Some commentators on X called it “sad.” Others used expletives. Either way, a video of Ethereum co-founder Vitalik Buterin went viral and not in a good way. The crypto community on X.com, rarely known for decorum, blasted Buterin for kneeling before a robot and emitting what sounds like a “meow” sound. To some, the video underscored why one needs to be “bullish” about Ethereum’s present and future. To others, it was worthy of a Studio Ghibli-style photo edit. Most people kept scrolling. See below. So much of my professional life…

Tag: Ethereums

Ethereum’s (ETH) path back to $2.5K depends on 3 key factors

Ether (ETH) price reclaimed the $2,000 support on March 24 but remains 18% below the $2,500 level seen three weeks ago. Data shows Ether has underperformed the altcoin market by 14% over the past 30 days, leading traders to question whether the altcoin can regain bullish momentum and which factors might drive a trend reversal. Ether/USD (left) vs. total altcoin capitalization, USD (right). Source: TradingView / Cointelegraph Ether appears well-positioned to attract institutional demand and significantly reduce the FUD that has limited its upside potential. Critics have long argued that…

Coinbase becomes Ethereum’s largest node operator with 11% stake

A Coinbase report revealed that the crypto exchange is the largest node operator on the Ethereum network, controlling 11.42% of the total staked Ether. In a performance report, Coinbase said it had 3.84 million Ether (ETH), worth about $6.8 billion, staked to its validators. The exchange said that, as of March 3, it has 11.42% of the total staked ETH. Anthony Sassano, host of The Daily Gwei, said that Coinbase’s stake makes the exchange the “single largest node operator” in the network. Sassano added that while the staking platform Lido…

Prediction Claims Ethereum’s Reign Is Ending

Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. A cryptocurrency expert thinks that XRP might overtake Ethereum in market value in the next three months, which could threaten Ethereum’s position as the second biggest cryptocurrency. This claim has triggered arguments…

Here’s How High The XRP Price Would Be If It Flips Ethereum’s Market Cap

Scott Matherson is a prominent crypto writer at NewsBTC with a knack for capturing the pulse of the market, covering pivotal shifts, technological advancements, and regulatory changes with precision. Having witnessed the evolving landscape of the crypto world firsthand, Scott is able to dissect complex crypto topics and present them in an accessible and engaging manner. Scott’s dedication to clarity and accuracy has made him an indispensable asset, helping to demystify the complex world of cryptocurrency for countless readers. Scott’s experience spans a number of industries outside of crypto including…

Ethereum’s future at risk without clear leadership, ex-engineer warns

Ethereum’s vision appears to be so messy that it leaves EVM changes in limbo, says a former Ethereum Foundation engineer. Frustrated by the lack of direction and stalled progress in Ethereum’s development, a former Solidity expert and compiler engineer claims there is a “lack of a clear and cohesive vision” for Ethereum (ETH) and the Ethereum Virtual Machine, making progress in the latter “impossible.” This is why I left the Ethereum Foundation. There is a lack of a clear and cohesive vision for Ethereum and EVM, making progress in EVM…

