Opinion by: Barna Kiss, CEO of Malda An idea recently floated by some prominent thinkers in the Ethereum space to reclaim value for the mainnet is the taxing of its Layer-2s. The future of Ethereum does not depend on policy but on enabling frictionless capital movement between the L2s in question. Tariffing rollups may appear a neat way to reclaim value for the mainnet. In practice, it would fragment the ecosystem, drain liquidity, push users toward centralized platforms, and avoid decentralized finance altogether. In a permissionless system, capital flows to…

Tag: Ethereums

12 minutes of nail-biting tension when Ethereum’s Pectra fork goes live

Ethereum developers will be holding their breath for the 12 minutes it takes to work out if Ethereum’s Pectra hard fork has finalized properly after it’s deployed tomorrow. During every Ethereum hard fork, there is roughly a 12-minute period — the time it takes for two epochs — where over a hundred tireless Ethereum developers vigilantly monitor the state of the network for signs of problems, wondering, Did we do enough? Every time Ethereum goes through a major hard fork — which is like replacing components of an airplane in…

Ethereum’s New Internship Initiative Aims to Foster Future Blockchain Innovators

Joerg Hiller May 06, 2025 01:44 Ethereum launches a new internship program to bridge the gap for newcomers, offering remote opportunities across various fields. Applications for host organizations close May 28, 2025. The Ethereum Foundation has announced a groundbreaking initiative aimed at nurturing the next generation of blockchain innovators through its Ethereum Season of Internships. This initiative addresses the challenge of retaining new talent within the Ethereum ecosystem by offering structured early-career opportunities, as reported by the official Ethereum blog. What is…

