However, it is not yet clear what the government’s legislation to safeguard people’s privacy will actually look like. Plus, the digital pound is still in its design phase, meaning nothing is set in stone, said Louise Abbott, a partner at Keystone Law. Source

Tag: Digital

US CBDC debate heats up amid elections. Does the country need a digital dollar?

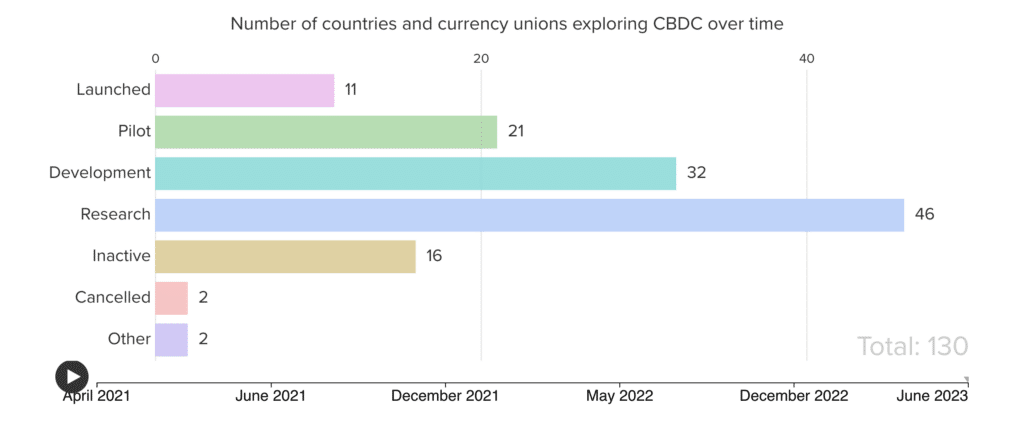

During the 2024 presidential race, the discussion on a U.S. CBDC becomes more intense. Candidates’ contrasting views mirror wider concerns about privacy and government control. As of Jan. 2024, the situation regarding central bank digital currencies (CBDCs) in the U.S. is characterized by caution and gradual progression, especially when compared to the advancements made by other countries. Currently, 11 countries have fully implemented digital currencies, while China, India, and several other countries are in the pilot phase. Source: Atlantic Council In the U.S., the development of a retail CBDC (direct-to-consumer)…

Navigating Control, Access, and Investment Strategies in the Digital Asset Landscape

Level of access: it refers to how closely an investor can interact with or from a digital asset in its purest form (on-chain). The more off-chain layers or wrappers around an asset, the less level of access. For example, the spot bitcoin ETF is a traditional (offchain) financial product backed 1:1 by bitcoins stored in a qualified custodian. Being cash-redeemable only, investors can’t redeem their shares for actual bitcoin, but they must liquidate them for cash. On the other end of the spectrum, self-custody is the purest, most direct access…

Digital Asset Platform Web3Intelligence Raises $4.5M Ahead of New Token Rollout

“Because we aggregate and standardize AML information, we can provide a comprehensive view of web3 wallets that meets the standards expected of compliance officers, as well as users seeking a holistic understanding of their digital asset portfolios.,” said Karim Chaib, CEO of Web3Intelligence. Source

Future Digital Pound Legislation Will Provide Protections to Privacy and Control

The consultation on a central bank digital currency (CBDC) was conducted by the government’s finance ministry alongside the Bank of England, and concluded in June. It received over 50,000 responses. A chief concern in the consultation was privacy and control of money. Source

The Digital Pound Consultation Will Drop Thursday Gov Official Says

“The government is proceeding I think with caution,” said Bowler, who holds the most senior rank for his civil service department. “There’s a number of issues around privacy, financial inclusion, whether there’s limits, monetary policy and interest and the consultation is out on that and you’ll hear more about it tomorrow.” Source

