Ethereum price is showing a few bearish signs below the $3,840 support. ETH could gain bearish momentum if there is a clear move below $3,700. Ethereum extended its decline and tested the $3,700 zone. The price is trading below $3,840 and the 100-hourly Simple Moving Average. There was a break below a key bullish trend line with support near $3,780 on the hourly chart of ETH/USD (data feed via Kraken). The pair could start a fresh increase unless there is a close below the $3,700 support. Ethereum Price Dips Again…

Tag: Ethereum

Bitcoin, Ethereum On Exchanges Drop To New Lows, What A Supply Squeeze Would Mean For The Market

Recent data shows that the supply of Bitcoin (BTC) and Ethereum (ETH) on exchanges has dropped significantly. This means the largest crypto tokens by market cap could be well-primed for significant moves to the upside, with a supply squeeze imminent. Supply Of Bitcoin And Ethereum Drop To New Lows BTC ECHO analyst Leon Waidmann shared Glassnode data, which showed that exchange balances for Bitcoin and Ethereum are at their lowest in years. Bitcoin’s supply on exchanges has dropped to 11.6%, while Ethereum’s supply has dropped to 10.6%. This suggests that…

Ethereum Endgame? Investors Pull $3 Billion From Exchanges

The winds of change are blowing through the Ethereum ecosystem. Since the long-awaited approval of spot Ether ETFs in the US on May 23rd, a quiet exodus of Ether has been underway. A massive amount of the world’s second-largest cryptocurrency, or around $3 billion, has vanished from centralized exchanges, marking the lowest level of Ether reserves in years. This flight of the digital asset has analysts buzzing with the possibility of a supply squeeze, potentially propelling Ether to new heights. Related Reading Exodus To Self-Custody: A Bullish Signal? Crypto analyst…

Sleepy Crypto Market ‘May Get Caught Offside’: QCP Capital Eyes Bullish Shift in Ethereum

This weekend, the Singaporean cryptocurrency firm QCP Capital reported a significant drop in market volatility after the approval of spot ethereum (ETH) exchange-traded funds (ETFs), despite ongoing catalysts. QCP highlighted that bitcoin is under bearish pressure due to potential new supply from the Mt Gox distribution, estimated at $9.6 billion, and from the DMM Bitcoin […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Can Ethereum Smash Through Resistance Or Stall After Rally?

Ethereum, the world’s second-largest cryptocurrency, finds itself at a critical juncture. After a strong 25% surge in the past month, outperforming its peers, Ethereum is facing a formidable hurdle in the form of resistance levels around $3,795 and $3,846. Analysts are watching this price battle closely, as it could determine the coin’s trajectory in the coming days. Related Reading Breaking Barriers Or Bracing For A Tumble? Technical analysis paints a contrasting picture for Ethereum. If the bulls can muster enough strength to push the price above $3,845, a continuation of…

JPMorgan Predicts ‘Negative’ Initial Reaction for Ethereum ETFs — Expects Lower Demand Than Bitcoin ETFs

JPMorgan has predicted an initial negative market reaction for spot ethereum exchange-traded funds (ETFs), expecting lower demand compared to bitcoin ETFs. The global investment bank also cautions that approximately $1 billion may exit the Grayscale Ethereum Trust, putting downward pressure on ether prices shortly after the launch of spot ethereum ETFs. ‘Initial Market Reaction to […] Original

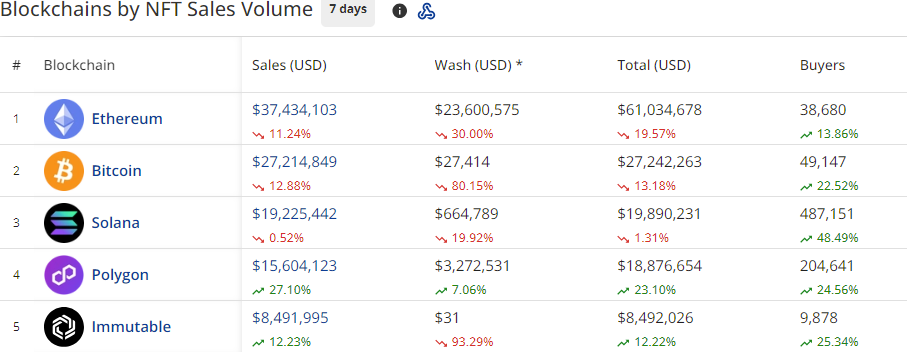

NFT market slumps over 7%: Ethereum leads despite declinee

The non-fungible token (NFT) market experienced another sluggish week, with overall sales dipping by 7.5% over seven days, reaching $121.4 million on June 1. Top blockchains by sales volume Over the last seven days, Ethereum (ETH) has stayed in first place as the leading blockchain for NFT transactions after overtaking Bitcoin (BTC) last week. According to data from CryptoSlam, the blockchain maintained its dominance with total sales of $37.43 million, despite an 11.24% decrease from the previous week. Bitcoin, the second most active blockchain for non-fungible token sales, raked in…

Cathie Wood’s Ark Invest Halts Spot Ethereum ETF Plans

Cathie Wood’s Ark Investment Management has withdrawn from the race to launch a spot ether exchange-traded fund (ETF), as its name was removed from the application filed with 21shares. The ETF, now renamed 21shares Core Ethereum ETF, reflects Ark’s decision not to pursue the ether ETF at this time. Despite this, Ark remains committed to […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Major cryptocurrency shift due to SEC Ethereum ETF ruling: VanEck CEO

VanEck CEO Jan van Eck sees a major sentiment shift underway in the cryptocurrency market linked to the U.S. Securities and Exchange Commission’s approval of a rule change allowing for Ethereum exchange-traded funds. “This is really one of the most amazing things that I’ve seen in my career with respect to securities regulation,” van Eck told CNBC’s “ETF Edge” this week. VanEck was the first to apply to the SEC for permission to list its proposed Ethereum ETF. With that first hurdle cleared, VanEck can begin the process of bringing…

Ethereum Investors Take On Sky-High Leverage: Brace For Volatile Storm?

Data shows the investors in the Ethereum derivatives market have been taking on very high leverage recently, something that could lead to volatility for the asset. Ethereum Estimated Leverage Ratio Has Been At Extreme Levels Recently As pointed out by an analyst in a CryptoQuant Quicktake post, the ETH Estimated Leverage Ratio has been on the up recently. The “Estimated Leverage Ratio” (ELR) refers to an indicator that keeps track of the ratio between the Ethereum Open Interest and Exchange Reserve. The former of these, the Open Interest, here is…