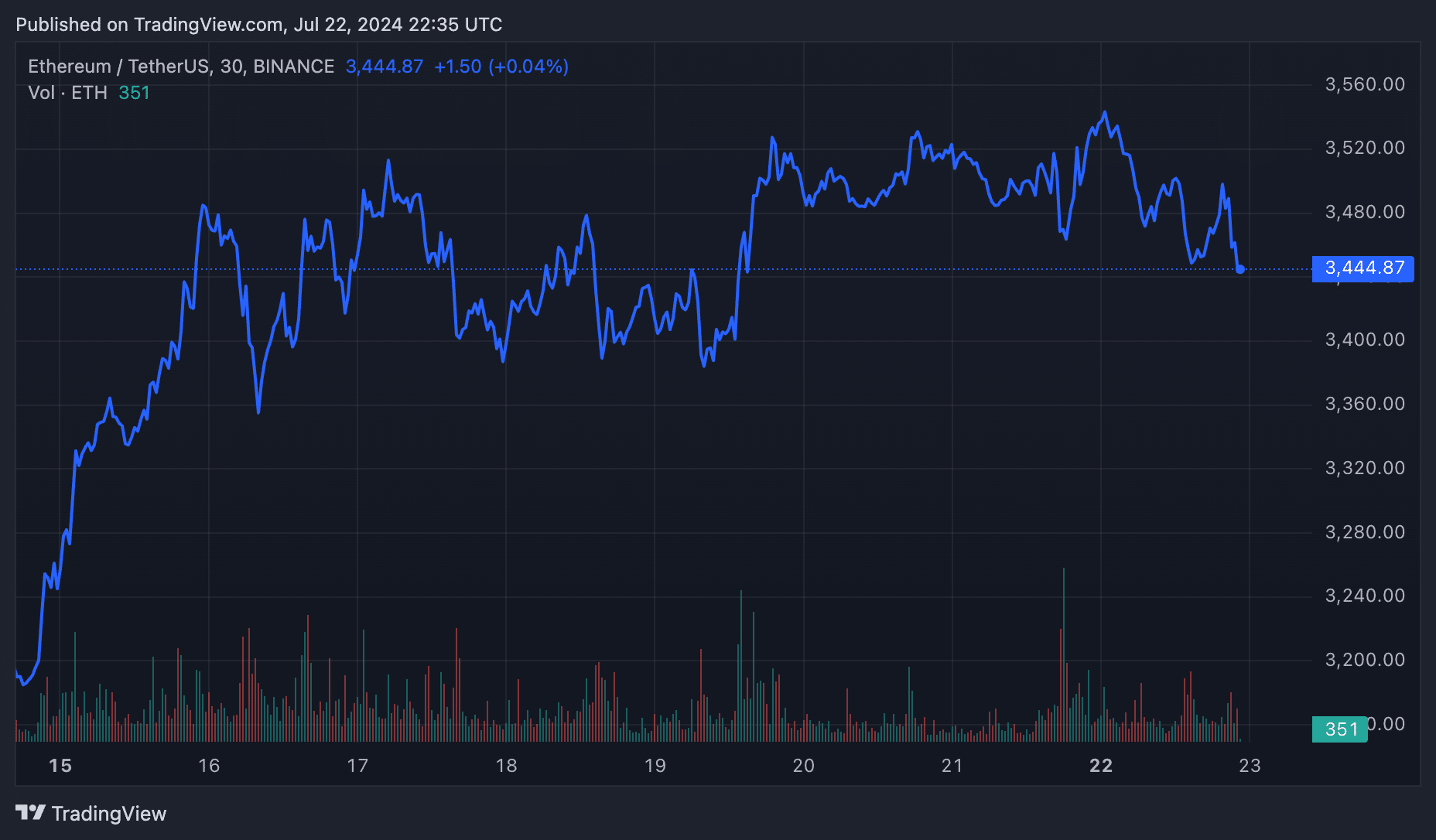

Ethereum’s price exhibited volatility on Tuesday, coinciding with the launch of U.S. spot ether exchange-traded funds (ETFs) on Wall Street. At around 5 a.m. EDT, ETH surged to an intraday high of $3,540 per coin but later dropped to approximately $3,406 by 12:55 p.m. in the afternoon. Ether’s Bearish Sentiment Dominates Trading Day Amid ETF […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Tag: Ethereum

Ethereum Price Stays Flat Despite Today’s ETF Debut: Here’s Why

In a day marked by the launch of the long-anticipated spot Ethereum (ETH) Exchange-Traded Fund (ETF) in the United States, the market’s response has been unexpectedly subdued. Analysts from Singapore-based crypto asset trading firm QCP Capital have shed light on the reasons behind this muted reaction, blaming the situation on previous market behaviors and other news from the broader market. Why The Ethereum Price Is Not Skyrocketing In their investor note, QCP Capital points out that the market may be adhering to a “buy the hype, sell the news” pattern,…

