Based on recent data, after a period of inflows, nine U.S. spot ethereum exchange-traded funds (ETFs) experienced withdrawals totaling $133.16 million on Wednesday. The majority of these withdrawals came from Grayscale’s ETHE, which saw a significant $326.86 million in outflows on July 24. Wednesday Sees $133M Exit U.S. Ethereum ETFs, Grayscale’s ETHE Major Driver U.S. […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Tag: Ethereum

Ethereum Name Service 153% Rally ‘Underway’, Analyst Says

Even though the crypto market has been quite unstable, Ethereum Name Service (ENS) has been showing a lot of growth potential. ENS has shown it can bounce back with an almost 4% rise in the last week. Its success over the last 30 days has been even better, with a 15% increase. People think that the release of Ethereum ETFs will be a big part of making ENS more well-known and appealing. These ETFs are a big change in the world of cryptocurrencies, and they might get more investors interested.…

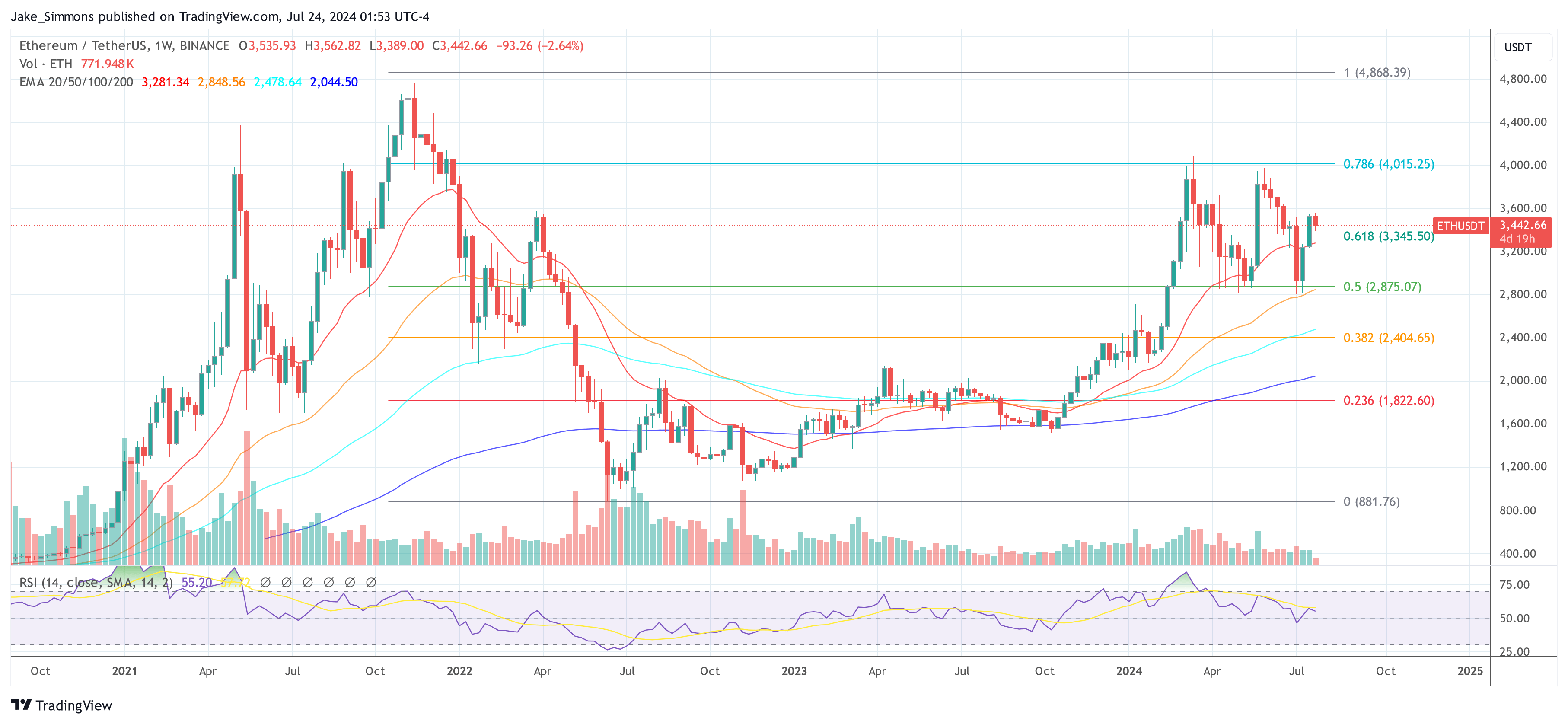

Ethereum Whales Take Over, ETH Stuck Below $3,500: What’s Going On?

