On Sept. 6, Vaneck announced its decision to close and liquidate the Vaneck Ethereum Strategy exchange-traded fund (EFUT). The liquidation comes after evaluating key factors, including performance and investor interest. The firm noted that shareholders will have until September 16, 2024, to sell their shares before delisting. Vaneck to Wind Down Ethereum Futures ETF According […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Tag: Ethereum

Ethereum Underperforms Bitcoin 2 Years After The Merge, According to Cryptoquant Data

Ethereum has underperformed bitcoin by 44% since The Merge, according to research from Cryptoquant. Despite significant upgrades and the recent approval of ethereum spot exchange-traded funds (ETFs), the cryptocurrency continues to face challenges relative to bitcoin. Cryptoquant: Ethereum Underperforms Bitcoin by 44% Ethereum’s transition to a proof-of-stake (PoS) blockchain, known as The Merge, took place […] Original

Ethereum Foundation's Main Wallet Down to About $650M, Top Official Says

Ethereum Foundation's Main Wallet Down to About $650M, Top Official Says Source

Bitcoin ETFs Lose $211 Million as Ethereum Funds See Modest Outflows

Thursday’s trading session saw spot bitcoin exchange-traded funds (ETFs) experienced outflows totaling $211.15 million, while ethereum ETFs faced a much smaller decline of $152,720. $211 Million Exits Bitcoin ETFs, Ethereum Funds Slip by $152K On Sept. 5, bitcoin and ethereum ETFs both took hits, with bitcoin ETFs leading the way in outflows. According to data […] Original

Ethereum Price Poised for Steady Recovery: Can It Build Momentum?

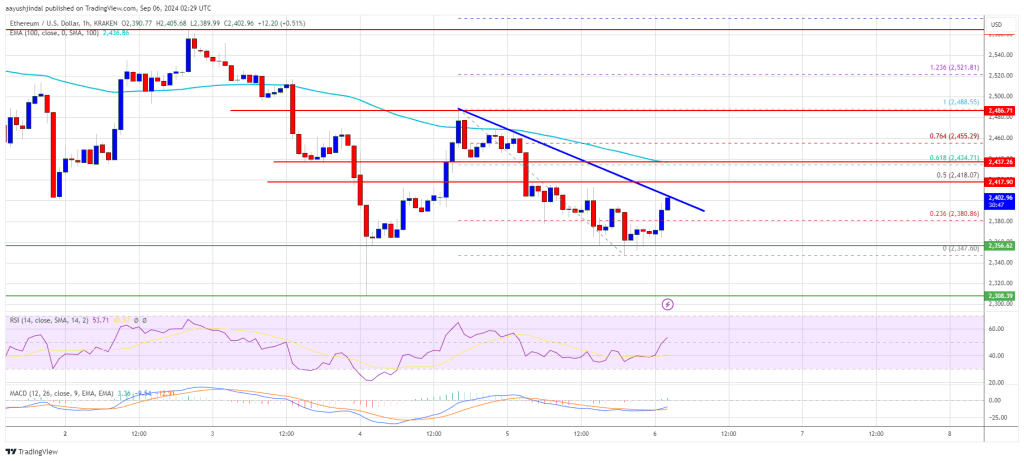

Este artículo también está disponible en español. Ethereum price is attempting a recovery wave above $2,380. ETH must clear the $2,440 resistance to continue higher in the near term. Ethereum is attempting a recovery wave from the $2,350 zone. The price is trading below $2,440 and the 100-hourly Simple Moving Average. There is a connecting bearish trend line forming with resistance at $2,400 on the hourly chart of ETH/USD (data feed via Kraken). The pair must clear the $2,440 resistance to continue higher in the near term. Ethereum Price Faces…

Ethereum (ETH) Triangle Formation Hints At A Double Bottom: Breakout and New ATH?

Este artículo también está disponible en español. Ethereum is trading near its yearly low of $2,400 after an 18% drop from local highs. ETH has notably underperformed compared to Bitcoin and other altcoins like Solana this cycle, leading to investor concerns. Related Reading One of the key reasons for this underperformance is the lack of enthusiasm surrounding Ethereum ETFs. Metrics from these funds show low interest from traditional investors, adding to the bearish sentiment around ETH. As the crypto market is gripped by fear and uncertainty, Ethereum traders are searching…

What Was Behind The Bitcoin And Ethereum Price Crash?

Este artículo también está disponible en español. Bitcoin (BTC) and Ethereum (ETH) have started September in the red, having already suffered price declines since the beginning of the month. This bearish sentiment towards the foremost cryptocurrencies and, by extension, the broader crypto market is due to several macroeconomic factors. Market Still Feeling The Effects Of The Yen Carry Trade Recent developments suggest Bitcoin and Ethereum are still feeling the effects of the abandonment of the Yen carry trade. The Yen recently surged against the US dollar, suggesting that investors are…

Bullish on Ethereum? Here’s Why This Layer-2 Meme Is Skyrocketing Past it’s Competitors

Este artículo también está disponible en español. The cryptocurrency landscape is dynamic and often unpredictable, with major players like Ethereum (ETH) frequently influencing market sentiment. Despite recent struggles, Ethereum remains a key pillar in the crypto world, and its ongoing developments continue to shape the future of digital assets. But while Ethereum’s trajectory is being closely monitored by investors, another digital asset is rapidly making waves—Mpeppe (MPEPE), a Layer-2 meme coin that’s soaring past its competitors and capturing the attention of crypto enthusiasts worldwide. Mpeppe (MPEPE): The Layer-2 Meme Coin…

Bitcoin and Ethereum ETFs Record $74 Million in Outflows, Grayscale Funds Lead Losses

On Sept. 4, 2024, the 12 U.S. spot bitcoin exchange-traded funds (ETFs) saw $37.29 million in outflows, while their ethereum counterparts, the nine spot ether ETFs, experienced roughly $37.51 million in reductions. Grayscale’s GBTC and ETHE Lead Withdrawals Both bitcoin and ethereum ETFs saw money flowing out on Wednesday, with nearly identical divestments. According to […] Original

Spot Bitcoin and Ethereum ETFs see 2nd consecutive day of joint outflows streak

Spot Bitcoin and Ethereum exchange-traded funds in the United States continue their streak with a second consecutive day of joint outflows this week. According to data from SoSoValue, the 12 spot Bitcoin ETFs recorded $37.29 million in net outflows on Sep. 4, marking the sixth consecutive day of outflows. Notably, the outflows from these ETFs were 87% lower than the $287.78 million outflows experienced the previous day—their highest outflows since May 1. Grayscale’s GBTC led the lot with $34.2 million leaving the fund, pushing its total outflows to date to…