Ethereum ETFs Witness Stellar Start As Trading Soars; Analyst Sees ETH’s Price Reaching $8,000 In Q4

Ethereum ETFs (exchange-traded funds) began trading on Tuesday, generating significant volume within the first 2 hours of trading. Interestingly, the Ethereum ETFs ranked among the top 1% regarding ETF volume. Related Reading Ethereum ETFs Surpass Traditional Launch Volumes According to Bloomberg ETF expert Eric Balchunas, the ETH ETFs traded $361 million in the first 90 minutes on launch day, surpassing the typical volume seen at the launch of traditional ETFs. Blachunas said: Here’s where we at after 90 minutes. $361m total. As a group that number would rank them about…

The Ethereum Blockchain Experienced Its Highest Inflationary Period in the Last Quarter: Fidelity

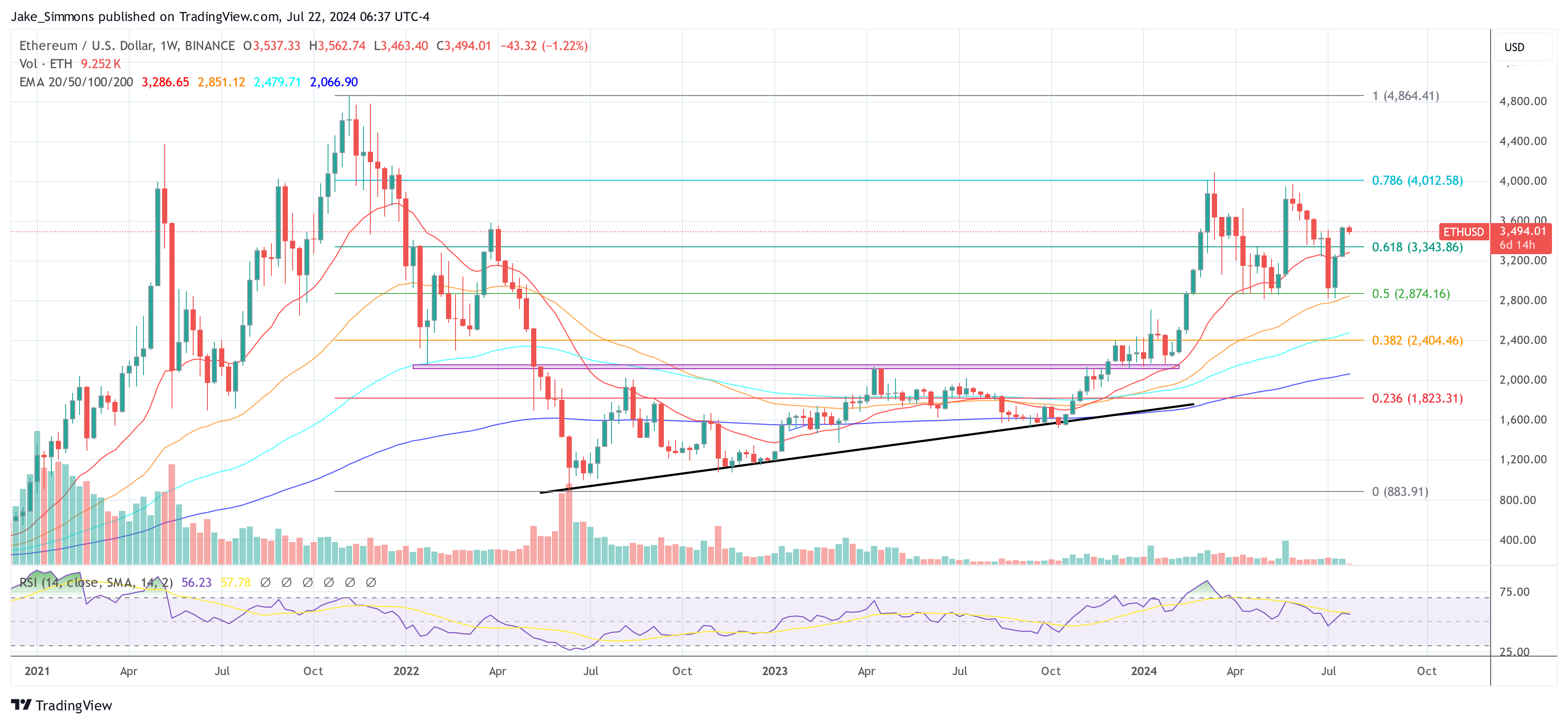

Ether is currently trading about 67% above its so-called realized price, which was $2,050 toward the end of the second quarter, the note said. That’s the highest since inception despite the fact that ETH remains well below its 2021 highs. The realized price is a measure that tries to capture the average cost basis of all current ETH holders. Ether was trading around $3,526 at publication time. Source link

