 billion in value. U.S. Bitcoin Reserve Skyrockets in Value In bitcoin’s earlier years, long before today’s lofty prices, the U.S. government offloaded large portions of […] Original

Bitcoin ETFs Log Another $1 Billion Day as Institutional Momentum Breaks Records

Bitcoin exchange-traded funds (ETFs) posted another billion-dollar inflow on Friday, their second in a row, pushing total net assets to a new record. Ether ETFs kept pace with a $204.82 million haul, marking yet another strong green session. Bitcoin ETFs Surge to $150 Billion AUM After $1 Billion Inflow The wave keeps growing, and the […] Original

Blackrock’s IBIT Shatters ETF Records, Hits $80 Billion AUM in 374 Days

Blackrock’s IBIT has officially become the fastest exchange-traded fund (ETF) to reach $80 billion in assets under management (AUM), hitting the milestone in just 374 days and helping push total spot bitcoin ETF assets past $140 billion. IBIT Rockets to $83 Billion, Fueling Spot Bitcoin ETF Boom Past $140 Billion Blackrock’s iShares Bitcoin Trust (IBIT) […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Bitcoin ETFs Break 2025 Record With $1.2 Billion Inflow as BTC Hits New All-Time High

Bitcoin ETFs shattered their 2025 inflow record with $1.2 billion on Thursday, June 10, as BTC surged to a new all-time high. Ether ETFs kept the green streak alive, pulling in another $383.10 million. Crypto ETF Frenzy: Bitcoin and Ether Funds See Combined $1.6 Billion Inflows in One Day Bitcoin ETFs just made history. A […] Original

Bitcoin Rally to $118K Wipes out Over $1 Billion in Short Bets

Bitcoin’s recent surge resulted in significant liquidations, with more than $1.09 billion in short contracts wiped out within a 24-hour period. Bitcoin Rally Triggers Liquidations Bitcoin’s rally to a new all-time high of over $118,000 triggered a massive wave of liquidations, wiping out more than $1.11 billion in short contracts in a single 24-hour period […] Original