Please see below the most recent research on crypto ETPs from publicly listed digital asset and fintech investment business Fineqia (CSE:FNQ). Fineqia International, a leading digital asset and fintech investment business, announces that its analysis of global Exchange-Traded Products (ETPs) with digital assets as underlying collateral, revealed a 5% growth in total crypto Assets Under Management (AUM) in January, to $52.0 billion from $49.5 billion. During the same month, the market value of crypto assets decreased 2.7%, to about $1.73 trillion from $1.77 trillion. The difference between the growth in AUM of crypto ETPs and the…

Tag: Digital

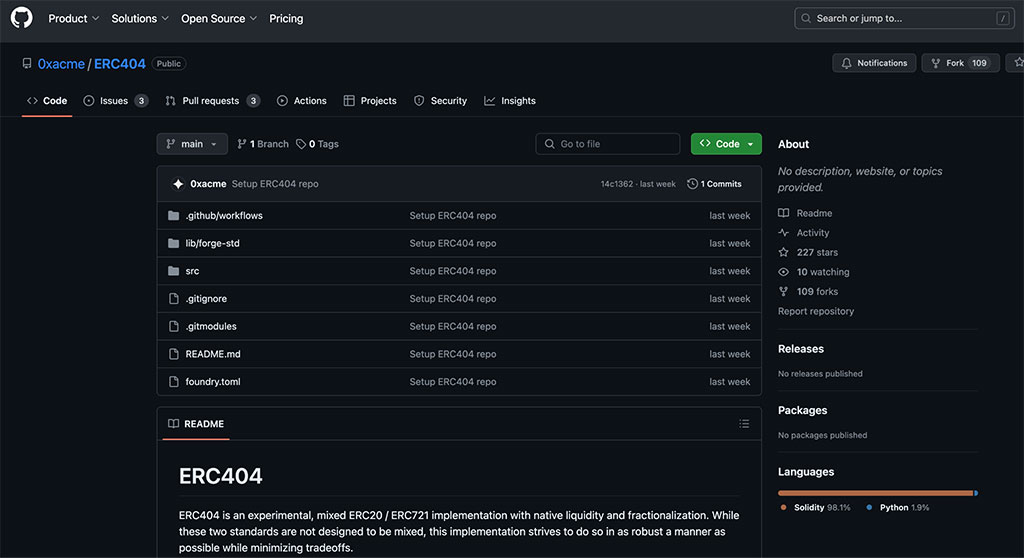

Ethereum’s ERC-404 Token Standard Sets New Era for Digital Assets

CoinspeakerEthereum’s ERC-404 Token Standard Sets New Era for Digital Assets The introduction of the ERC-404 token standard has captured the crypto community’s attention in a groundbreaking development for the Ethereum blockchain. ERC-404 Hybrid Structure & Functionality Garners Developers The new token, pioneered by pseudonymous developers under the Pandora project, is a unique fusion of ERC-20 and ERC-721 functionalities. The project is still in testnet as it’s yet to be audited. One of the founders believes this feat could take a “couple of weeks” to complete. Pandora and ERC-404 ERC-404 has…

NFTs Are the Pillars of Digital Capitalism, Animoca Founder Says

Yat Siu explains why we shouldn’t dismiss NFTs as monkey JPEGs and how blockchain acts as a political system of sorts, fostering a consensus-based democratic process. Source

The Evolution of Stablecoins into Commodities, Real Estate, and Crypto Baskets Redefines Digital Asset Stability

Another groundbreaking approach is stablecoins tied to a basket of cryptocurrencies, like DAI and wrapped bitcoin, offer stability while capturing the potential upside of the digital asset market. These diversified stablecoins mitigate single-currency risk and provide exposure to a broader spectrum of cryptocurrencies, reducing volatility and enhancing portfolio resilience. The emergence of stablecoins beyond USD pegs reflects a maturing market and growing investor demand for stability, transparency, and diversification in digital assets. These alternative stablecoins offer a compelling value proposition for investors seeking to preserve capital and navigate the dynamic…

Skyline Digital makes TradFi accessible on Web3 – Blockchain News, Opinion, TV and Jobs

Zug, Switzerland, February 7th, 2024, Chainwire The Swiss-based platform Skyline Digital empowers underbanked Web3 Businesses, Founders, and DAOs to access third-party fiat payments, OTC trades, tokenized real-world assets, vIBANs, and on/off-ramping. Web3 Businesses, DAOs, and High Net Worth Individuals find themselves underserved by traditional banks, while custodial and centralized crypto exchanges pose risks and unreliability. Skyline Digital has made it a mission to solve these issues at the core of Web3 business with its non-custodial platform, providing access to TradFi services directly from any wallet. Switzerland is the crypto-friendly home…

Crypto Winter In Spain? New Taxes Target Digital Assets

In a move that could have ripple effects across Europe, Spain is tightening its grip on crypto monitoring and seizing digital assets for tax debts. The Ministry of Finance, led by María Jesús Montero, is spearheading legislative reforms to grant the Spanish Tax Agency enhanced powers to identify and seize crypto holdings from taxpayers with outstanding debts. This follows a February 1st decree expanding the entities obligated to report tax information to the Treasury, encompassing banks, savings banks, and even electronic money institutions. The measures come amidst Spain’s proactive approach…