Bitwise pledges to donate 10% of Ethereum ETF

Bitwise Asset Management said it will allocate 10% of profits from its spot Ethereum ETF toward supporting Ethereum open-source development. Bitwise, a crypto index fund manager, said in a press release on Monday it would donate some of the profits from its spot Ethereum exchange-traded fund (ETF) to Ethereum developers in a bid to support open-source development. In the announcement, the Chicago-headquartered firm said it will send 10% of profits of the Bitwise Ethereum ETF to two organizations: Protocol Guild, a funding organization, and PBS Foundation, a non-profit research entity.…

Ethereum Eclipses Solana In 2024 Inflows Amid Hype For Upcoming ETF Launch

According to a recent report from CoinShares, Ethereum (ETH) saw an uptick in inflows last week, surpassing Solana’s (SOL) inflows for 2024, coinciding with the impending launch of exchange-traded funds (ETFs) that will allow regulated investment in the US for the second-largest cryptocurrency by market capitalization. ETH Dominates Inflows The report highlights Ethereum’s strong momentum recorded over the past month, with inflows reaching $45 million last week, amounting to the year for over $103 million, outpacing Solana’s inflows year-to-date (YTD). Solana, however, also witnessed inflows of $9.6 million during the…

Ethereum ETFs get final approval to trade in the US

The U.S. SEC has granted the final go-ahead for the first spot ETH ETFs in the United States. Trading is set to begin tomorrow, July 23. Today, July 22, the U.S. Securities and Exchange Commission accepted the securities filings of several spot Ethereum (ETH) exchange-traded funds, clearing them for trading starting on Tuesday, as scheduled. The SEC approved ETH ETF products from a total of eight issuers, including asset management giants Fidelity, Blackrock and VanEck, as well as 21Shares, Bitwise and others. The SEC first approved applications for the above…