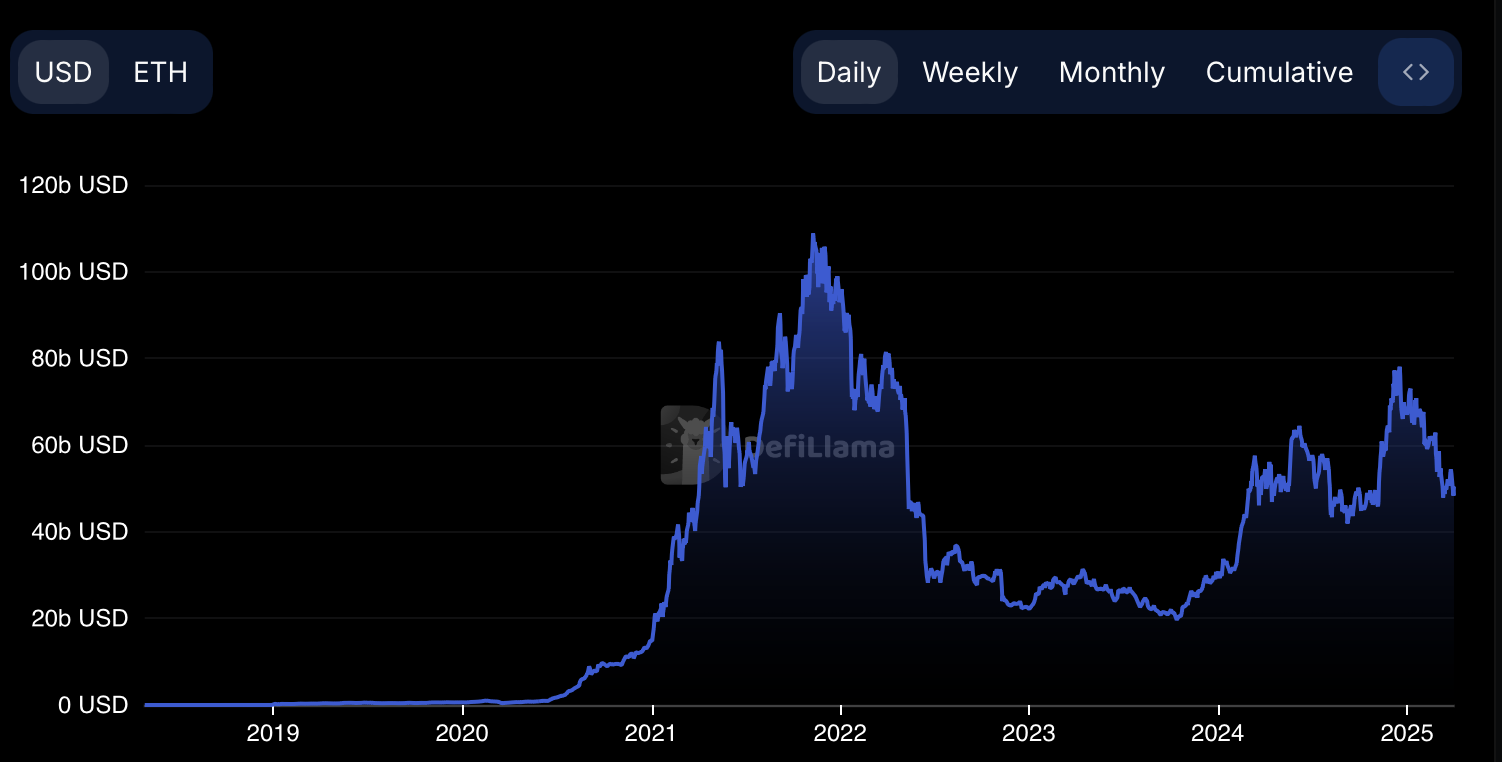

Ethereum’s era of crypto dominance is over — LONGITUDE panel

Ethereum’s relative dominance among layer-1 (L1) blockchain networks has declined, resulting in an “open race” to become the leading Web3 platform, according to Alex Svanevik, CEO of data service Nansen. “If you’d asked me 3–4 years ago whether Ethereum would dominate crypto, I’d have said yes,” Svanevik said during a panel discussion at the LONGITUDE by Cointelegraph event. “But now, it’s clear that’s not what’s happening.” Ethereum is still the most popular L1 network. According to data from DefiLlama, its roughly $52 billion in total value locked (TVL) represents 51%…

Ethereum’s ‘capitulation’ suggests ETH price is undervalued: Fidelity report

Key Takeaways: Fidelity Digital Assets’ report said that multiple Ethereum onchain metrics suggest ETH trades at a discount. The BTC/ETH market cap ratio is at mid-2020 levels. Ethereum’s layer-2 active addresses hit new highs at 13.6 million. Fresh data from Fidelity Digital Assets hints at a cautiously optimistic outlook for Ethereum, suggesting its dismal Q1 performance could be an opportunity. According to their latest Signals Report, Ether (ETH) dipped 45% during Q1, wiping out it post-US election gains after peaking at $3,579 in January. The altcoin posted a death cross…

Ethereum’s Destino Devconnect Aims to Propel Argentina into Blockchain Future

Timothy Morano Apr 22, 2025 11:36 Destino Devconnect launches a local grant initiative to accelerate Ethereum adoption in Argentina, ahead of Devconnect ARG 2025 in Buenos Aires. In a bid to enhance blockchain adoption in Latin America, Ethereum has announced the launch of Destino Devconnect, an initiative aimed at bringing Argentina on-chain. This program, which will run until November, invites local developers and enthusiasts to join forces in promoting Ethereum technology throughout Argentina and the broader Latin American region, according to the…

Ethereum’s True Value? Lower Than You Think

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. Bitcoin maximalist Samson Mow has doubled up on his value criticism of Ethereum’s price, asserting ETH is still overvalued despite Bitcoin’s price almost quadrupling since 2022. The JAN3 CEO…

Here’s Where Ethereum’s Last Line Of Defense Lies, According To On-Chain Data

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. On-chain data shows Ethereum has broken under all major investor cost basis levels, except for one. Here’s where this price level is currently situated. Ethereum Has Only Realized Price…

Ethereum’s chart looks “disastrous” — and the ETH/BTC ratio just confirmed it

Can Ethereum still claim L1 dominance as Solana gains ground and the ETH/BTC ratio crashes below 0.022? ETH/BTC hits a multi-year low Ethereum (ETH), the world’s second-largest crypto by market cap, is facing a sobering reality check. The ETH/BTC ratio, a metric used to gauge Ethereum’s strength relative to Bitcoin (BTC), has dropped to 0.022, its lowest level since December 2020, signaling a sharp decline in Ethereum’s relative performance. ETH/BTC lifetime price chart | Source: TradingView Since September 2022, when the ratio hovered around 0.085, Ethereum has shed more than…

Ethereum’s weekly blob fees hit 2025 lows

The Ethereum network’s main source of income from layer-2 (L2) scaling chains — “blob fees” — has sunk to the lowest weekly levels so far this year, according to data from Etherscan. In the week ending March 30, Ethereum earned only 3.18 Ether (ETH) from blob fees, according to Etherscan, or approximately $6,000 US dollars as of April 1. This figure marks a 73% drop from the prior week and a more than 95% decline from the week ending March 16, when Ethereum’s income from blob fees exceeded 84 ETH,…