Reacting to Coinbase’s announcement, BONK quickly took to its heels, gaining nearly 8% in value to reach $0.00001132. Solana-based memecoin Bonk (BONK) is set to be listed on Coinbase, a major US-based cryptocurrency exchange. This was revealed in an announcement by the exchange on Wednesday as it unveiled its listing roadmap via a blog post. According to Coinbase’s statement, it will henceforth use blogposts such as the latest one, to announce every asset listing decision. This is aimed at increasing transparency by providing some sort of information balance, the platform…

Tag: Exchange

Crypto Exchange Coinbase Lists New DeFi Altcoin Project Built on Base Blockchain

Coinbase, the biggest crypto exchange in the US, is listing a new altcoin project built on its proprietary Ethereum (ETH) layer-2. In a new announcement made through the Coinbase Assets account on the social media platform X, Coinbase announces they are listing Seamless (SEAM). According to the Seamless website, the crypto project is the first “native, decentralized, non-custodial lending and borrowing protocol” built on the Coinbase-backed layer-2 scaling solution Base. Project incubator Coinbase says Base is designed to offer a safe, low-cost, developer-friendly way to build on-chain. The layer-2 network is…

Venture Capital Arm of Crypto Exchange KuCoin Invests in Bitcoin (BTC) Layer-2 Project

The venture capital division of the cryptocurrency exchange KuCoin is announcing an investment in Dovi, a Bitcoin (BTC) layer-2 solution that is compatible with the Ethereum Virtual Machine smart contract platform. Lou Yu, the head of KuCoin Labs, says the investment will assist Dovi in realizing its various product and market goals. On its commitment to the Bitcoin ecosystem, KuCoin Labs says, “KuCoin Labs will continue to focus on incubation, investing in the BTC ecosystem, and bringing the next BTC ecosystem phenomenon-level application to the industry. We welcome other BTC-native…

Crypto Exchange Binance Announces Upcoming Listing for New Low-Cap Altcoin Project

Top global crypto exchange Binance is about to list a new gaming-related altcoin project, according to the company. In a new announcement, Binance says that it will add Fusionist (ACE) to its Launchpool platform, which allows users to stake coins in exchange for new ones. ACE is the native token of Endurance, a decentralized gaming and social blockchain, which Fusionist, a Web3 AAA game, will use as its mainnet. Staking of ACE is expected to start Wednesday, Binance says, and open trading of the altcoin could begin December 18th. When…