How to protect your digital currency

More and more banks have been giving the green light to cryptocurrency. What exactly do these banks offer customers, and how can they decide which is the right bank for them? In our current dynamic financial era, the emergence of crypto-friendly banks was likely inevitable but has still been very welcome, particularly among crypto enthusiasts. These banks are helping redefine how digital assets are handled, serving as conduits between traditional economic systems and the growing world of cryptocurrencies. They simplify the management and growth of digital currencies, making them more…

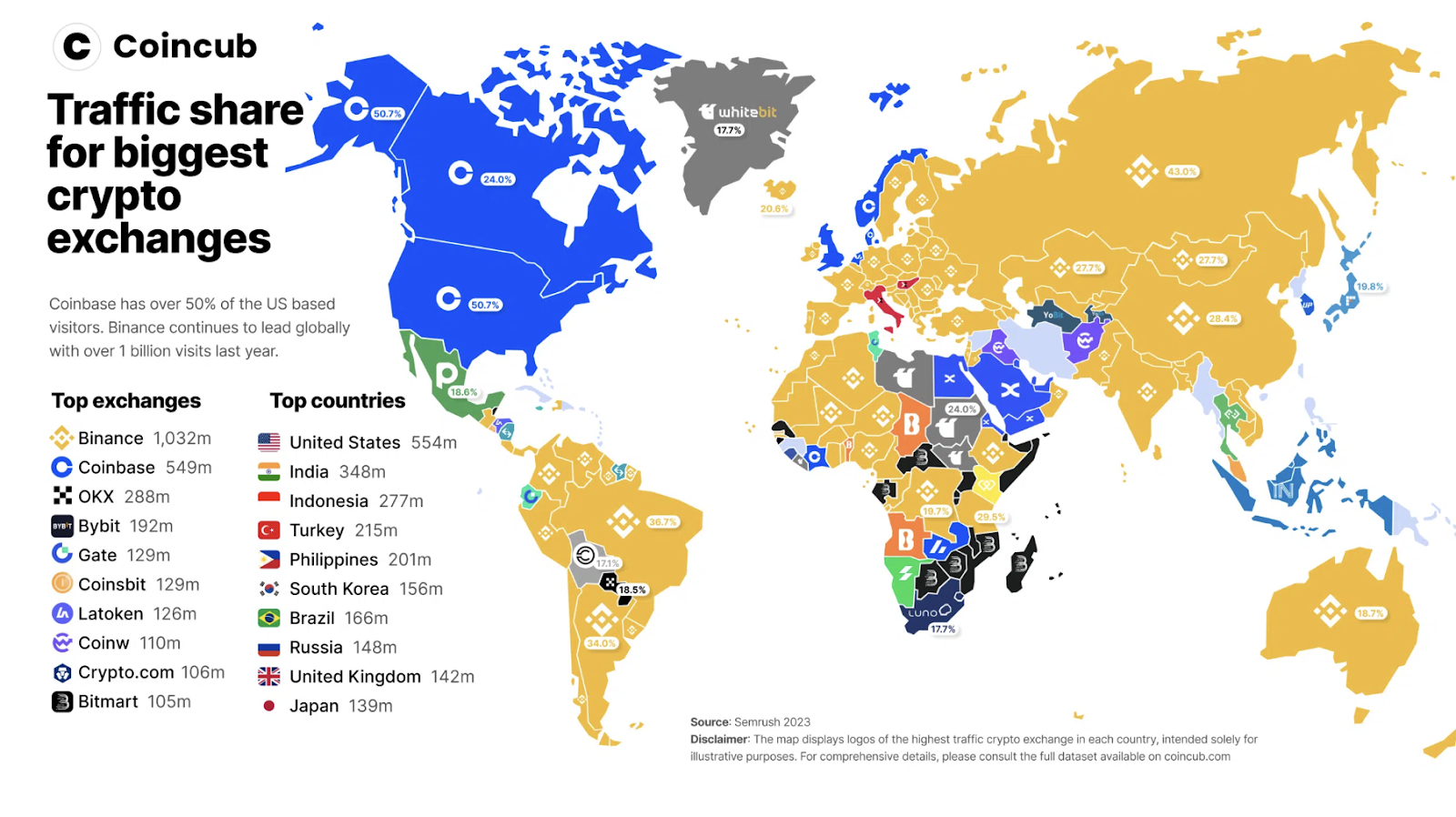

Does your digital asset exchange abide by the rules?

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial. The United States Securities Exchange Commission’s (SEC) eleven Bitcoin ETF approvals, which took over a decade of efforts by fund managers to accomplish, have institutionalized Bitcoin, allowing digital assets to seep into investors’ portfolios in the US forever. With the two largest digital asset exchanges—Coinbase and Binance—still battling in court with the SEC, digital asset investors should beware that to protect investors, federal agencies SEC, Commodity Futures…

Marathon Digital pays Hut 8 $13.5m to run two Bitcoin mining sites

Marathon Digital has finalized a deal with Hut 8 to take over the operational control of Bitcoin mining sites by paying a termination fee of $13.5 million. Marathon’s control of the mining sites in Granbury, Texas, and Kearney, Neb., slated for completion by April 30, follows Marathon’s Jan. 16 acquisition of the sites for $178.6 million. Hut 8 has managed operations under a contract inherited from a previous merger, valued at $1.2 million per month. The transition aims to enhance Marathon’s operational efficiency and cost-effectiveness in Bitcoin (BTC) mining at…

Thai SEC Orders Zipmex to Suspend Digital Asset Trading and Brokerage Services

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of…