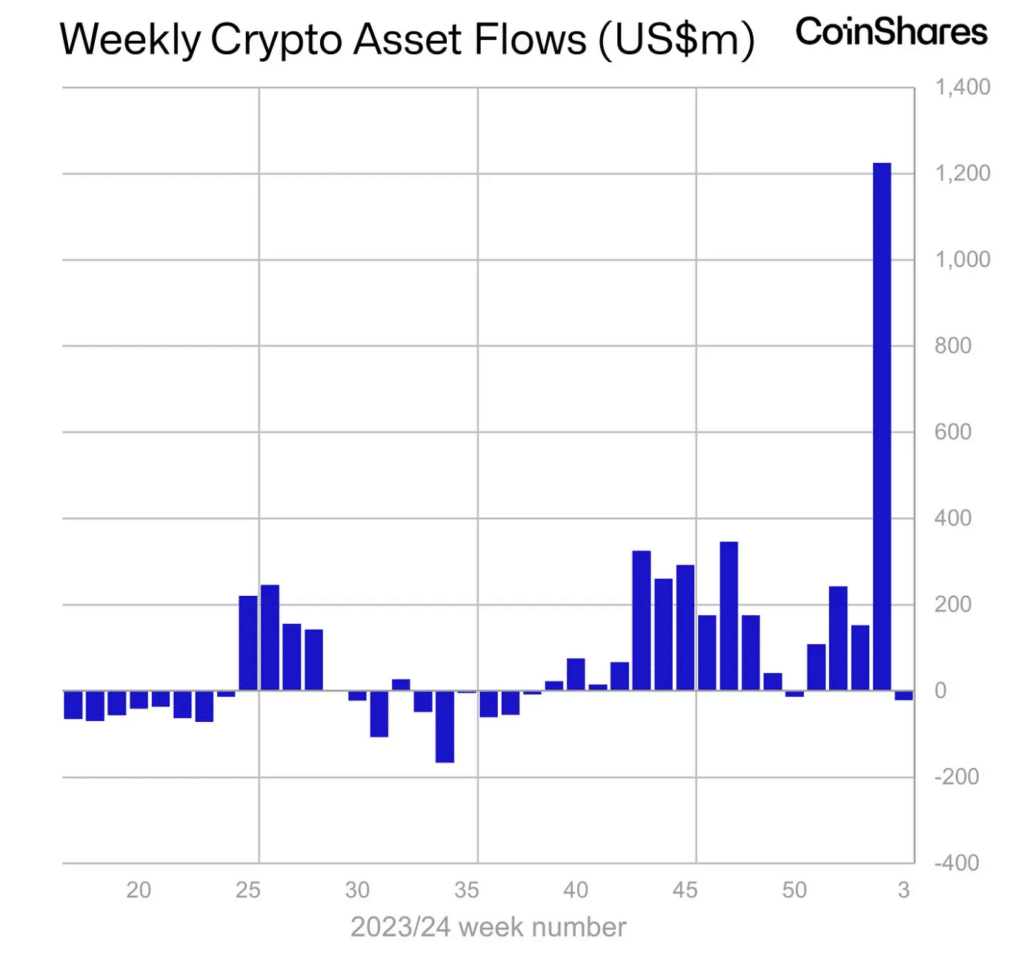

Digital asset investment products saw $21m in outflows

Investment crypto products’ outflows amounted to $21 million last week. According to a CoinShares report, outflows from investment products into digital assets were modest at $21 million last week. However, this figure masks very high Bitcoin (BTC) trading volumes last week, totaling $11.8 billion, seven times the average weekly trading volume in 2023. Source: CoinShares Geographically, capital inflows into the United States totaled $263 million, while Canada and Europe saw outflows of $297 million. Analysts suggest that such trends are explained by the migration of assets to the United States.…

‘One-Stop Station’ Digital Identity Service Root Protocol Raises $10M Seed Funding

The funding rounds, which gave Root a $100 million valuation, were led by Animoca Brands and included contributions from a slew of other notable investors, including Signum Capital, Ankr Network, CMS Holdings and angel investors Tekin Salimi and Meltem Demirors. Source

Donald Trump Promises to "Never Allow" Central Bank Digital Currencies (CBDC) if Elected

Former President Donald Trump joins Ron DeSantis as a critic of CBDCs. Source

Gemini Receives Digital Asset Service Provider Registration In France

Cryptocurrency exchange Gemini, founded by the Winklevoss twins, has been granted crypto registration by the French markets watchdog Autorite des marches financiers (AMF). According to a recent announcement made by the exchange, this approval allows Gemini to offer its services as a virtual asset services provider in France. The company plans to roll out its products to both retail and institutional clients in the coming weeks. Gemini Seizes Growth Opportunities In Europe As announced, Gemini customers in France will gain access to a wide range of cryptocurrencies for trading, as…