The largest cryptocurrency held its perch where it spent much of the previous three days. Original

Tag: Data

Bitcoin on-chain data shows miners offloading BTC as revenues shrink

Bitcoin’s on-chain data provides evidence that Bitcoin miners are offloading their holdings. The factors influencing the selling pressure could be reduced earnings from a cooldown in Ordinals activity as well as mining difficulty and hash rate reaching an all-time high. According to on-chain analytics firm Glassnode, “Miners have been sending a significant amount of coins to exchanges.” Glassnode data shows Bitcoin (BTC) miners’ inflows to exchanges spiked to a three-year high on June 3 to levels last seen during the bull market of early 2021. Across the past week, #Bitcoin Miners have…

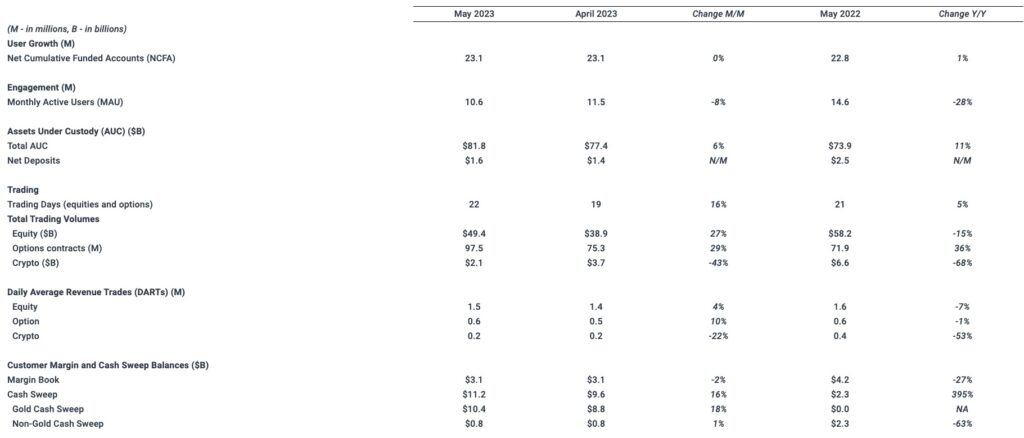

Robinhood reports mixed operating data for May 2023, user engagement down

Robinhood Markets, Inc. has disclosed selected monthly operating data for May 2023, which depicts a complex portrait of growth and decline in user engagement and trading activities. Robinhood reported an increase in net cumulative funded accounts (NCFA) to 23.1 million at the end of May, up roughly 20,000 from the previous month. Notably, however, the trading platform experienced a decrease in monthly active users (MAU), which fell to 10.6 million in May, representing a drop of approximately 900,000 from April 2023. The company’s assets under custody (AUC) exhibited positive growth,…

Onchain Data Points to Billions in Outflows from Binance Following SEC Lawsuit, CEO CZ Responds

Following reports of increased outflows after news of the lawsuit broke, Binance CEO CZ argued that there was potential for on-chain data to be misinterpreted. Crypto exchange Binance has experienced billions of dollars in outflows over the past week. This is according to on-chain data from various data analytics platforms. The exchange’s CEO Changpeng ‘CZ’ Zhao has argued that such data can be misinterpreted and the situation may not be as dire as it appears. Analytics Data Points to Large Outflows from Binance Following SEC Lawsuit According to major blockchain…

Binance CEO CZ responds as data points to billions in exchange outflows

While data suggests that crypto assets have been flowing out of centralized exchanges at an accelerated pace over the last week, Binance CEO Changpeng Zhao argues it may not be as bad as it appears. Leading analytics platforms such as Nansen and DeFiLlama have all measured increased exchange outflows from Binance over the past seven days after news of the SEC lawsuit against the firm hit the airwaves. According to Nansen, there has been a net outflow of $2.36 billion from Binance over the past seven days along with $123.7 million…

Millions in Polygon’s MATIC Tokens Were Sent to Binance and Coinbase Ahead of 30% Slide, Data Shows

“Altcoins can crash this weekend even more as trading volumes are thin and market makers such as Binance have become less active,” one crypto firm warned. Source

Bitcoin price races toward $27K, but a swift recovery is not confirmed by market data

Bitcoin might have displayed strength by quickly recovering from the $25,500 support level on June 6, but that doesn’t mean that breaking above $27,500 will be an easy task. Investors still expect stricter regulatory scrutiny after FTX’s bankruptcy in November 2022, including the recent suits against Coinbase and Binance. A total of eight cryptocurrency-related enforcement actions have been undertaken by the United States Securities and Exchange Commission (SEC) over the past six months. Some analysts suggested the SEC is attempting to redeem itself for failing to police FTX by taking action against the…

$1,280,000,000 in Crypto Yanked Out of Coinbase Amid SEC Lawsuit Against the US Exchange: On-Chain Data

Blockchain data and research firm Nansen says that hundreds of millions of dollars exited the Coinbase group in the wake of a lawsuit filed by the U.S. Securities and Exchange Commission (SEC). According to Nansen, Coinbase and the exchange’s custodial arm recorded negative netflows, the sum of deposits and withdrawals, of approximately $1.28 billion after the SEC move. “As we write, the SEC has announced that it is suing Coinbase. Looking at on-chain centralized exchange data, it shows that Coinbase + Coinbase custody have negative netflows of $1.28 billion.” Source:…

Lightning Data Analytics Firm Amboss Launches New ‘Liner’ Index for Bitcoin Yield

“We operate a liquidity marketplace. If you want to buy a channel from anybody that has an offer listed, you can go and do that and compare the prices,” said Shrader. “That’s one piece of it, just provisioning this liquidity. On the other side, the person that’s providing the liquidity, they get some yield out of it.” Original

Binance likely updated bitcoin confirmation process, on-chain data reveals

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied New on-chain data has picked out activity surrounding Binance’s consolidation transactions. As observed, the latest batch of these transactions has been subjected to a replaced-by-fee (RBF) shift, escalating from 13.5 sats/vb to 56.4 sats/vb. It is despite these transactions failing to “signal BIP125 replaceability”, suggesting that Binance, the world’s largest exchange, could be running a Full-RBF Peering Bitcoin core advocated by Peter Todd. RBF is a standard protocol in the Bitcoin network allowing the sender to increase the…