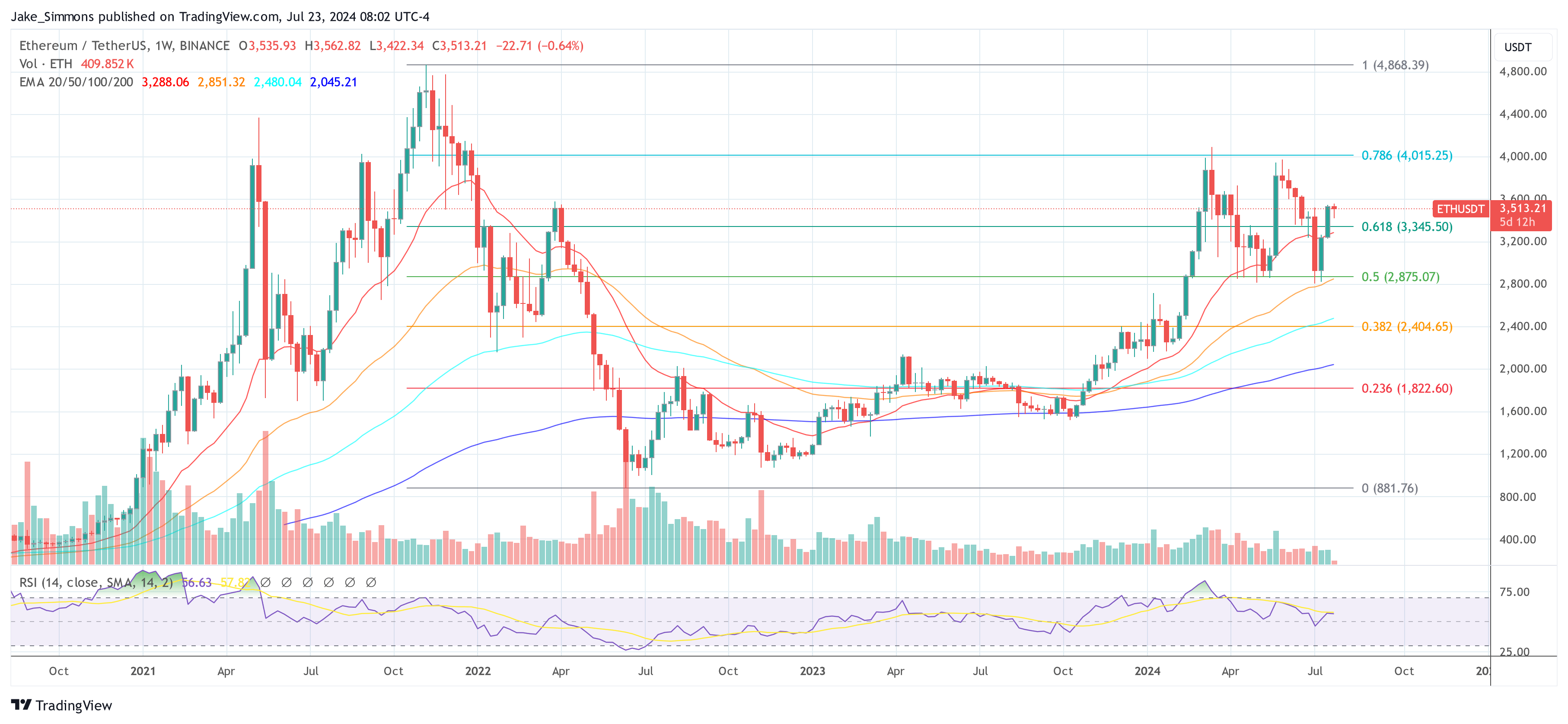

Ethereum Retraces: Here’s Why ETH Bulls Must Decisively Break Above $3,500

Ethereum is firm when writing, rapidly rising after slipping to around $2,800 earlier this month. As of writing, the second most valuable coin is up by over $24% and remains in an uptrend despite the scare of July 4 and 5. Ethereum Finds Strong Resistance At $3,500 Even as buyers expect ETH bulls to press on and push the coin above $3,700, a key resistance line, on-chain data shows that there is resistance. According to IntoTheBlock data on July 22, ETH has strong resistance at $3,500, which has been the…

Spot Ethereum ETFs Will Draw $1.2 Billion Monthly: Research Firm

The US spot Ethereum ETFs are set to launch on Tuesday, July 23rd, with projections indicating potential monthly inflows of $1.2 billion. This forecast comes from ASXN, a research firm specializing in crypto finance analytics. US Spot Ethereum ETFs Could Surprise To The Upside At the core of ASXN’s analysis is the comparison between the newly introduced Ethereum ETFs and the previously launched Bitcoin ETFs. One of the critical differentiators highlighted in the report is the fee structure. The Ethereum ETFs, while mirroring the fee approach of Bitcoin ETFs, introduce…

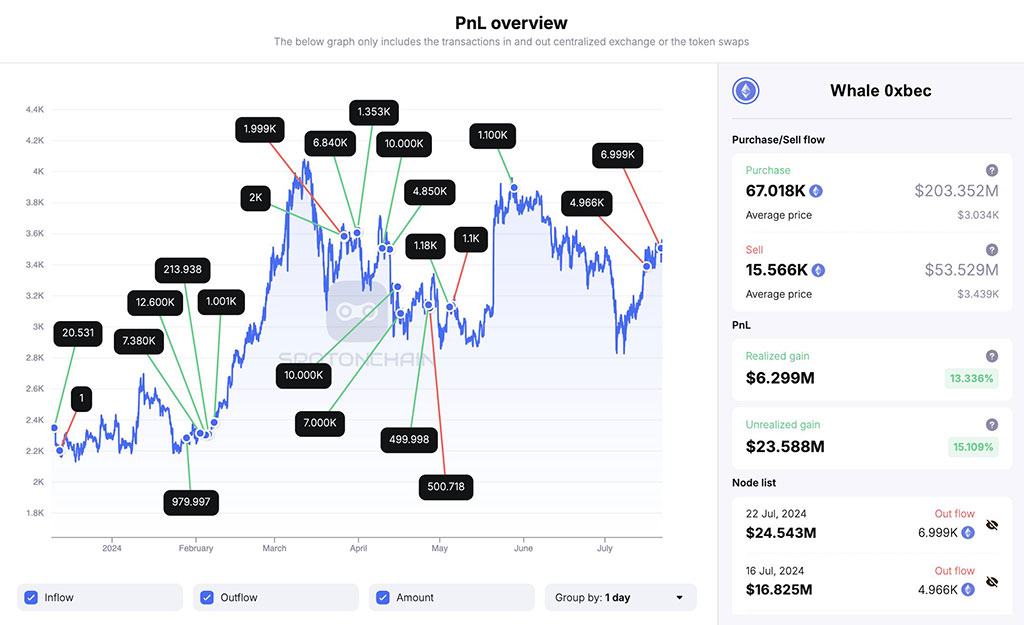

Ethereum Whale Watch: Will $120M+ ETH Pending Dump Affect ETH ETF Hype?

CoinspeakerEthereum Whale Watch: Will $120M+ ETH Pending Dump Affect ETH ETF Hype? Some Ethereum (ETH) whales have positioned themselves to benefit from US spot ETH ETF speculation, which is set to launch on July 23. About $122 million worth of ETH has been moved to centralized exchanges (CEXes) for sell-offs from three whales. According to the on-chain analysis platform Spot On Chain, $89 million ETH has been moved to Binance and OKX exchanges in the past 9 days. During the early London trading session on 22nd July, another whale transferred…