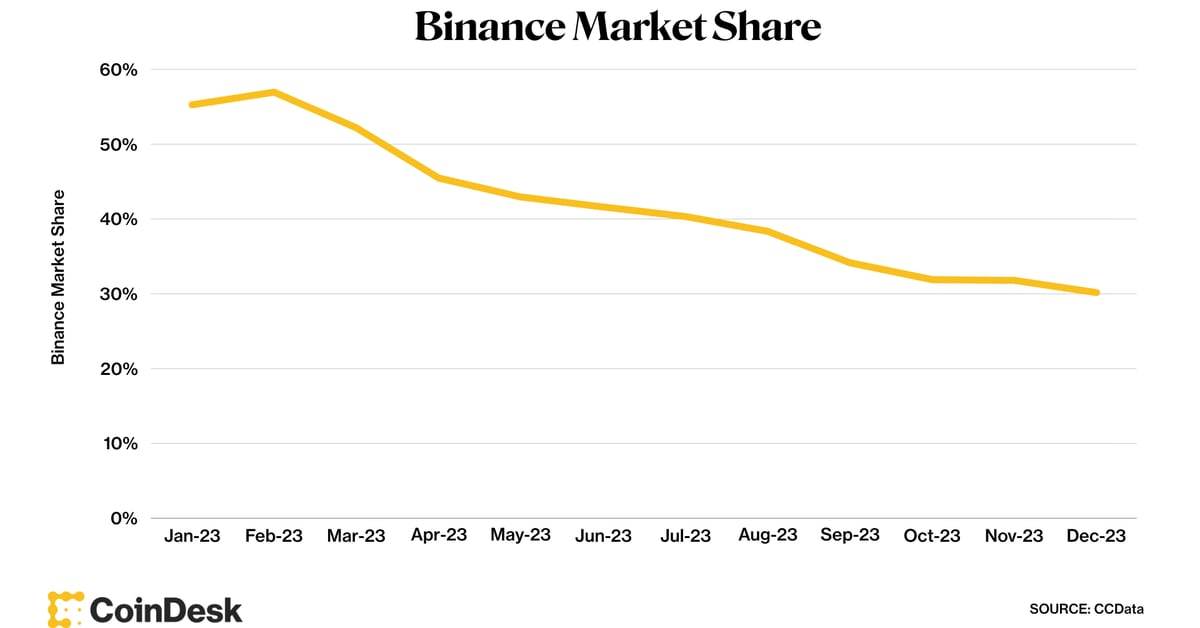

Crypto Exchange Binance Saw Major Decline in Market Share in 2023

Despite Binance’s decline in spot trading market share over the year, it still remains the largest cryptocurrency exchange by a wide margin. In second place to Binance’s 30% is Seychelles-based OKX, which has seen its market share grow to 8% in December from around 4% to start the year, according to CCData. Source

M&G invests $20m in UK’s first regulated Bitcoin derivatives exchange

London-based global investment manager M&G Investments has injected $20 million into Global Futures & Options Holdings, positioning it as the first FCA-regulated and centrally-cleared trading venue for digital currency asset derivatives in the U.K. According to the Dec. 11 announcement, the strategic partnership, in collaboration with London Clearing House, aims to meet the increasing demand from institutional investors. Growing institutional interest In a recent series B funding round, M&G’s Crossover strategy allocated capital from the $162 billion Prudential With-Profits Fund to Global Futures & Options Holdings (GFO-X). The investment underscores M&G’s…

Decentralized Exchange Uniswap Expands to Bitcoin Sidechain Rootstock

Uniswap version 3 (v3) has been deployed on Rootstock by GFX Labs, the team behind trading terminal Oku, according to an emailed announcement shared with CoinDesk on Monday. According to Uniswap’s website, the project, originally designed for Ethereum, has also been deployed on the Ethereum layer-2 networks Arbitrum, Optimism and Polygon. Original

UK asset manager M&G invests $20M in Bitcoin derivatives exchange

The investment arm of UK-based pension fund M&G has invested $20 million in the country’s first regulated Bitcoin (BTC) derivatives exchange, Global Futures & Options Holdings (GFO-X). An announcement from M&G and GFO-X outlined the details of the investment, which forms part of a $30 million Series B funding round for the derivatives exchange. The platform will initially offer clearing of Bitcoin index futures and options contracts. The move provides a platform for traditional finance institutions to gain exposure to a variety of cryptocurrency derivatives investment products. GFO-X is set…

Crypto exchange HTX see outflows top $258M following exploit

Crypto investors have been moving their assets away from crypto exchange HTX (formerly known as Huobi) following a Nov. 22 exploit that saw the exchange pause its services and lose a total of $30 million. Between Nov. 25 — the day that HTX resumed its services — and Dec. 10, the exchange witnessed some $258 million in net outflows, according to data from DefiLlama. HTX witnessed $258 million in net outflows between Nov. 25 and Dec. 10. Source: DefiLlama DefiLlama data shows HTX’s reserves comprise 32.3% Bitcoin (BTC) and 31.8%…

Crypto Exchange Founder Pleads Guilty to $700,000,000 Unlicensed Money Transmitting Charges: DOJ

Former crypto exchange CEO Anatoly Legkodymov has pleaded guilty to federal charges for his role in illegally transporting and transmitting hundreds of millions of dollars worth of illicit funds. The U.S. Department of Justice (DOJ) says that Legkodymov, the founder of crypto exchange Bitzlato admitted to operating an unlicensed money-transmitting business at a Brooklyn federal court this week. The DOJ says that Bitzlato became a haven for criminal proceeds and funds because the firm did not implement proper know-your-customer (KYC) procedures. The exchange also allegedly facilitated more than $700 million…