Ethereum prices are stable at spot rates, moving horizontally even after the United States Securities and Exchange Commission (SEC) approved the list and trading of spot Ethereum ETFs on July 23. Ethereum is trending below the crucial resistances at $3,500 and $3,700 at press time. However, buyers have kept prices above $3,300 as price action moves horizontally. Though there are expectations of volatility, reading from options data, now that spot Ethereum ETFs are available for trading, one analyst picked out a critical development that might affect the BTC-ETH dynamic. Ethereum…

Forget $10,000, Crypto Analyst Says Spot Ethereum ETFs Will Drive ETH To $14,000

The long-awaited Ethereum ETFs have finally hit the market, marking a significant milestone for Ethereum and other altcoins. Industry experts and enthusiasts are looking at how the effects could play out on Ethereum’s price action in the coming months. Renowned crypto analyst Doctor Profit has made a bold prediction. According to him, Ethereum’s value is set to break through the $10,000 barrier, with the potential to reach a peak of $14,000. The catalyst for this anticipated surge is none other than the Ethereum ETFs, which are expected to act as…

The Protocol: Ethereum ETFs Aren't Blockchain, but Buyers Ape In

As Bitcoiners descend on Nashville for a big annual conference, we’re covering robust demand for new Ethereum spot exchange-traded funds (ETFs) and recapping the $230 million WazirX hack. Source link

Ethereum Flatlines Following Spot ETF Day 1: Full Recap

The much-anticipated launch of several Ethereum-based spot exchange-traded funds (ETFs) failed to ignite a significant Ethereum (ETH) price rally. Despite considerable trading volumes and large inflows for the “newborn” ETFs on their first day, the Grayscale outflows have been too massive (once again) to propel the Ether price upwards. Ethereum ETFs Start Strong, But Grayscale … Eric Balchunas, a senior ETF analyst at Bloomberg, shared via X (formerly Twitter), “DAY ONE in the books for Eth ETFs who did $1b in total volume, which is 23% of what the spot…

Ethereum ETFs Launch About To Kickstart The Altseason?

The long-awaited Ethereum Exchange-Traded Funds (ETFs) are finally live, registering over $100 million in volume in the first 15 minutes. Investors expect to see the launch’s impact on the crypto market, while some market watchers believe ETH ETF’s performance will kickstart the Altcoin season. Related Reading Ethereum Spot ETFs Are Officially Live On Monday, the US Securities and Exchange Commission (SEC) gave the final nod to Ethereum spot ETFs, setting the launch date for Tuesday, July 23. After the approval, investors raised the alarm following some online reports. Per Whale…

Ethereum ETF inflows could surpass $20b

Investors’ eyes are fixed on spot Ethereum ETFs and how products could perform in the opening months after Bitcoin funds were hugely successful. On Tuesday, the first nine U.S. spot Ethereum (ETH) ETFs opened for trading on national exchanges following the Securities and Exchange Commission’s (SEC) final greenlight. Wall Street players and retail investors can now access exposure to crypto’s second-largest decentralized token, ETH, via a regulated institutional wrapper. According to Bloomberg’s James Seyffart, the funds debuted with nearly $10.3 billion in assets under management (AUM). Most of that money is…

Arbitrum Attracts Over 48% Of Assets From Ethereum: Why Is ARB Down 68% In 7 Months?

ARB, the native token of Arbitrum, the Ethereum layer-2 solution, is down 68% from January 2024 highs. However, there is good news: While ARB holders “suffer” in the face of unrelenting bears, positive on-chain developments reveal a platform that is not only the largest by total value locked (TVL) but also brimming with potential. Over 48% Of Ethereum Bridged Assets End Up In Arbitrum Taking to X, one analyst notes a surge in user activity on Arbitrum and that the platform leads across multiple key performance indicators (KPIs). Of importance,…

Bitwise becomes 1st US ETF to post Ethereum addresses

Bitwise disclosed several ENS addresses used to store Ethereum tokens for its spot ETH ETF, which launched on Tuesday. Bitwise became the first U.S. spot Ethereum (ETH) ETF issuer to publish wallets after committing to transparency for its ETHW fund. The wealth manager made a similar move in January when it disclosed public Bitcoin (BTC) addresses for assets underpinning the BITB spot BTC ETF. Five addresses assigned Ethereum Name Service (ENS) tags were posted shortly before ETHW and eight other funds started trading. ENS sub-names simplify Ethereum addresses, which are typically…