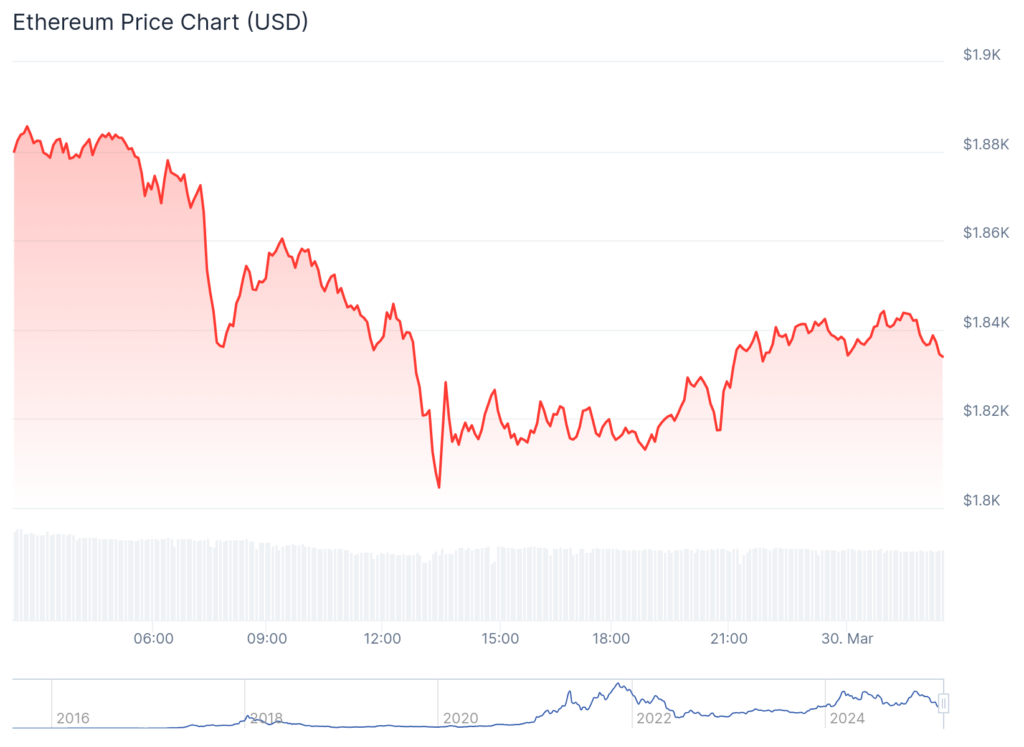

Ethereum’s $1.8K Wake-Up Call: Can Tech Outshine Market Skepticism?

The second-largest cryptocurrency, ethereum (ETH), dipped to $1,809 on Monday, hitting a notable low. Meanwhile, the BTC/ETH ratio slipped under 0.24, a level not seen since February 2020. Bitcoin-Ether Ratio Taps Multi-Year Lows Ethereum is down 8% at the time of writing over the last day, and earlier it down 10% against the U.S. dollar […] Source CryptoX Portal

Ethereum’s Devconnect 2025 to Transform Buenos Aires into Blockchain Hub

Zach Anderson Mar 05, 2025 06:10 Devconnect 2025 will be held in Buenos Aires, Argentina, from November 17-22, aiming to boost Ethereum adoption and showcase blockchain innovations. Ethereum’s much-anticipated Devconnect 2025 is set to take place in Buenos Aires, Argentina, from November 17 to November 22. The event aims to further solidify Argentina’s position as a leading adopter of Ethereum technology, according to the Ethereum blog. Argentina’s Role in the Blockchain Ecosystem Argentina has emerged as a significant player in the blockchain…

Ethereum’s Pectra upgrade could lay groundwork for next market rally

Ethereum’s highly anticipated Pectra upgrade could set the stage for the next phase of the 2025 crypto market cycle, according to analysts, even as Ether continues to underperform Bitcoin. The Ether (ETH) price fell over 32% during February, finding a local bottom at an over two-month low of $2,073 before recovering to the current $2,245 mark, Cointelegraph Markets Pro data shows. ETH/USD, 1-year chart. Source: Cointelegraph Ethereum’s upcoming Pectra upgrade, scheduled for March 5, could help ease long-term selling pressure, according to Gabriel Halm, a research analyst at blockchain intelligence…

Ethereum’s Pectra Upgrade Goes Live on ‘Holesky’ Testnet, But Fails to Finalize

Ethereum’s Pectra upgrade went live on the Holesky testnet on Monday but failed to finalize in the expected time. Pectra was activated on the Holesky testnet at 21:55 UTC (4:55 p.m. ET), but did not initially finalize according to blockchain data. Finality is the state in which, once a transaction is confirmed and added to a block, it is immutable and cannot be reversed. A testnet is a network that copies a main blockchain (in this case Ethereum), and is used to test upgrades or new code before it goes…